ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

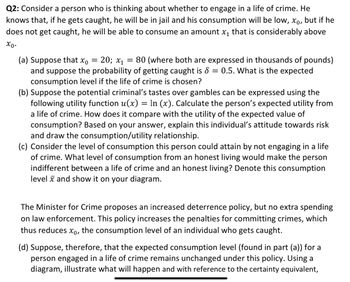

Transcribed Image Text:Q2: Consider a person who is thinking about whether to engage in a life of crime. He

knows that, if he gets caught, he will be in jail and his consumption will be low, xº, but if he

does not get caught, he will be able to consume an amount x₁ that is considerably above

Χρ·

(a) Suppose that x₁ = 20; x₁ = 80 (where both are expressed in thousands of pounds)

and suppose the probability of getting caught is 8 = 0.5. What is the expected

consumption level if the life of crime is chosen?

(b) Suppose the potential criminal's tastes over gambles can be expressed using the

following utility function u(x) = In (x). Calculate the person's expected utility from

a life of crime. How does it compare with the utility of the expected value of

consumption? Based on your answer, explain this individual's attitude towards risk

and draw the consumption/utility relationship.

(c) Consider the level of consumption this person could attain by not engaging in a life

of crime. What level of consumption from an honest living would make the person

indifferent between a life of crime and an honest living? Denote this consumption

level and show it on your diagram.

The Minister for Crime proposes an increased deterrence policy, but no extra spending

on law enforcement. This policy increases the penalties for committing crimes, which

thus reduces x, the consumption level of an individual who gets caught.

(d) Suppose, therefore, that the expected consumption level (found in part (a)) for a

person engaged in a life of crime remains unchanged under this policy. Using a

diagram, illustrate what will happen and with reference to the certainty equivalent,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- At races, your horse, White Rum, has a probability of 1/20 of coming 1st, 1/10 of coming 2nd and a probability of 1⁄4 in coming 3rd. First place pays $5,000 to the winner, second place $4,000 and third place $1,350.Hence, is it worth entering the race if it costs $1050? Your company plans to invest in a particular project. There is a 40% chance you will lose $3,000, a 45% chance you will break even, and a 15% chance you will make $5,500. Based solely on this information, what should you do? On 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forwarda) (3) Consider two investments X and Y, where X pays $0 and $10 with equal probability and Y pays 0 with probability 0.75 and $20 with probability 0.25. What investment would an investor choose if her utility function is u(x) = x? u(x) = x u(x) = 1-e 10 () (i) (ii)arrow_forwardOnline sale Suppose a student is considering selling their used smartphone online. They can sell it now for $p or wait and sell it next month for a different price. If they wait, they will receive a random offer with an equal probability of being either $300 or $100. The student can only receive one offer and cannot sell the phone after the second month. 1. Calculate the expected price in the next month. 2. Suppose that the current price p is equal to 200. (a) Give a reason why selling today could be a good idea. (b) Give a reason why selling next month could be a good idea.arrow_forward

- Becky is deciding whether to purchase an insurance for her home againtst burglary. the payoff for her is shown as follow: Net worth of her Net worth of her home: $ 20000 burglary(10%) Net worth of her Net worth of her home: $50000 burglary (90%) The insueance would cover all the loss from burlary and the insurance fee is $8000. Her utility funtion is given as u=w ^0.3 Should Beck purchase the insurance Explain.arrow_forwardplease only do: if you can teach explain each partarrow_forward2. Christiaan can go hiking, or he can stay at home. Hiking would be fun if nothing bad happens, but there is a risk if he goes hiking that he will meet a bear (not fun) or get bitten by a snake (very not fun). Christiaan decides that if there is a 5% chance of meeting a bear and a 1% chance of getting bitten by a snake, he would prefer to go hiking rather than stay at home. However, if the chance of meeting a bear is 10% and the chance of a snake bite is 5%, he definitely would rather stay at home. then (a) Consider the utility function: U (stay home) = 25, U (hike no event) = 100, U (hike & snake) -1000, U (hike & bear) = -200. Does this utility function represent Christiaan's pref- erences? Explain. (b) Suppose that the utility function in (a) does represent Christiaan's preferences. Would Christiaan prefer to hike or stay home if the probability of meeting a bear is 6% and the probability of being bitten by a snake is 4%? Show your work.arrow_forward

- Suppose 1,250 raffle tickets are being sold for $5 each. One ticket will be chosen to receive a cash prize of $2,500, and three tickets will be chosen to recelve cash prizes of $500. Let x be the amount of money won/lost by purchasing one raffle ticket. Find the expected value for . (Round your answer to the nearest penny. Do not include as sign in your answer. Your answer may be positive or negative.)arrow_forwardTo go from Location 1 to Location 2, you can either take a car or take transit. Your utility function is: U= -1Xminutes -5Xdollars +0.13Xcar (i.e. 0.13 is the car constant) Car= 15 minutes and $8 Transit= 40 minutes and $4 What is your probability of taking transit given the conditions above? What is your probability of taking transit if the number of buses on the route were doubled, meaning the headways are halved? Remember to include units.arrow_forwardanswer this properly, remember (0.35x50)+(0.65x10)=£24 herearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education