Database System Concepts

7th Edition

ISBN: 9780078022159

Author: Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Python question please include all steps and screenshot of code. Also please provide a docstring, and comments through the code, and test the given examples below. Thanks.

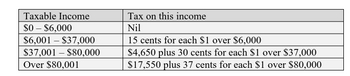

Here are (slightly fictional) tax brackets (Use The Attached Image):

For example, suppose you make $90,000; then you fall into the 4th tax bracket which

means you owe $17550 + $.37 * (90000-80000) = $21250.00 in taxes. Write function

tax() that as an input takes your (taxable) income and then calculates and returns how

much tax you owe.

>>> tax(5500)

0

>>> tax(7000)

150

>>> tax(38000)

4950

>>> tax(81000)

17920

Transcribed Image Text:### Taxable Income and Corresponding Tax Rates

This table provides a breakdown of tax rates based on different ranges of taxable income:

| **Taxable Income** | **Tax on this Income** |

|--------------------|------------------------|

| $0 – $6,000 | Nil |

| $6,001 – $37,000 | 15 cents for each $1 over $6,000 |

| $37,001 – $80,000 | $4,650 plus 30 cents for each $1 over $37,000 |

| Over $80,001 | $17,550 plus 37 cents for each $1 over $80,000 |

#### Analysis of Tax Calculation:

1. **For income from $0 to $6,000**: No tax is applied.

2. **For income from $6,001 to $37,000**: The tax is calculated as 15 cents for every dollar exceeding $6,000.

3. **For income from $37,001 to $80,000**: A base tax of $4,650 is applied, with an additional 30 cents for every dollar over $37,000.

4. **For income over $80,001**: A base tax of $17,550 is charged, plus an additional 37 cents for every dollar exceeding $80,000.

This structured approach helps in understanding how different income levels are taxed progressively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Similar questions

- Replace all the 0 (Zero) digits in your ID by 4. Example: If your ID is 382200448 , it becomes 382244448 Take the first 6 digits and substitute them in this expression (( A + B) / C) * ((D-E)/F)-2) according to the following table; [1 mark] Letter Replace by Digit Example Digit A 1st 3 B 2nd 8 C 3rd 2 D 4th 2 E 5th 4 F 6th 4 After substitution your expression ? Draw a rooted tree that represents your expression. [3 marks] What is the prefix form of this expression. [3 marks] What is the value of the prefix expression obtained in step 2 above? [3 marks]arrow_forwardDevelop a menu-based shape-maker, using randomly generated sizes & characters: pyramid, inverted pyramid, diamond, and hourglass. Use functions to perform tasks, including separate functions for generating a random integer in a range and for generating a random character in a range. The four different shapes are made from a randomly generated printable character and a randomly generated maximum width between 4 and 12. Beneath the shape, print a descriptive caption stating the symbol and the maximum width.arrow_forwardForm Validation for jscript. This is the requirement. I just need the code and attached to my jscode. Payment Information Validation Validate the customer’s payment information as follows: Expiry Date (Month) Required field Expiry Date Valid expiry date to ensure the card being used has not expired Card Number Required field, Valid Card Number NOTE: regarding the expiry date, you MUST use the date object to ensure that your date check is dynamic. here is the given html code. <li> <label for="month">Expiry Date</label> <select id="month" name="month"> <option>- Month -</option> <option value="1">January</option> <option value="2">February</option> <option…arrow_forward

- First, new file in the PyCharm integrated development environment (IDE), title it "TextBasedGame.py," and include a comment at the top with your full name. As you develop your code, remember that you must use industry standard best practices including in-line comments and appropriate naming conventions to enhance the readability and maintainability of the code. In order for a player to navigate your game, you will need to develop a function or functions using Python script. Your function or functions should do the following: Show the player the different commands they can enter (such as "go North", "go West", and "get [item Name]"). Show the player's status by identifying the room they are currently in, showing a list of their inventory of items, and displaying the item in their current room. #Sample function showing the goal of the game and move commands def show_instructions(): #print a main menu and the commands print("Dragon Text Adventure Game") print("Collect 6…arrow_forwardPlease please with this using javaarrow_forward21. Which properties will extend a grid item so that it covers multiple rows and columns, specifically the area from row gridlines 3 to 5 and from column gridlines 1 to 3? Group of answer choices a. grid-row: 3/5; grid-column: 1/3; b. grid-row: 2/4; grid-column: 4; c. grid-column-start: 3; grid-column-end: 5; d. grid-column-start-end: 1/3; grid-row-start-end: 3/5;arrow_forward

- simply fill in the blanks. To make it easier for you to enter the number, you may simply enter the number without having to indicate the base using the subscript. For example, you may enter AF instead of AFsixteen: Fill in the blanks. Provide the number immediately before and after the given number in the given base, respectively. No work to be shown for this problem. You may Click on Show Rich-Text Editor option for more formatting tools, such as subscript. 8D9FFsixteen. 1. F8DAOsixteen, 2. 3. 57100eight 4. , 100110000two, 4200seven, 5.arrow_forwardIn the langauage R: Which of the following statements is NOT correct about themes in R? Select one: Once set, a theme applies to all subsequent plots and remains active until it is replaced by a different theme The theme_set() function takes the name of a theme as an argument If we want to change the overall look of the figure all at once, we can use ggplot’s theme engine The theme_minimal() function can make ggplot output look like it has been featured in the Wall Street Journalarrow_forwardCreate three students with the following details: Snow White, student ID: A00234,credits: 24 Lisa Simpson, student ID: C22044,credits: 56 Charlie Brown, student ID: A12003,credits: 6 Then enter all three into a lab and print a list to the screen.arrow_forward

- import numpy as np # Given current stock pricecurrent_price = 163.02 # Simulate future stock pricesnum_samples = 1000 # You can adjust this number based on your needsgrowth_rate_samples = np.random.lognormal(mean=-0.8404, sigma=2.5, size=num_samples)future_prices = current_price * np.exp(growth_rate_samples) # Print or visualize the simulated future pricesprint(future_prices) i cant get an answer , im keeping errorsarrow_forwardIn java Develop a menu-based shape-maker, using randomly generated sizes & characters: pyramid, inverted pyramid, diamond, and hourglass. Use functions to perform tasks, including separate functions for generating a random integer in a range and for generating a random character in a range. The four different shapes are made from a randomly generated printable character and a randomly generated maximum width between 4 and 12. Beneath the shape, print a descriptive caption stating the symbol and the maximum width.Define the random integer and random character functions in a separate class in a separate source code file and call these functions from the shape maker.arrow_forwardplease use letter Marrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Database System Concepts

Computer Science

ISBN:9780078022159

Author:Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher:McGraw-Hill Education

Starting Out with Python (4th Edition)

Computer Science

ISBN:9780134444321

Author:Tony Gaddis

Publisher:PEARSON

Digital Fundamentals (11th Edition)

Computer Science

ISBN:9780132737968

Author:Thomas L. Floyd

Publisher:PEARSON

C How to Program (8th Edition)

Computer Science

ISBN:9780133976892

Author:Paul J. Deitel, Harvey Deitel

Publisher:PEARSON

Database Systems: Design, Implementation, & Manag...

Computer Science

ISBN:9781337627900

Author:Carlos Coronel, Steven Morris

Publisher:Cengage Learning

Programmable Logic Controllers

Computer Science

ISBN:9780073373843

Author:Frank D. Petruzella

Publisher:McGraw-Hill Education