A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

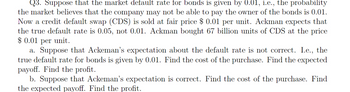

Transcribed Image Text:Q3. Suppose that the market default rate for bonds is given by 0.01, i.e., the probability

the market believes that the company may not be able to pay the owner of the bonds is 0.01.

Now a credit default swap (CDS) is sold at fair price $ 0.01 per unit. Ackman expects that

the true default rate is 0.05, not 0.01. Ackman bought 67 billion units of CDS at the price

$ 0.01 per unit.

a. Suppose that Ackeman's expectation about the default rate is not correct. I.e., the

true default rate for bonds is given by 0.01. Find the cost of the purchase. Find the expected

payoff. Find the profit.

b. Suppose that Ackeman's expectation is correct. Find the cost of the purchase. Find

the expected payoff. Find the profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Similar questions

- The following table lists several corporate bonds issued during a particular quarter. Company AT&T Bank ofAmerica GeneralElectric GoldmanSachs Verizon WellsFargo Time toMaturity(years) 10 10 2 3 8 7 AnnualRate (%) 2.40 3.00 5.25 7.15 6.15 2.50 If the General Electric bonds you purchased had paid you a total of $6,630 at maturity, how much did you originally invest? (Round your answer to the nearest dollar.) $arrow_forwardFor a fully-discrete 10-year term insurance on (40) with face amount of 1000 You are given the following: A40.5 = 0.695; A. = 0.045; *40:5] A45:5 = 0.725; A! *45:5] A45.5 0.050; d = 0.08 %3D Calculate 5V, the net premium reserve at time 5.arrow_forwardA life insurance company sells annuities to men aged exactly 60. Each policyholder pays a single net premium, P, and then receives anannuity of $30 000 a year in arrear (so that the first annuity payment is on the 61st birthday). Assume that mortality follows the Standard Select Life Table,and that the interest rate is 5% per year. Now suppose that the office sells 1 000 such annuities simultaneously toindependent lives. Calculate the value of P such that the probability thatthe present value of the profit to the insurance company is positive is 95%.arrow_forward

- Suppose that the advance estimate for fourth quarter GDP growth is 2%. Which of the following is true? 1.It is likely that the final estimate will be higher than 2% because there are omissions in the initial numbers. 2.We will not know the final estimate until the end of the calendar year. 3.It is likely that the final estimate will be lower than 2% due to errors in the initial numbers. 4.We do not know whether the final estimate will be higher or lower than 2%.arrow_forwardConsider the following. My recent marketing idea, the Miracle Algae Growing Kit, has been remarkably successful, with monthly sales growing by 7% every 6 months over the past 4 years. Assuming that I sold 100 kits the first month, how many kits did I sell in the first month of this year? Determine the following values given that FV = PV(1 + i)", where FV and PV are measured in kits and time is measured in 6 month periods. PV = i = n = Solve for FV. (Round your answer to the nearest whole number.) FV = How many kits did I sell in the first month of this year? kitsarrow_forwardThe APR for loans can also be approximated (however, not within the 1 4 of 1% accuracy required by Regulation Z†) by using the following formula: APR = 2mI P(n + 1) where m = the number of payment periods per year I = the interest (or finance charge) P = the principal (amount financed) n = the number of periodic payments to be made. Thus, if m = 12, I = $264, P = $1200 and n = 30, APR = 2mI P(n + 1) = 2 × 12 × 264 1200 × 31 = 17%. Use the APR formula to find the APR to one decimal place. (Assume m = 12.) AmountFinanced FinanceCharge Number ofPayments $4000 $332 12 %State the difference between the answer obtained by the formula and the answer obtained using the True Annual Interest Rate (APR) table. (Round your answer to one decimal place.) %arrow_forward

- 2. An annuity provides a payment of n at the end of each year for n years. What is the present value of the annuity if the annual effective rate of interest is 1/n?arrow_forward7. Find the future value (A = P + Prt) of a simple interest investment of $1600 invested for 5 years at 14%.arrow_forward4. a. Suppose that betwee 401(k) and your employer 8.3%compounded annually dollar, after 18 years?arrow_forward

- A proposed project has the following cash flow estimates.Assuming statistically independent cash flows, a normally distributed net present value, and a minimum attractive rate of return of 15%, determine the following. For the following questions, employ an analytical solution: a. the mean and standard deviation of net present value. b. the probability that the net present value is negative. c. the probability that the net present value is greater than $1,000,000. Assume the initial investment and annual receipts are normally distributed. d. Using a Monte Carlo simulation with 10,000 iterations, estimate the probability that the present worth is negative.arrow_forwardThere is a 0.9987 probability that a randomly selected 32-year-old male lives through the year. A life insurance company charges $197 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $100,000 as a death benefit Complete parts (a) through (c) below. a. From the perspective of the 32-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is S The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.)arrow_forward7.31. A financial institution has entered into a swap where it agreed to receive quarterly payments at a rate of 2% per annum and pay the SOFR three-month reference rate on a notional principal of $100 million. The swap now has a remaining life of 10 months. Assume the risk-free rates with continuous compounding (calculated from SOFR) for 1 month, 4 months, 7 months, and 10 months are 1.4%, 1.6%, 1.7%, and 1.8%, respectively. Assume also that the continuously compounded risk-free rate observed for the last two months is 1.1%. Estimate the value of the swap.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON