FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

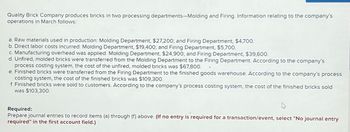

Transcribed Image Text:Quality Brick Company produces bricks in two processing departments-Molding and Firing. Information relating to the company's

operations in March follows:

a. Raw materials used in production: Molding Department, $27,200; and Firing Department, $4,700.

b. Direct labor costs incurred: Molding Department, $19,400; and Firing Department, $5,700.

c. Manufacturing overhead was applied: Molding Department, $24,900; and Firing Department, $39,600.

d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's

process costing system, the cost of the unfired, molded bricks was $67,800.

e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process

costing system, the cost of the finished bricks was $109,300.

f. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold

was $103,300.

Required:

Prepare journal entries to record items (a) through (f) above. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- BNC Company produces a product in two departments: (1) mixing and (2) finishing. the company uses a process cost accounting system. Accounting Transactions No. Transactions (e) manufacturing overhead is applied to the product based on machine hours used in each department: mixing department - 400 machine hours at $30 per machine hour. Finishing department - 500 machine hours at $20 per machine hour. (f) units costing $56,000 were completed in the mixing department and were transferred to the finishing department. (g) units costing $70,000 were completed in the finishing department and were transferred to finished goods. (h) finished goods costing $40,000 were sold on account for $55,000. Prepare the journal entries to record the preceding transactions for BNC Company. List debit transactions first and then list credit transactions. General Journals No. Account Titles and Explanation Debit ($) Credit ($) (e) work in process inventory - mixing…arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 9,000 units, 70% completed Direct materials, 212,000 units @ $1.8 Direct labor Factory overhead Bal. ? units, 50% completed 28,800 381,600 314,000 122,170 a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. To Finished Goods, 207,000 units 1. Cost of beginning work in process inventory completed this period. 2. Cost of units transferred to finished goods during the period. 3. Cost of ending work in process inventory. 4. Cost per unit of the completed beginning work in process inventory, rounded to the nearest cent. $ 0.0.0.0 $ ?arrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, thefollowing information was supplied by its accountant: Direct materials inventory $62,400Work-in-process inventory 33,900Finished goods inventory 55,600 During June, direct labor cost was $143,000, direct materials purchases were $346,000, and thetotal overhead cost was $375,800. The inventories at the end of June were:Direct materials inventory $63,000Work-in-process inventory 37,500Finished goods inventory 50,800 Required:1. Prepare a cost of goods manufactured statement for June.2. Prepare a cost of goods sold schedule for June.arrow_forward

- Barry Pottery Supplies manufacturers supplies used during the pottery process. They have multiple processes, the first of which is Molding. The following information relates to the Molding beginning balance: 5,300 physical units $184,700 beginning cost During the period, 12,400 additional physical units are started. An additional costs of $77,900 in direct materials and $84,000 in manufacturing overhead are incurred. Additionally, 1,890 direct labor hours were incurred. Factory laborers are paid at a rate of $50 per hour. At the end of the period, 6,900 physical units remained in progress. These physical units were 60% complete. Using the information provided, calculate the work in progress ending balance. Round your answer to the nearest whole dollar.arrow_forwardWowza Corporation manufactures party supplies and uses a predetermined overhead. The CFO has estimated total manufacturing costs to be $108.500, and the activity driver labor hours, which are estimated to be 62,000 hours. The following beginning balances are below: Work in Process Finished Goods $ 19,800 $ 37,100 Prepare these journal entries: #1) Manufacturing overhead was applied using 68,000 direct labor hours. #2) Seventy-five percent of Work in Process was transferred to the Finished Goods department. Please provide two journal entries.arrow_forwardhow I do these entries? Quality Brick Company produces bricks in two processing departments—Molding and Firing. Information relating to the company’s operations in March follows: Raw materials used in production: Molding Department, $28,500; and Firing Department, $5,500. Direct labor costs incurred: Molding Department, $19,700; and Firing Department, $5,400. Manufacturing overhead was applied: Molding Department, $23,300; and Firing Department, $39,600. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company’s process costing system, the cost of the unfired, molded bricks was $69,500. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company’s process costing system, the cost of the finished bricks was $109,400. Finished bricks were sold to customers. According to the company’s process costing system, the cost of the finished bricks sold was $104,300.…arrow_forward

- Munabhaiarrow_forwardThe April Work in Process account for Coventry Co. contained the following: Beginning balance -- $19,000 debit Direct materials -- $11,000 debit Direct labor -- $8,000 debit Overhead -- $13,000 debit Transfer to finished goods -- $3,000 credit Overhead is applied at a rate of 125% of direct labor cost. The only job in process at April 30, Job #897, has been charged with direct labor cost of $4,000. What amount of direct materials cost has been charged to Job 897? $____________arrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education