These are for a study guide ( not a grade please do not decline)

Question 1: A currency

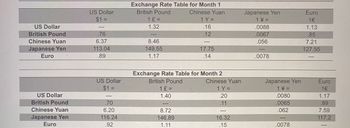

Question 2: Spanish holders of real estate and transportation in Spain are attracting investment ma from British investors using pound Sterling. In what month do the British investors buy Spanish real estate and transportation. Explain using numbers and show how you got it.

Question 3: An American company contracts a Japanese's architect to design a new building in Seattle for 8,075000 dollars. How much in yen would it cost in month 1 vs month 2. Which month would the Americans prefer to pay off the contract. Show math

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPQ 22b What is a situation the purchasing power exchange rate would be used?arrow_forwardThe interest rate in Eastlandia is 15% and the interest rate in USA is 11%. If the exchange rate of Eastlandia depreciates by 3%, what is the adjusted interest rate differential? Typed and correct answer please. I ll ratearrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward2. Analyze the data from China, Japan, Switzerland, Indonesia, Ukraine, and Taiwan (6 countries), and fill in the table as follow showing overvalued and undervalued currencies. (10%) Write a conclusion stating why PPP doesn't hold true according to the actual data. (10%) Country Local dollar Implied PPP Actual of the dollar price 1 United States China Indonesia Switzerland Ukraine Taiwan 5 20 30000 6.5 54 69 exchange rate 1 6.8 14000 0.9 28 30 Under/over against the dollar 0% valuationarrow_forwardThe following report is the amount of various currencies on December 31, 2015 owned by Jordan Exchange Company, as shown below Student Name Student ID EXI D Jordan Exchange Company Currencies Report at December 31, 2015 Currency Existing Quantity Purchasing Price Market Price Value of Existing Currency In JD at: Purchase Price Market Price Lower Price US Dollar 50000 0.709 0.708 222 999 British Pound 20000 0.99 1.01 999 227 Australian Dollar 15000 0.515 0.52 ??? 222 292 Euro 5000 0.769 0.768 Required: 1. Create a new work sheet (Currencies), and enter previous data in it. 2. Insert necessary equations in the related cells to calculate the value of existing currencies in JOD at purchase price and market prices. 3. Use (IF) function to calculate the value of existing currencies in JOD at lower of purchase or market price.arrow_forward

- A depreciation of the Canadian dollar will make Canadian goods ________ to foreigners and make imported goods ________ for Canadian residents. Select one: a. more expensive; cheaper b. more expensive; more expensive c. cheaper; cheaper d. cheaper; more expensivearrow_forwardConsider a basket of consumer goods that costs $60 in the United States. The same basket of goods costs NOK 40 in Norway. Holding constant the cost of the basket in each country, compute the real exchange rates that would result from the two nominal exchange rates in the following table. Cost of Basket in U.S. (Dollars) 60 60 Cost of Basket in Norway (Kroner) 40 40 Nominal Exchange Rate (Kroner per dollar) 3.00 2.00 Real Exchange Rate (Baskets of Norwegian goods per basket of U.S. goods)arrow_forwardOtondo , a currency trader in East African Community, has ksh 400,000. He wishes to assess his triangular arbitrage by moving to Uganda, and Tanzania. The exchange rate quotes from the currency convertor was: 32TZ/1 KES 20UGH/IKES Agreed exchange rate between Uganda shillings and Tanzania shilling was 1.5 UGH /1TZ Compute the results. Explain your resultsarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education