FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

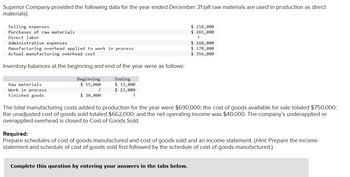

Transcribed Image Text:Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct

materials):

Selling expenses

Purchases of raw materials

Direct labor

Administrative expenses

Manufacturing overhead applied to work in process

Actual manufacturing overhead cost

Inventory balances at the beginning and end of the year were as follows:

Raw materials

Work in process

Finished goods

Beginning

$ 55,000

?

$ 30,000

Ending

$ 33,000

$ 23,000

?

$ 218,000

$ 265,000

?

$ 160,000

$ 370,000

$ 356,000

The total manufacturing costs added to production for the year were $690,000; the cost of goods available for sale totaled $750,000;

the unadjusted cost of goods sold totaled $662,000; and the net operating income was $40,000. The company's underapplied or

overapplied overhead is closed to Cost of Goods Sold.

Complete this question by entering your answers in the tabs below.

Required:

Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income

statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please explain last three subpartsarrow_forwardDullea Corporation reported the following data for the month of May: Inventories Beginning Ending Raw materials $21,000 $21,000 Work in process $21,000 $14,000 Finished goods $27,000 $56,000 Additional information: Sales $290,000 Raw materials purchases $76,000 Direct labor cost $45,000 Manufacturing overhead cost $76,000 Selling expense $28,000 Administrative expense $42,000 The cost of goods manufactured for May was: $194,000 $121,000 $204,000 $187,000 Show work/calculationarrow_forwardKaranarrow_forward

- Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses $ 212,000 Purchases of raw materials $ 270,000 Direct labor ? Administrative expenses $ 152,000 Manufacturing overhead applied to work in process $ 376,000 Actual manufacturing overhead cost $ 358,000 Inventory balances at the beginning and end of the year were as follows: Beginning Ending Raw materials $ 51,000 $ 32,000 Work in process ? $ 32,000 Finished goods $ 31,000 ? The total manufacturing costs added to production for the year were $680,000; the cost of goods available for sale totaled $745,000; the unadjusted cost of goods sold totaled $666,000; and the net operating income was $39,000. The company’s underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement.arrow_forwardCost data for Disksan Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $310,000 $276,600 Work in process 215,200 238,400 Finished goods 162,800 190,100 January 31 Direct labor $565,000 Materials purchased during January 604,800 Factory overhead incurred during January: Indirect labor 60,440 Machinery depreciation 35,000 Heat, light, and power 13,600 Supplies 8,540 Property taxes 8,860 Miscellaneous costs 16,400 Required: A. Prepare a cost of goods manufactured statement for January. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. “Less” or “Plus” will automatically appear if it is required. Enter all amounts as positive numbers. Be sure to complete the statement heading. B. Determine the cost of goods sold for January.arrow_forwardCost Flow Relationships The following information is available for the first year of operations of Idgie Inc., a manufacturer of fabricating equipment: Sales $1,261,700 340,700 Gross profit Indirect labor 113,600 Indirect materials 46,700 Other factory overhead 21,400 Materials purchased 643,500 1,392,900 46,700 Total manufacturing costs for the period Materials inventory, end of period Using the above information, determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

- Stevens Company's inventory on March 1 and the costs charged to Work in Process—Department B during March are as follows: Beginning work in process, 12,000 units, 60% completed $62,400 From Department A, 55,000 units started this period Direct materials added 115,500 Direct labor incurred 384,916 Factory overhead incurred 138,000 During March, all direct materials were transferred from Department A, the units in process at March 1 were completed, and of the 55,000 units entering the department, all were completed except 6,000 units that were 70% completed. Inventories are costed by the first-in, first-out method. Prepare a cost of production report for March. If required, round your cost per equivalent unit amounts to four decimal places. Round all other amounts to the nearest dollar. If an amount value is zero enter "0" as answer. Stevens Company Cost of Production Report--Department B For the Month Ended March 31 Unit Information Units…arrow_forwardInformation from the records of Conundrum Company for September was as follows: Sales $307,500 Selling and administrative expenses 52,500 Direct materials used 66,000 Direct labor 75,000 Variable factory overhead 50,000 Factory overhead 51,250 Inventories Sept. 1 Sept 30 Direct materials $ 8,000 $10,500 Work in process 18,750 21,000 Finished goods 17,250 14,250 Conundrum Company produced 20,000 units.What is the total product cost per unit (rounded to the nearest cent)? a.$12.24 b.$14.74 c.$12.11 d.$12.18arrow_forwardDuring the year, a company purchased raw materials of $77,319, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Beginning Ending Raw materials inventory $17,433 $16,428 Work in process inventory 241,437 234,422 Finished goods inventory 312,844 342,386 Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold. Cost of materials used in production $fill in the blank 1 Cost of goods manufactured $fill in the blank 2 Cost of goods sold $fill in the blank 3arrow_forward

- Subject - Acountingarrow_forwardStevens Company's inventory on March 1 and the costs charged to Work in Process—Department B during March are as follows: Beginning work in process, 12,000 units, 60% completed $ 62,400 From Department A, 55,000 units started this period Direct materials added 115,500 Direct labor incurred 384,915 Factory overhead incurred 138,000 During March, all direct materials were transferred from Department A, the units in process at March 1 were completed, and of the 55,000 units entering the department, all were completed except 6,000 units which were 70% completed. Inventories are costed by the first-in, first-out method. Required: Prepare a cost of production report for March. Round cost per equivalent unit to four decimal places and the other answers to the nearest dollar. If your answer is zero, enter “0”. Prepare a cost of production report for March. Round cost per equivalent unit to four decimal places and the other answers to the nearest dollar.…arrow_forwardWasson Company reported the following year-end information: Beginning work in process inventory Beginning raw materials. inventory Ending work in process inventory Ending raw materials inventory Raw materials purchased Direct labor Manufacturing overhead $ 35,000 18,000 38,000 15,000 560,000 210,000 120,000 What is Wasson's total cost of work in process for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education