FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

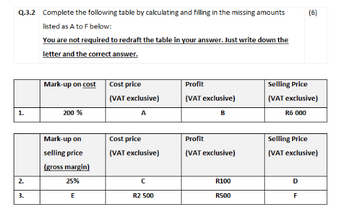

Transcribed Image Text:Q.3.2 Complete the following table by calculating and filling in the missing amounts

listed as A to F below:

You are not required to redraft the table in your answer. Just write down the

letter and the correct answer.

Mark-up on cost

Cost price

Profit

(VAT exclusive)

(VAT exclusive)

1.

200 %

A

B

(6)

Selling Price

(VAT exclusive)

R6 000

Mark-up on

Cost price

Profit

Selling Price

selling price

(gross margin)

(VAT exclusive)

(VAT exclusive)

(VAT exclusive)

2.

25%

с

R100

D

3.

E

R2 500

R500

F

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is the right answer in the options?arrow_forwardPlease help me with show all calculation thankuarrow_forwardExercise 21.12 (Static) Pricing a Special Order (LO21-1, LO21-2, LO21-3) Mazeppa Corporation sells relays at a selling price of $28 per unit. The company's cost per unit, based on full capacity of 160,000 units, is as follows: Direct materials Direct labor Overhead (2/3 of which is variable) Mazeppa has been approached by a distributor in Montana offering to buy a special order consisting of 30,000 relays. Mazeppa has the capacity to fill the order. However, it will incur an additional shipping cost of $2 for each relay it sells to the distributor. a-1. Assume that Mazeppa is currently operating at a level of 100,000 units. Show the calculation for the unit price to charge the distributor which will generate an increase in operating income of $2 per unit? a-2. What is your interpretation of the changes to the contribution margin per unit and the operating income on account of the unit price charged to the distributor? b-1. Assume that Mazeppa is currently operating at full capacity.…arrow_forward

- Please do not give solution in image format thankuarrow_forwardomplete the table: Cost Markup Selling Price $480 40% on selling price _______ ?selling pricearrow_forwardUse the below table to answer the following questions. Selling Price = $43.00 Fixed Cost $47,200 47, 200 47,200 57, 200 57, 200 57, 200 67,200 67,200 67,200 Required Variable Cost 15 16 17 15 16 17 15 16 17 2,200 $14,400 12, 200 10,000 4,400 2,200 (5,600) (7,800) (10,000) 3,200 $42,400 39, 200 36,000 32,400 29, 200 26,000 22,400 19, 200 16,000 Sales Volume 4,200 Profitability $70,400 66, 200 62,000 60,400 56,200 52,000 50,400 46, 200 42,000 5,200 $98,400 93,200 88,000 88,400 83,200 78,000 78,400 73,200 68,000 6, 200 $126,400 120, 200 114,000 116,400 110, 200 104,000 106,400 100, 200 94,000 a. Determine the sales volume, fixed cost, and variable cost per unit at the break-even point. b. Determine the expected profit if Franklin projects the following data for Delatine: sales, 4,200 bottles; fixed cost, $47,200; and variable cost per unit, $17. c. Franklin is considering new circumstances that would change the conditions described in Requirement b. Specifically, the company has an…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education