FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Give me answer within 45 min please I will give you upvotes its ver urgent ......thankyou...

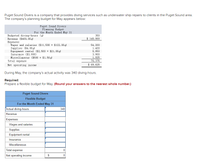

Transcribed Image Text:Puget Sound Divers is a company that provides diving services such as underwater ship repairs to clients in the Puget Sound area.

The company's planning budget for May appears below:

Puget Sound Divers.

Planning Budget

For the Month Ended May 31

Budgeted diving-hours (4)

350

Revenue ($400.00 g)

$ 140,000

Expenses:

54, 200

Wages and salaries ($11,500 + $122.00 g)

Supplies ($4.00g)

1, 400

Equipment rental ($2,500 + $21.00g)

9,850

Insurance ($3,900)

3,900

Miscellaneous ($500+ $1.50g)

1,025

Total expense

70, 375

Net operating income

$ 69, 625

During May, the company's actual activity was 340 diving-hours.

Required:

Prepare a flexible budget for May. (Round your answers to the nearest whole number.)

Puget Sound Divers

Flexible Budget

For the Month Ended May 31

Actual diving-hours

340

Revenue

Expenses:

0

Wages and salaries

Supplies

Equipment rental

Insurance

Miscellaneous

Total expense

Net operating income

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- e File Edit View History Bookmarks Profiles Tab Window Help Week 4 Home X Short Exercis X G Dalton Hair St X C For each acco X plus.pearson.com/products/658729f2-cb81-45ee-babb-bf032e847a35/pages/urn:pearso... ☆ 5 6 32 Total 33 Net (b) 34 Total 35 A partial worksheet for Ramey Law Firm is presented below. Solve for the missing information. A 6 32 Total 33 Net (c) 34 Total 35 End of Chapter: Completing the Accounting Cycle A J Income Statement Debit (a) 8,375 (d) Credit $ 24,850 (e) $ 24,850 JA 23 Income Statement Debit $ 22,400 K Credit (a) F4-34 S-F:4-8. Determining net loss using a worksheet (Learning Objective 2) A partial worksheet for Aaron Adjusters is presented below. Solve for the missing information. 5,300 (f) L ▶ M Balance Sheet Debit $ 211,325 C For each acce X (e) L Debit (b) (d) (g) Credit $ 202,950 tv (c) (f) Balance Sheet M Credit $61,400 + $ 61,400 AA ⠀arrow_forwardJournalize this transaction: Paid $320 to Ameren for the monthly bill. Edit View Insert Format Tools Table 12pt v Paragraph v В I U MacBook Pro Oine Fi En ACCT 101 Onre le Oa01 for Ais eet # $ % & 3.arrow_forwardEdit View History Bookmarks Profiles Tab Window Help t Fridays - Become a w x sp MyPath - Home Gradebook / ACC 202: Manage X M Question 7 - Chapter 11 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Maps News Translate M SmartBook 2.0 M SmartBook 2.0 Homework i t Perez Company is considering an investment of $28,245 that provides net cash flows of $9,300 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A What is the internal rate of return of this investment? Present value factor Internal rate of return FI Required B @ 2 F2 # 3 APR…arrow_forward

- Can you help me with this problem pleasearrow_forwardNeed help with answering the questiins. Thank youarrow_forwardvbbroncos.schoolsplp.com/enrollments/156569804/items/CL1W7/work?prev-YU132 A ALEKS - Gracie Glov. M My Classes | McGra.. A Classes O Western Brown Loc. Jal Desmos | Graphing... Glover Next Activity > Models B: Lesson 2 - Other Forms of Compensation Target due: 1/14/21 16.66% A O 3) Choose the correct answer. -Maribel is offered a job as a paralegal at an annual base salary of $47,000. In addition, the company will pay the following benefits: a retirement contribution that is 10.5% of Maribel’Ms base salary, disability insurance totaling $338, medical insurance totaling $6,500, and a year-end bonus of 17% of her base salary. What is the annual value of this job to Maribel? O $47,000 O $66,435 $58,773 $66,763 $58,435 口 O 4) Choose the correct answer. Marrow_forward

- O Mail - Edjouline X E Content - ACG2 X * CengageNOW. X O (58) YouTube * from Towards a X m/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < ☆ STIOW Me TOW Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $410,000; Allowance for Doubtful Accounts has a credit balance of $3,500; and sales for the year total $1,850,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Check My Work Previous Next V O 11:51arrow_forwardPlease help me solve itarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education