Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

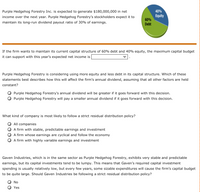

Transcribed Image Text:Purple Hedgehog Forestry Inc. is expected to generate $180,000,000 in net

40%

income over the next year. Purple Hedgehog Forestry's stockholders expect it to

Equity

60%

Debt

maintain its long-run dividend payout ratio of 30% of earnings.

If the firm wants to maintain its current capital structure of 60% debt and 40% equity, the maximum capital budget

it can support with this year's expected net income is

Purple Hedgehog Forestry is considering using more equity and less debt in its capital structure. Which of these

statements best describes how this will affect the firm's annual dividend, assuming that all other factors are held

constant?

Purple Hedgehog Forestry's annual dividend will be greater if it goes forward with this decision.

Purple Hedgehog Forestry will pay a smaller annual dividend if it goes forward with this decision.

What kind of company is most likely to follow a strict residual distribution policy?

All companies

A firm with stable, predictable earnings and investment

A firm whose earnings are cyclical and follow the economy

A firm with highly variable earnings and investment

Gaven Industries, which is in the same sector as Purple Hedgehog Forestry, exhibits very stable and predictable

earnings, but its capital investments tend to be lumpy. This means that Gaven's required capital investment

spending is usually relatively low, but every few years, some sizable expenditures will cause the firm's capital budget

to be quite large. Should Gaven Industries be following a strict residual distribution policy?

No

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Petersen Co. has a capital budget of $ 910 . The company wants to maintain a target capital structure that is 65 percent debt and remaining percent is equity. The company forecasts that its net income this year will be $ 809 . If the company follows a residual distribution policy (with all distributions in the form of cash dividends), what will be its payout ratio? Enter your answer to the nearest .1%. Enter your answer as a whole number, thus 25.1% would be 25.1 not .251. Do not use % signs in your answer. Your Answer: Answerarrow_forwardThe projected capital budget of Kandell Corporation is $575,000, its target capital structure is 60% debt and 40% equity, and its forecasted net income is $575,000. If the company follows a residual dividend policy, what total dividends, if any, will it pay out? Select the correct answer. a. $344,887 b. $345,000 c. $344,831 d. $344,944 e. $344,774arrow_forwardGBATT has a capital need of $100 million to fund its operations. GBATT has an equity investor that has made an investment in the common stock of GBATT for 60% of this amount but there is the anticipation is that they will earn a 15% return on this investment through capital returns and dividends. This level of anticipated return takes into account the anticipated risk in the investment. With this amount of capital support, GBATT was able to find a lender who will provide the balance of the capital needed at an interest rate of 10% with such debt to be paid out over 10 years. Such lender will require GBATT to fully collateralize its buildings in support of its bond payments. What is the cost of capital in this example?arrow_forward

- MaxValue is expected to have EBIT of $1,500,000.00 one year from now. Because MaxValue is in a mature industry, the CEO expects the company's EBIT to grow at the stable growth rate of 2% per year forever. The firm's WACC is 9% and its corporate tax rate is 40%. Capital expenditures are 25% of EBIT while changes in networking capital is 10% of EBIT. Depreciation is 15% of EBIT. What is the value of the firm? a) $21,428,571.43 b) $8,742,857.14 c) $17,142,857.14 d) $8,571,428.57 e) $16,071,428.57arrow_forwardKahn Inc. has a target capital structure of 60% common equity and 40% debt to fund its $11 billion in operating assets. Furthermore, Kahn Inc. has a WACC of 15%, a before - tax cost of debt of 10%, and a tax rate of 25%. The company's retained earnings are adequate to provide the common equity portion of its capital budget. Its expected dividend next year (D1) is $4, and the current stock price is $30. What is the company's expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. If the firm's net income is expected to be $1.4 billion, what portion of its net income is the firm expected to pay out as dividends? Do not round intermediate calculations. Round your answer to two decimal places. (Hint: Refer to Equation below.) Growth rate = (1 - Payout ratio) ROEarrow_forwardKahn Inc. has a target capital structure of 45% common equity and 55% debt to fund its $10 billion in operating assets. Furthermore, Kahn Inc. has a WACC of 12%, a before-tax cost of debt of 9%, and a tax rate of 25%. The company's retained earnings are adequate to provide the common equity portion of its capital budget. Its expected dividend next year (D1) is $3, and the current stock price is $33. What is the company's expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's net income is expected to be $1.9 billion, what portion of its net income is the firm expected to pay out as dividends? Do not round intermediate calculations. Round your answer to two decimal places. (Hint: Refer to Equation below.) Growth rate = (1 - Payout ratio)ROE %arrow_forward

- Dyrdek Enterprises has equity with a market value of $12.6 million and the market value of debt is $4.45 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.9 percent. The new project will cost $2.56 million today and provide annual cash flows of $666,000 for the next 6 years. The company's cost of equity is 11.79 percent and the pretax cost of debt is 5.06 percent. The tax rate is 24 percent. What is the project's NPV? Multiple Choice $208,195 $194,561 $536,049 $183,363 $364,858arrow_forwardKahn Inc. has a target capital structure of 40% common equity and 60% debt to fund its $8 billion in operating assets. Furthermore, Kahn Inc. has a WACC of 13%, a before-tax cost of debt of 11%, and a tax rate of 25%. The company's retained earnings are adequate to provide the common equity portion of its capital budget. Its expected dividend next year (D1) is $2, and the current stock price is $26. a. What is the company's expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the firm's net income is expected to be $1.6 billion, what portion of its net income is the firm expected to pay out as dividends? Do not round intermediate calculations. Round your answer to two decimal places. (Hint: Refer to Equation below.) Growth rate (1-Payout ratio)ROE %arrow_forwardYour firm has an ROE of 11.1%, a payout ratio of 29%, $585,100 of stockholders' equity, and $420,000 of debt. If you grow at your sustainable growth rate this year, how much additional debt will you need to issue? The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter anc in these problems in anticipation of the return of standard depreciation practices during your career. The sustainable growth rate is %. (Round to three decimal place.) The ending total assets at the sustainable growth rate will be $ (Round to the nearest dollar.) Because the firm grew at its sustainable growth rate, its debt/equity ratio remains constant at 0.717826 and the debt-to-assets ratio will be 0.417869. Thus, the new debt in the capital structure will be 0.417869×$1,084,312= $453,100. Since the firm started at $420,000, it will issue about $33,100 in additional debt.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education