ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

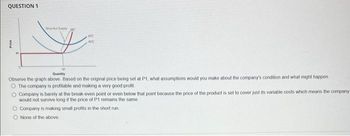

Transcribed Image Text:QUESTION 1

DA MC

ATC

AVC

Quantity

Observe the graph above. Based on the original price being set at P1, what assumptions would you make about the company's condition and what might happen

O The company is profitable and making a very good profit

O Company is barely at the break-even point or even below that point because the price of the product is set to cover just its variable costs which means the company

would not survive long if the price of P1 remains the same

O Company is making small profits in the short run

O None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose solar panel manufacturing is an industry subject to significant economies of scale, and there are currently three solar panel manufacturers all with identical costs. If the demand for solar panels is 5 times the quantity produced at the bottom of the long-run average cost curve, which of the following is most likely to happen to the solar panel manufacturing industry in the long run? O The number of solar panel manufacturers will increase O The price of solar panels will increase O The fixed costs of manufacturing solar panels will increase The quantity supplied of solar panels will decreasearrow_forwardIf the price is given what is the formula equation to fiqure what the maximum profit is for a perfectly competitive firm?arrow_forwardOne word The level of output of a firm where the price of the product is just enough to cover the average variable costarrow_forward

- Amos McCoy is currently raising corn on his 100-acre farm and earning an accounting profit of $100 per acre. However, if he raised soybeans, he could earned an accounting profit of $200 per acre. Is he currently earning an economic profit?arrow_forwardThe graph below depicts a typical firm in a perfectly competitive price-taker industry. The curve AC represents average total cost. MC F H AC Current Price (in the Short Run) %3D M LK Quantity If the current market price for the firm is A given the firm's cost conditions, which output should it produce? Select one: a. M b.L C.K d.1 Pricearrow_forwardATC MC Z AVC V. W $13 $10 T $7 $4 N 5 7 9 10 12 144 The graph above shows cost curves of a firm in a competitive market. Several points are marked on the graph to allow tracing curves. Some of them can also be used to indicate various prices. Refer to the graph to answer the following questions: 1. The short-run supply of the firm can be traced by connecting points 2. If the market price is $4 then in the short-run the firm would supply units. At this price the firm would 3. If the market price is $10 then in the short-run the firm would supply units. At this price the firm would 4. If the market price is $7 then in the short-run the firm would supply units. At this price the firm would 5. In the short run, the firm is better off continuing to operate (i.e. Q>0) despite losses if the price is in the interval above and below %24arrow_forward

- simply answer the questionarrow_forwardP.S. I sent this once before and it got reject because it was "graded". I haven't put anything on the question yet nor pushed the Grade This Now button.arrow_forwardRequired information The following figure shows the costs for a perfectly competitive producer: AVC, ATC, MC $46 235 30 25 20 15 10 5 0 MC 10 20 30 40 50 60 70 80 90 100 ATC AVC Output per period Refer to the above figure to answer this question. If the price of the product is $10, what is the profit-maximizing (or loss-minimizing) output?arrow_forward

- Hi, I do not understand why B is the correct answer for number 3. How do I know that this monoply is earning a normal economic profit in the long run?arrow_forwardQuestion 31 2.5 pts The following figure shows the marginal cost curve, average total cost curve, average variable cost curve, and marginal revenue curve for a firm for different levels of output. Price MC ATC AVC F G R MR W 0 A B Quantity At the output level OC, average fixed cost is equal to ○ MC GM GZ ZM 000 оarrow_forwardUse the information in the graphs below to answer the following questions SAb $/gal 25- S1 25 H MC ATC 20 20 15 15 P1 10 10 P2 5 4 6 8 10 2. Thousands of gal/week 1 3 Millions of gal/week What is the long-run equilibrium price in this market? Please enter your answers as whole numbers with and do not type out your answer in words (ie. $5 or $5.00 not "Five dollars"). How many gallons per week will the individual firm produce to maximize profits in equilibrium? Please enter your answers as whole numbers with no extra words (ie. 5000 not "5000 gallons/week"). What is the individual firm's long run economic profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education