ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

A5.

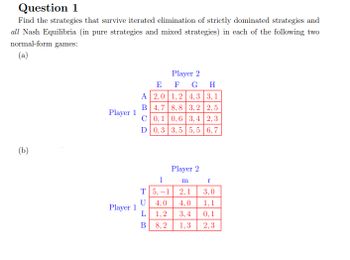

Transcribed Image Text:Question 1

Find the strategies that survive iterated elimination of strictly dominated strategies and

all Nash Equilibria (in pure strategies and mixed strategies) in each of the following two

normal-form games:

(a)

Player 2

E

F G H

Player 1

A 2,0 1,2 4,3 3,1

B4,7 8,8 3,2 2,5

C 0,1 0,6 3,4 2,3

D 0,3 3,5 5,5 6,7

(b)

Player 2

Player 1

1

T5,-1

U 4,0

L 1,2

B 8,2

m r

2,1 3,0

4,0 1,1

3,4

0,1

1,3 2,3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What are the key taxes levied which can be collected by state, territory, and local government in Australia? How is GST revenue shared with the states and territories?arrow_forward7arrow_forwardUse the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. V Taxable Income $0-$9,700 $9,701-$39,475 $39,476-$84,200 $84,201-160,725 $160,726-$204,100 $204,101-$510,300 Over $510,300 1st attempt Tax rate 10% 222335 12 24 37 See Hinarrow_forward

- a tax decrease will decrease consumption a tax increase will increase consumption consumption and after-tax income are unrelated consumption varies inversely with after-tax incomes consumption varies directly with after-tax incomesarrow_forwardRoberto Clemente's marginal federal income tax rate is 20%. How much money will Roberto save in federal income taxes if he deposits the $13,675 in a tax-deferred retirement account instead of depositing it in a taxable account? Taxes round to the dollararrow_forwardWhere does the 404 come from?arrow_forward

- Income taxes are calculated based on gross income less certain allowabledeductions. They are also assessed on gains resulting from the disposal of property. What is a 10-word or less definition appropriate for a corporation, based on Wikipedia, for each of the following factors? a. Gross income. b. Expenses. c. Depreciation. d. Interest. e. Property (e.g., equipment) disposition.arrow_forwardQ30arrow_forwardFind the sales tax and total sale. Item marked price Sales tax rate Sales tax Total sales $582.41 5.017% Item marked price Sales tax rate Sales tax Total sale $582.41 5.017% $ $ (Round to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education