Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN: 9780547587776

Author: HOLT MCDOUGAL

Publisher: HOLT MCDOUGAL

expand_more

expand_more

format_list_bulleted

Question

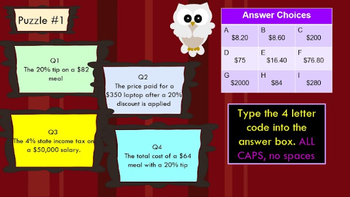

Transcribed Image Text:Puzzle #1

Q1

The 20% tip on a $82

meal

Q2

The price paid for a

$350 laptop after a 20%

discount is applied

Answer Choices

B

$8.20

$8.60

$200

D

E

F

$75

$16.40

$76.80

G

H

$2000

$84

$280

Q3

The 4% state income tax on

a $50,000 salary.

Q4

The total cost of a $64

meal with a 20% tip

Type the 4 letter

code into the

answer box. ALL

CAPS, no spaces.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The cost of one dozen cutters is listed as $525. A multiple discount of 12% and 8% is applied to the purchase. Determine the net (selling) price of the cutters.arrow_forwardMary is a sales person for Challenge Furniture. She receives an incremental commission based on the table below. If she sells $26,000 and has already received a draw of $766.15, how much commission is still owed to Mary? Level Sales volume Commission Rate 1 $0-11,700 3.7% 2 $11,700-21,200 4.3% 3 Over $21,200 4.9% $507.85 Need Help? Watch It Read It Master Itarrow_forwardwhy is an electric bill a variable expense?arrow_forward

- Giovanni and Josh run an online tutoring website First time student receive a 5% discount for first month only bringing the first month's tuition to $150 a month What is the original price or list price? What will be the cost for three months?arrow_forwardlist. 9 = 8 %3Darrow_forwardImagine that you are helping out a friend by taking care of their dog for the month of December while they are away taking care of family members. Your friend offers to compensate you by giving you a penny on Dec. 1, 2¢ on Dec. 2, 4¢ on Dec. 3, etc. Does this seem like a good deal? Before you answer, complete the chart below that would give your compensation through Dec. 14. Use dollars for the units. Date Compensation 1-Dec 0.01 2-Dec 0.02 3-Dec 4-Dec 5-Dec 6-Dec 7-Dec 8-Dec 9-Dec 10-Dec 11-Dec 12-Dec 13-Dec 14-Decarrow_forward

- Assume Buddy’s Farm Supply wants to make $45000 in net income. If the tax rate is 25%, how much operating income must Buddy have? $56250 $360000 $60000 $180000arrow_forwardThe weekly payroll of Abkar Hardware includes 19 employees who earn $220 each. How much is the employer's share of total Social Security and Medicare taxes for the first quarter of the year? a $218.46 b $436.92 c $4,157.01 d $8,314.02arrow_forwardSuppose your friend wins the lottery and is thinking of buying a new Tesla for around $125,980. The taxes on this vehicle will total $9,133.55. What is the effective tax rate that your friend is paying on the Tesla? 92.75% 13.79% 12.79% 7.25%arrow_forward

- S. 8S-4 = 3S + 21 %3D Due Tomoarrow_forward$34.95 – $6.99 = $27.96 %3D % = 6.99 original price discount price Calculator: 34.95 – 6.99 = 27.96 ne original price. if necessary. 4. A game system with a sale price of $178.20 plus 7% sales tax Sales tax: U Total price: 5. A 14% commission on $3,840 in sales 14%, 0n 2, •14 XB3,Q Commission: 57.60 $531. 5. A picture frame with a regular price of $12.98 at 25% discount 75% A92.98arrow_forwardLiquid weed killer is available in two sizes: 32 oz. costs $32.79 or 16 oz. costs $20.38. Calculate the cost per oz. for each and option to determine which is the better bargain. Enter the cost in dollars per ounce of the better bargain rounded to the nearest cent. 0.08arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Holt Mcdougal Larson Pre-algebra: Student Edition...

Algebra

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897...

Algebra

ISBN:9780079039897

Author:Carter

Publisher:McGraw Hill

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,