ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 1

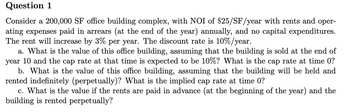

Consider a 200,000 SF office building complex, with NOI of $25/SF/year with rents and oper-

ating expenses paid in arrears (at the end of the year) annually, and no capital expenditures.

The rent will increase by 3% per year. The discount rate is 10%/year.

a. What is the value of this office building, assuming that the building is sold at the end of

year 10 and the cap rate at that time is expected to be 10%? What is the cap rate at time 0?

b. What is the value of this office building, assuming that the building will be held and

rented indefinitely (perpetually)? What is the implied cap rate at time 0?

c. What is the value if the rents are paid in advance (at the beginning of the year) and the

building is rented perpetually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Bruno Corporation is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $439,500. The company believes that with this new machine it will improve productivity and increase quality, resulting in an increase in net annual cash flows of $103,887 for the next 6 years. Management requires a 10% rate of return on all new investments. Calculate the internal rate of return on this new machine. Should the investment be accepted?arrow_forwardQuestion: Your client is asking you to design a Flux Capacitor. The Flux Capacitor is expected to cost $5,200 to build. If operations and maintenance costs are anticipated to be 15% of the build costs the first year of operation and operation and maintenance costs will increase by 6% each year after, how much will your client have invested in the Flux Capacitor after 5 years? Notes from instructor: I have had a few questions about the Econ. Assignment. I want to clarify that the 6% interest rate does not accumulate over 4 years and it is not added to the 15%. If something increases by the interest it is (1+i) each year. I recommend finding the cost of each year and then summing them up. The equation is not direct from the FE manual so this is going to best your best course of action for now.arrow_forwardFor upvote see the attachment and answer correctly ASAP with step by step explanation within 40minutesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education