ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

5

Transcribed Image Text:Q5 (ILOs measured: B1, B2, C2, C3)

For Independent IRR Projects answer the following question

The High Society Baked Bean Co. is considering a new canner. The canner costs $120 000 and

will have a scrap value of $5000 after its 10-year life. Given the expected increases in sales, the

total savings due to the new canner, compared with continuing with the current operation, will be

$15 000 the first year, increasing by $5000 each year thereafter. Total extra costs due to the more

complex equipment will be $10 000 per year. The MARR for High Society is 12 percent. Should

it invest in the new canner?

Note: There are several ways a student can do this. In this problem, equating annual outflows

and receipts appears to be the easiest approach, because most of the cash flows are already

stated every year.

5000(A/F,i,10) + 15 000 + 5000(A/G,i*,10)

-120 000(A/P,i,10) 10 000 = 0

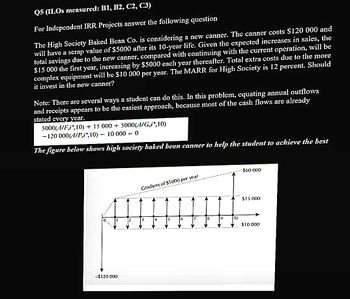

The figure below shows high society baked bean canner to help the student to achieve the best

0

-$120 000

Gradient of $5000 per year

15

6

8

9

10

$60 000

$15.000

$10 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 13. Discuss the potential impact of utility computing.14. Discuss the ethics related to use of RFID tags.arrow_forwardEconomics Anna has recently completed her dentistry degree and has taken up employment in a Sydney hospital Anna incurred the outgoings listed below. she would like to know whether they are allowable deduction. with reference to relevant law and provisions and principal advise Anna 1. travelling to Melbourne hospital for a seminar on how a hospital clinic works before interview: $400 2. moving from her home in Melbourne to relocate to Sydney to live with parents: $2000 3. childcare expenses of $25000 for her three year old daughter while Anna works. her contract of employment specifies the relevant child centre that Anna must send her daughter toarrow_forward18arrow_forward

- I need answer typing clear urjent no chatgpt used i will give upvotes full explanationarrow_forwardAt a price of $14, country 1 will (a) offer for export 9 units of this product. (b) seek to import 9 units of this product. (c) choose not to trade. (d) increase supply. (e) offer for export 18 units of this productarrow_forward2. Compare the choices between offshore branch and offshore subsidiary.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education