FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

For case B

What’s the standby charge

What’s the operating cost benefit

What’s the total benefit

Show step by step

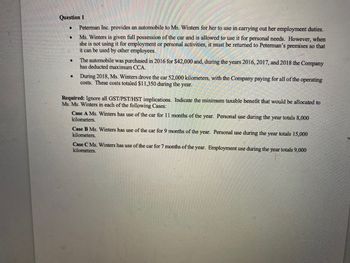

Transcribed Image Text:Question 1

Peterman Inc. provides an automobile to Ms. Winters for her to use in carrying out her employment duties.

Ms. Winters is given full possession of the car and is allowed to use it for personal needs. However, when

she is not using it for employment or personal activities, it must be returned to Peterman's premises so that

it can be used by other employees.

●

●

The automobile was purchased in 2016 for $42,000 and, during the years 2016, 2017, and 2018 the Company

has deducted maximum CCA.

During 2018, Ms. Winters drove the car 52,000 kilometers, with the Company paying for all of the operating

costs. These costs totaled $11,350 during the year.

Required: Ignore all GST/PST/HST implications. Indicate the minimum taxable benefit that would be allocated to

Ms. Ms. Winters in each of the following Cases:

Case A Ms. Winters has use of the car for 11 months of the year. Personal use during the year totals 8,000

kilometers.

Case B Ms. Winters has use of the car for 9 months of the year. Personal use during the year totals 15,000

kilometers.

Case C Ms. Winters has use of the car for 7 months of the year. Employment use during the year totals 9,000

kilometers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Merits and demerits of the cost value profit analysis CVParrow_forwardwhat would be the difference in gross margin between fifo and lifo cost flow assumptionsarrow_forward2. The following total cost graphs indicate which type of cost behavior? A. VARIABLE COST B. FIXED COST C. MIXED COST D. STEP COSTarrow_forward

- simple cost analysis method to identify fixed costs and variable costs in a linear cost function is ........ methodarrow_forward2. What is cost-volume-profit analysis and what are the important assumptions of this analysis?arrow_forwardn Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 105,000 73,500 31,500 27,720 $ 3,780 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) Contribution margin per unitarrow_forward

- Express the two ways of contribution margin?arrow_forward1. Now change all of the dollar amounts in the data area of your worksheet so that it looks like this: 1 2 3 Data 4 Sales Variable costs: 5 67 00 8 A Chapter 1: Applying Excel 9 10 11 Cost of goods sold Variable selling Variable administrative Fixed costs: Fixed selling Fixed administrative $ $ $ $ $ $ B 32,000 16,000 1,600 1,400 2,500 1,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education