ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

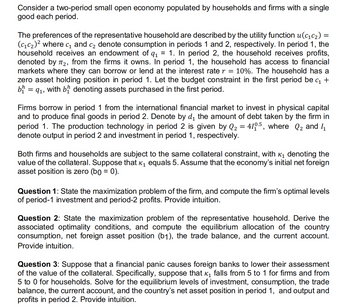

Transcribed Image Text:Consider a two-period small open economy populated by households and firms with a single

good each period.

The preferences of the representative household are described by the utility function u(c₁c₂) =

(C₁C₂)² where c₁ and c₂ denote consumption in periods 1 and 2, respectively. In period 1, the

household receives an endowment of q₁ 1. In period 2, the household receives profits,

denoted by T₂, from the firms it owns. In period 1, the household has access to financial

markets where they can borrow or lend at the interest rate r = 10%. The household has a

zero asset holding position in period 1. Let the budget constraint in the first period be c₁ +

b = 9₁, with b denoting assets purchased in the first period.

Firms borrow in period 1 from the international financial market to invest in physical capital

and to produce final goods in period 2. Denote by d₁ the amount of debt taken by the firm in

period 1. The production technology in period 2 is given by Q₂ = 410.5, where Q₂ and 1₁

denote output in period 2 and investment in period 1, respectively.

Both firms and households are subject to the same collateral constraint, with ₁ denoting the

value of the collateral. Suppose that ê₁ equals 5. Assume that the economy's initial net foreign

asset position is zero (bg = 0).

Question 1: State the maximization problem of the firm, and compute the firm's optimal levels

of period-1 investment and period-2 profits. Provide intuition.

Question 2: State the maximization problem of the representative household. Derive the

associated optimality conditions, and compute the equilibrium allocation of the country

consumption, net foreign asset position (b1), the trade balance, and the current account.

Provide intuition.

Question 3: Suppose that a financial panic causes foreign banks to lower their assessment

of the value of the collateral. Specifically, suppose that ₁ falls from 5 to 1 for firms and from

5 to 0 for households. Solve for the equilibrium levels of investment, consumption, the trade

balance, the current account, and the country's net asset position in period 1, and output and

profits in period 2. Provide intuition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 16 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- With the use of an example, briefly explain the main difference between the ex-ante and the ex-post opportunity cost of capital. Why does this matter for the evaluation of an investment decision? In what ways can managers utilise the distinction between ex-ante and ex-post opportunity cost of capital when deciding on the firm’s strategy?arrow_forwardPlease get correct, means a lot. Super important.arrow_forwardProfuts are maximized at the unit of output table[[Q, P, TC, TR, MR, MC , Profit], [0, $5, $9, , , , ],[1, $5, $10,,,, ], [2, $5, $12,,,, ], [3, $5, $15,,,, ], [4, $5, $ 19,,,, ], [5, S5, $24, , , , ], [6, $5, $30,,,, ], [7, $5, $45,,,,]] 2nd 5th 3rd 7tharrow_forward

- Suppose that a monopolist offers two different products with demand functions P1 = 56 – 4q1 P2 48 – 292 The monopolist's joint cost function is C(q1, 92) qỉ + 5q192 + q? %3Darrow_forwardSuppose we have one consumer with a Cobb Douglas utility function for consumption, x, and leisure, R : u(x, R) = a ln a+(1-a) In R. The consumer is endowed with one unit of labor/leisure and there is one firm with a constant-returns to scale technology: a = aL. Determine r(p, w) and R(p, w).arrow_forwardQ8 The theory of the firm is based on the following two key assumptions. a. Firms seek to maximise profits and the firm is a single, consistent decision-making unit. b. Firms seek to maximise revenues and to maximise undistributed profits. c. Firms seek to maximise profit and to distribute the maximum value in dividends. d. Each firm has a highly diversified product and this leads to profit maximisation. e. Firms seek to become as large as possible and they seek to maximise total revenue.arrow_forward

- Jared values his entrepreneurial skill at $10,000 annually to run a similar type if business if he had not elected to open his own restaurant. The table summarizes his operations for the past year. Total sales revenue $590,000 Employee wages $120,000 Materials $350,000 Interest on loan $5,000 Utilities $10,000 Rent $25,000 Total explicit costs $510,000 6. What is Jared's accounting profit? 7. Find Jared's total implicit costs. 8. What was Jared's economic profit last year?arrow_forwardRequired information Px| 0 ABC MC ATC AVC D K Q Refer to the above graph. To maximize profits, the firm should produce the quantity:arrow_forwardState one potential positive consequence and one potential negative consequence of MOORE'S LAW for a BUSINESS. Explain CLEARLY how these BUSINESS consequences follow from MOORE'S LAW.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education