ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

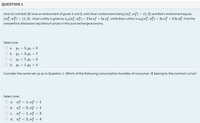

Transcribed Image Text:QUESTION 1

Alice (A) and Bob (B) have an endowment of goods 1 and 2, with Alice's endowment being (wf, wg) = (1,2) and Bob's endowment equals

(wf, w) = (1,3). Alice's utility is given by ua(zf, x4) = 2 ln z4 + In z4, while Bob's utility is up(zf, x}) = In z? + 2 ln z}. Find the

competitive (Walrasian) equilibrium prices in this pure exchange economy.

Select one:

O a.

P1 = 5, P2 = 3

%3D

O b.

P1 = 3, P2 = 7

%3D

O c.

P1 = 7, P2 = 3

O d. Pi = 1, P = 4

Consider the same set up as in Question 1. Which of the following consumption bundles of consumer A belong to the contract curve?

Select one:

O a. rf = 1, xg = 1

O b. af = 2, xg = 1

O c. af = 1, x

O d. af = 2, xg = 4

%3D

%3D

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Similar questions

- Graph make grapharrow_forward7arrow_forwardConsider an economy with 2 goods and 2 agents. The Örst agent has the utilityfunction, u (x1; x2) = ln x1 + 2 ln x2, and the other one has u (y1; y2) = 2 ln y1 + ln y2.The aggregate endowments of the 2 goods are given by (50; 100). Suppose there is asocial planner who cares about agents equally.(a) Set up the plannerís problem b) Calculate the first-best outcome (i.e., the social plannerís solution).arrow_forward

- Astrid’s utility function is UA(HA,CA) = HA · CA. Birger’s utility function is UB(HB,CB) = min{HB , CB }. If Astrid’s initial endowment is no cheese and 5 units of herring and if Birger’s initial endowments are 6 units of cheese and no herring, then where p is a competitive equilibrium price of herring and cheese is the numeraire, it must be that demand equals supply in the herring market. This implies that i. 6/(p+1)+2.5=5. ii. 5/6 = p. iii. 6/p + 5/2p = 5. iv. 6/5 = p. v. min{5, 6} = p. The answer is i. Please show me how to get the answer. thank you!arrow_forward4. Aaron and Burris have the following utility functions over two goods, x and y. Aaron’s utility function: UA(xA, yA) = min{xA/3, yA} Burris’s utility function: UB(xB, yB) = 9xB + 3yB Aaron’s endowment is eA = (2, 4). Burris’ endowment is eB = (10, 8). In an Edgeworth Box diagram, show which allocations are in the core. Solve for the set of Pareto optimal allocations (i.e. the contract curve) in the Edgeworth Box. Illustrate the contract curve in an Edgeworth Box diagram. Let good y be the numeraire (i.e. set py = 1 and let px = p). Solve for the Walrasian competitive equilibrium allocation and price ratio.arrow_forwardConsider the following pure exchange, Edgeworth box economy. There are two consumers, Adam and Mark, and two goods. Adam has an endowment of 7 units of good 1 and 3 units of good 2 (i.e. wadam = (7, 3)), while Mark has an endowment of 3 units of good 1 and 7 units of good2 (wmark$ = (3,7)). The consumers' utility functions are given by: Uadam = Xa1 + Xa2 and Umark = min{xm1, Xm2) where x¡1 is the consumption of good 1 by consumer (i = adam, mark) (a) Find the set of Pareto optimal allocations of this economy (b) Find the Walrasian equilibrium.arrow_forward

- In a two-good market, a consumer starts with an initial endowment of (x₁, x2) = (15.00, 5.00), while the market prices for these goods are given by (P1, P2) = (7.00, 3.00). The consumer has the following utility function: U 0.52 0.48 - Given this information, what will this consumer's final choice of quantity for each good be? x1 = x2 =arrow_forward= 5. Consider an economy with a single (representative) agent with utility function u(x, lc) = x¹/514/5 and an endowment of 0 units of x and 10 units of time, which the agent can use as leisure (c) or labor (L) (i.e., L + lc = 10). The agent owns a firm that produces good x using L as an input, with technology of production given by x(L) = 3√L. Let the price of x be p = 1 and let w denote the price of time (i.e., the price of leisure and the wage). Find the competitive price of time w and the competitive allocation.arrow_forwardConsider the pure exchange economy with 2 goods, good 1 and good 2, and two consumers, consumer A and consumer B. The consumers have the following utility functions: UA(X1A,X2A)=X1A+3X2A; UB(X1B,X2B)=X1B +X2B. Consumer A is initially endowed with 4 units of good A and no unit of good 2, that is, consumer A's initial endowment is (w1A,W2A)=(4,0). Consumer B is initially endowed with 3 units of good 2 and no unit of good 1, that is, (w1B,W2B)=(0,3). In order to implement the allocation (x1A,X2A)=(0,1), (x1B,X2B)=(4,2) as a Walrasian equilibrium, what transfer of wealth should we make between the consumers if good 1 is the numeraire, that is, if p1 =1? An amount 7 of wealth should be transferred from consumer A to consumer B. O a. O b. None of the other answers. O c. An amount 3 of wealth should be transferred from consumer A to consumer B. O d. An amount 3 of wealth should be transferred from consumer B to consumer A. e. An amount 7 of wealth should be transferred from consumer B to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education