ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

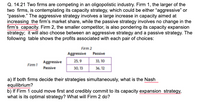

Transcribed Image Text:Q. 14.21 Two firms are competing in an oligopolistic industry. Firm 1, the larger of the

two firms, is contemplating its capacity strategy, which could be either "aggressive" or

"passive." The aggressive strategy involves a large increase in capacity aimed at

increasing the firm's market share, while the passive strategy involves no change in the

firm's capacity. Firm 2, the smaller competitor, is also pondering its capacity expansion

strategy; it will also choose between an aggressive strategy and a passive strategy. The

following table shows the profits associated with each pair of choices:

Firm 2

Aggressive Passive

Aggressive

25,9

33, 10

Firm1

Passive

30, 13

36, 12

a) If both firms decide their strategies simultaneously, what is the Nash

equilibrium?

b) If Firm 1 could move first and credibly commit to its capacity expansion strategy,

what is its optimal strategy? What will Firm 2 do?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The dropdown options are "Cleans" or "Does not clean." thank you!arrow_forwardTwo men’s clothing stores that compete for most of the market in a small town in Ohio and will choose their weekly advertising levels sequentially. The newspaper advertising department calls the clothing stores in alphabetical order to find out how much advertising each firm wishes to buy. Somehow — and nobody at the newspaper knows exactly how this happens — Arbuckle’s advertising decision “leaks out” to Mr. B’s, which then knows Arbuckle’s advertising decision when it makes its advertising decision for the week. The following payoff table facing the two firms, Arbuckle & Son and Mr. B’s, shows the weekly profit outcomes for the various advertising decision combinations. The payoff table is common knowledge. Use this payoff table to construct the appropriate sequential decision on the blank game tree provided below. If the manager at Arbuckle and Son employs the roll-back method to make the advertising decision for Arbuckle, the likely outcome will be: Multiple Choice $5,000 of…arrow_forwardMegan and Martha own competing hair salons that are in the same neighborhood. They are both considering offering their clients discounts in order to increase business. The payoff matrix shows their yearly incomes in thousands of dollars if they offer and do not offer discounts to their customers. Martha Megan Discount No Discount Discount $50, $75 $75, $60 No Discount $35, $90 $70, $85 If both Megan and Martha did not discount, what would each earn in yearly income? Megan would earn $50,000; Martha would earn $75,000. Megan would earn $75,000; Martha would earn $60,000. Megan would earn $35,000; Martha would earn $90,000. Megan would earn $70,000; Martha would earn $85,000. Megan would earn $35,000; Martha would earn $85,000.arrow_forward

- O Cell A O Cell C O Cell E O Cell I None of the abovearrow_forwardq19 If you advertise and your rival advertises, you each will earn $4 million in profits. If neither of you advertises, you will each earn $10 million in profits. However, if one of you advertises and the other does not, the firm that advertises will earn $1 million and the non-advertising firm will earn $5 million. If you and your rival plan to be in business for 10 years, then the Nash equilibrium is a. for each firm to not advertise in any year. b. for neither firm to advertise in early years but to advertise in later years. c. for each firm to advertise every year. d. for each firm to advertise in early years but not advertise in later years.arrow_forwardFirms 1 and 2 compete in a Cournot duopoly. If firm 2 adopts a strategy that raises firm 1's marginal cost: firm 2's reaction function will shift up. firm 1's reaction function will shift down. firm 2's reaction function will shift down. firm 1's reaction function will shift up.arrow_forward

- 8.8arrow_forwardOn a duopolistic market, two tobacco firms are considering separately whether or not to engage in a marketing campaign. The market share gained from advertising will depend on whether the other competitor also advertises. The payoffs in millions of pounds for the firms are displayed in the following payoffs table where the first figure in the bracket denotes the payoff to A, and the second figure the payoff to B. Firm B\Firm A Firm A advertises Firm A no advertising Firm B advertises (60,75) (20,150) Firm B no advertising (120, 25) (100,120) a. Is there a dominant strategy? If so, what is the dominant strategy? Explain the meaning of a dominant strategy. b. Is there a Nash equilibrium? If so, what is it? Explain briefly what this implies. Explain the concept of Nash equilibrium. c. Does this advertising game pose a prisoners' dilemma? Justify your answer and explain what this means for the case of making advertising in cigarettes illegal.arrow_forwardAlcoa and Kaiser, duopolists in the market for primary aluminum ingot, choose prices of their 500 foot rolls of sheet aluminum on the first day of the month. The following payoff table shows their monthly payoffs resulting from the pricing decisions they can make. Suppose Alcoa and Kaiser repeat their pricing decision on the first day of every month. Suppose they have been cooperating for the past few months, but now the manager at Kaiser is trying to decide whether to cheat or to continue cooperating. Kaiser’s manager believes Kaiser can get away with cheating for two months, but he also believes that Kaiser would be punished for the next two months after cheating. After punishment, Kaiser’s manager expects the two firms would return to cooperation. Kaiser’s manager ignores the time-value of money and does not discount future benefits or costs. 4. Suppose you were asked to manage a golf course that was currently charging a uniform price. Would you suggest that the course continue…arrow_forward

- The Tampa Tribune and the St. Petersburg Times compete for readers in the Tampa Bay market for newspapers. Recently, both newspapers considered changing the prices they charge for their Sunday editions. Suppose they considered the following payoff table for making a simultaneous decision to charge either a low price of $0.50 or a high price of $1.00. Tampa’s profits are shown in regular type. St. Petersburg’s profits are shown in bold. 1. Tampa Tribune's dominant strategy is ____________ (low price, high price, it has no dominant strategy).arrow_forwardApple and Microsoft are competing over computer operating systems. Each can target their product to business or personal market. Apple will announce their new operating system before Microsoft decided on their operating systems next features. If Apple focuses on the personal market and Microsoft focuses on business Apple earns 100 million and Microsoft 150 million. If Microsoft focus on personal and Apple focuses on business Microsoft earns 90 million and Apple 200 million. If both focus on the personal market each earns 115 million and if both focus on the business market they each earn 125 million. Write a game tree for this game and find the equilibrium strategy and equilibrium payoffs clearly labeling both.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education