FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

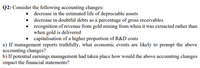

Transcribed Image Text:Q2: Consider the following accounting changes:

• decrease in the estimated life of depreciable assets

• decrease in doubtful debts as a percentage of gross receivables

• recognition of revenue from gold mining from when it was extracted rather than

when gold is delivered

capitalisation of a higher proportion of R&D costs

a) If management reports truthfully, what economic events are likely to prompt the above

accounting changes?

b) If potential earnings management had taken place how would the above accounting changes

impact the financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 41 Collateralised debt obligations (CDOs) were responsible for significant damage and disruption to global financial markets as: the securities' cash flow was based on cash flows from other financial securities and not the cash flows from real assets investors accepted the recommendations of CDO arrangers and rating agencies O the CDOs' cash flows were based on cash flows from real assets and not from other financial securities O many investors were unable to assess the fairness of pricesarrow_forwardSelect all that are true with respect to depreciation. Group of answer choices Depreciation is a cash flow outflow at the time it is recorded in the financial statements Depreciation itself is not a cash flow Accounting depreciation impacts cash flow, Tax depreciation does not Accounting depreciation does not impact cash flow, Tax depreciation does impact cash flow The depreciation tax shield is a relevant cash flow for decision makingarrow_forwardWhich of the following is an advantage of cash basis accounting vs. accrual basis accounting? It provides a more accurate representation of cash generated in a specific period. It usually leads to better adherence to the matching principle. It usually provides less volatile year-to-year operating results. It provides a better indication of the entity’s long-run cash-generating ability.arrow_forward

- 1.-Accounting profit plus depreciation charges equals cash flow, when the company does not handle credits. True or false? (Class exercise)arrow_forward[S1] Analysts and investors may differ on the value theygive to an asset or business depending on their estiinatesof cash flows and related risks on the asset or ssusiness.[S2] Relative valuation can be made on unique assets orinvestments. A. Only S1 is true.B. Only S2 is true.C. Both are true.D. Both are false.arrow_forwardWhy are unrealized gains and losses from available-for-sale securities not reported as a component of net income? Select one: a. Because goodwill exists that must be separately accounted for b. Because the investor has the ability to exercise significant influence over the investee c. Because consolidated financial statements must be prepared d. Because large swings in market value over which management has no control may distort current period performance as measured by net incomearrow_forward

- In the era of inflation, if This leads to achieving holding losses O a. Monetary assets > monetary liabilities Monetary assets = monetary liabilities Non-monetary assets > non-monetary liabilities O b. O c. O d. Monetary assets < monetary liabilities.arrow_forwardThe company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from a. Increase of return on marketable securities b. None of the choices is correct c. Increase in the annual demand for cash d. Decrease of debt to asset ratioarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education