FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

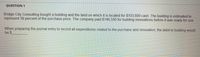

Transcribed Image Text:**Question 1**

Bridge City Consulting bought a building and the land on which it is located for $103,800 cash. The building is estimated to represent 39 percent of the purchase price. The company paid $146,550 for building renovations before it was ready for use.

When preparing the journal entry to record all expenditures related to the purchase and renovation, the debit to building would be $__________.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- O Determine Cost of Land Four Corners Delivery Company acquired an adjacent lot to construct a new warehouse, paying $29,000 and giving a short-term note for $325,000. Legal fees paid were $2,375, delinquent taxes assumed were $9,200, and fees paid to remove an old building from the land were $22,200. Materials salvaged from the demolition of the building were sold for $5,300. A contractor was paid $1,076,200 to construct a new warehouse. Determin he cost of the land to be reported on the balance sheet.arrow_forwardHaresharrow_forwardeBook Show Me How Determining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $41,000 in cash and giving a short-term note for $282,000, Legal fees paid were $2,290, delinquent taxes assumed were $14,200, and fees paid to remove an old building from the land were $21,000. Materials salvaged from the demolition of the building were sold for $4,800. A contractor was paid $981,900 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. X Feedback Check My Work Costs incurred to ready the asset for use are added to the asset account. Materials salvaged and sold during the process reduce the cost of the land.arrow_forward

- i need the answer quicklyarrow_forwardes Required information. [The following information applies to the questions displayed below.] Bridge City Consulting bought a building and the land on which it is located for $135,000 cash. The land is estimated to represent 50 percent of the purchase price. The company paid $6,000 for building renovations before it was ready for use. 3. Compute straight-line depreciation on the building at the end of one year, assuming an estimated 10-year useful life and a $4,000 estimated residual value. (Do not round intermediate calculations.) 4. What should be the book value of (a) the land and (b) the building at the end of year 2? Straight-Line Depreciation 3 4(a) Land 4(b) Buildingarrow_forwardPlease answer do not image formatarrow_forward

- i need the answer quicklyarrow_forwardasv.1arrow_forwardRodriguez Company pays $331,695 for real estate with land, land improvements, and a building. Land is appraised at $243,000; land improvements are appraised at $81,000; and the building is appraised at $216,000. 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised Value x Total Cost of = Apportioned Acquisition Cost Land Land improvements Building Totals Required 2 > Required 1arrow_forward

- QUESTION 1 Scott Industries had the following transactions during 2022: 1. Acquired an office building on three acres of land for a lump-sum price of $2,000,000. According to independent appraisals, the fair values were $1,325,000 and $790,000 for the building and land, respectively. A cash down payment of $500,000 20-Jan was made with the remainder financed. 2. Purchased equipment paying $19,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be paid in five annual installments of $19,000 on the anniversary date of the contract. Based on Cool Globe's 8% borrowing rate for such transactions, the implicit interest cost is $19,139. 3-Feb 3. Received a gift of land and building in Twin Pines Park as an inducement to 15-Mar relocate. The land and buildings have fair values of $39,000 and $395,000. Required: Pepare the journal entries for the transactions above. Round journal entry amounts to the nearest whole dollar. Date Accounts Debit Credit…arrow_forwardParagraph Styles A medical facility purchased a new copy machine for the billing office at a price of $25,000,000.00 on January 1, 2021. Its useful life is 6 years with a salvage value of $2,500,000.00. Calculate deprecation for the first 4 years using the following methods: (you may round all figures to the nearest dollar) Straight Line DDB SYDarrow_forwardKmuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education