Q1. Describe two ways through which the consolidated government (fiscal and monetary authorities) can finance a deficit.

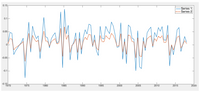

Q2. The figure below shows the evolution of two different measures of inflation. Which of these series is showing the evolution of a measure of headline inflation, and which one is showing the evolution of a measure of underlying inflation? Justify your answer, and give an example of a measure of underlying inflation.

Q3. Consider the following quote by Ed Prescott: “The policy implication of [my] research is that costly efforts at stabilization are likely to be counterproductive.” Provide a brief justification of Prescott’s view based on the results of the Real Business Cycle Theory studied in class.

Q4.Provide one argument in favour and one argument against the following statement: “Ideally, it would be optimal to set the nominal interest rate to zero at all times.”

Q.5Evaluate the validity of the following claim: “Under a fixed exchange rate, the monetary authority looses its ability to implement independent

Q6.Are current account deficits necessarily undesirable? Provide a brief justification.

Step by stepSolved in 2 steps

- Suppose a central bank targets an inflation rate of 3%. She projects a long-term economic growth rate of 4%. Suppose the new Chairman of the central bank will assume his duty next year. He is widely expected to be a “monetary hawk” – he favors a “tighter” growth in money supply. Other things being constant, how would this affect the expected inflation rate, nominal interest rate and the current general price level? Using relevant Classical Theories, briefly explain your answers.arrow_forwardThe economy of Macro Island is described by the quantity equation with constant velocity. All residents of Macro Island understand the quantity theory and use it to form their expectations of inflation. Real income grows at a steady 2 percent per year, and the nominal interest rate is 5 percent. In one year, people had expected the money supply to grow by 4 percent, but in fact it grew by only 3 percent. a. What was the inflation rate? (3% 4% 1% 2%) b. What was the expected inflation rate? (1% 4% 3% 2%) c. What was the ex ante real interest rate? (4% 2% 1% 3%) d. What was the ex post real interest rate? (2% 1% 4% 3%) e. Did the deviation of inflation from what was expected hurt creditors or debtors? ( Creditors Debtors)arrow_forwardWhat Can the Fed Do about Inflation? In the article by Thomas Hogan, we learn that Russia's invasion of the Ukraine nor the shortage or supply chain issues has not derived the main causes of inflation. (Hogan, 2022) The main cause for the issues that we have been facing come directly from the constant price changes and the monetary policy that is currently in place. We learn that with Federal Open Market Committee (FOMC) has not adjusted their monetary policy, and have been raising the rates in such small increments that is causing the inflation to continue in an upward trend. What needs to occur is the FOMC needs to raise interest rates in greater scales in order the combat the inflation that is taking place and stabilize the price levels that are out there. (Hogan, 2022) What needs occur is that the Fed needs to come up with a policy that will allow for a predetermined path that slows down and regulating the money growth back to a safe place. Having the guidance from the article…arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardpart Barrow_forward1) https://www.econlowdown.org/resource-gallery/monetary_policy_tools 2) https://www.wsj.com/articles/zimbabwe-money-aa13a052?mod=hp_featst_pos5 3) https://news.sky.com/video/jamaican-bank-releases-reggae-song-on-inflation-12058864 please I need a short summary of these articles.arrow_forward

- true or false Suppose that the central bank lost credibility in the sense that people no longer believe its inflation target (that is, inflation expectations are not `anchored’). In this case, both short-run output and long-run output do not increase in response to a permanently higher inflation target.arrow_forwardOld MathJax webview Assume the public have rational expectations. According to the model, which policy is better: A monetary authority bound by rules or discretion? Assume the public have rational expectations. According to the model, which policy is better: a monetary authority bound by rules or discretion? For my equilibrium rate of inflation my answer was 0. For my equilibrium rate of output I got 2.5.arrow_forwardAssume the Federal Reserve has forecasted inflation over the next year to be over its target. Because it conducts policy based on uncertain forecasts and on lags in its effects on the economy, a prudent policy for it to follow is Question 40 options: making small changes in interest rates over time to do nothing to increase the growth rate of the monetary base make large changes in interest rates and then wait to see what inflation doesarrow_forward

- Suppose the economy begins at full employment. Label this starting point as point "1." Then, suppose that, due to increased instability in the financial markets, a decrease in investor and consumer confidence occurs. Show the effects on your graph and label the new equilibrium point "2." Lastly, suppose the Federal Reserve wants the economy to return to full-employment as quickly as possible. Should the Fed intervene? If so, show the impact of successful monetary policy on your graph. Label this new equilibrium point "3."arrow_forwardWhy do some economists support some level of inflation over completely stable prices? Instructions: You may select more than one answer. Click the box with a check mark for correct answers and click to empty the box for the wrong answers. ? Reduced risk of deflation ? Easier for firms to adjust real wages ? More opportunity for contractionary fiscal policy ? More difficult for firms to adjust real wages ? More opportunity for expansionary monetary policyarrow_forwardConsider the following simple monetary rules estimated for two different periods, 1969-1985 and 1985-2005, and interpret each rule. During which period does the Fed appear to be most anti- inflation? Explain your answer. Monetary Policy Rule Period 1969-1985 R₁ = 6.35 +0.67 (π, t-π) 1985-2005 R 1.35 +1.34 (tn) (Source: Estimated using FRED II data)arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education