FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

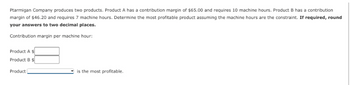

Transcribed Image Text:Ptarmigan Company produces two products. Product A has a contribution margin of $65.00 and requires 10 machine hours. Product B has a contribution

margin of $46.20 and requires 7 machine hours. Determine the most profitable product assuming the machine hours are the constraint. If required, round

your answers to two decimal places.

Contribution margin per machine hour:

Product A $

Product B $

Product

is the most profitable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Yasmin Co. can further process Product B to produce Product C. Product B is currently selling for $30 per pound and costs $29 per pound to produce. Product C would sell for $56 per pound and would require an additional cost of $24 per pound to produce. The differential cost of producing Product C is a.$24 per pound b.$29 per pound c.$30 per pound d.$56 per poundarrow_forwardPlease help me with show all calculation thankuarrow_forwardGladstorm Enterprises sells a product for $50 per unit. The variable cost is $32 per unit, while fixed costs are $9,504. Determine the break-even point in sales units. Round answer to the nearest whole number. units Determine the break-even point in sales units if the selling price was increased to $65 per unit. Round answer to the nearest whole number. unitsarrow_forward

- Given the following cost and activity observations for Bounty Company's utilities, use the high-low method to determine Bounty's variable utilities cost per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,016 15,480 April 2,659 10,374 May 2,878 11,831 June 3,587 17,811 a.$0.62 b.$0.12 c.$1.25 d.$0.58arrow_forwardGrace Co. can further process Product B to produce Product C. Product B is currently selling for $22 per pound and costs $14 per pound to produce. Product C would sell for $37 per pound and would require an additional cost of $11 per pound to produce. The differential revenue of producing and selling Product C is Oa. $37 per pound Ob. $26 per pound Oc. $23 per pound Od. $15 per poundarrow_forwardasmin Co. can further process Product B to produce Product C. Product B is currently selling for $34 per pound and costs $29 per pound to produce. Product C would sell for $62 per pound and would require an additional cost of $25 per pound to produce. What is the differential cost of producing Product C? a.$25 per pound b.$62 per pound c.$34 per pound d.$29 per poundarrow_forward

- Dengerarrow_forwardCarmen Co. can further process Product J to produce Product D. Product J is currently selling for $21.15 per pound and costs $16.40 per pound to produce. Product D would sell for $42.80 per pound and would require an additional cost of $9.55 per pound to produce. The differential cost of producing Product D is Oa. $9.55 per pound Ob. $5.73 per pound Oc. $7.64 per pound Od. $11.46 per poundarrow_forwardAarrow_forward

- Lindstrom Company produces two fountain pen models. Information about its products follows: Product A Product B Sales revenue Less: Variable costs Contribution margin Total units sold Lindstrom's fixed costs total $86,500. Required: $ 76,600 41,400 $ 46,000 5,000 $ 123,400 52,800 $ 91,000 5,000 1. Determine Lindstrom's weighted-average unit contribution margin and weighted-average contribution margin ratio. 2. Calculate Lindstrom's break-even point in units and in sales revenue. 3. Calculate the number of units that Lindstrom must sell to earn a $150,000 profit. 4. Calculate Lindstrom's margin of safety (in units and sales dollars) and margin of safety as a percentage of sales based on the sales data provided in the table above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the number of units that Lindstrom must sell to earn a $150,000 profit. Note: Do not round your intermediate calculations. Round your answer…arrow_forwardCarmen Co. can further process Product J to produce Product D. Product J is currently selling for $23.80 per pound and costs $16.00 per pound to produce. Product D would sell for $42.45 per pound and would require an additional cost of $9.80 per pound to produce. The differential cost of producing Product D is a. $7.84 per pound b. $11.76 per pound c. $5.88 per pound d. $9.80 per poundarrow_forwardEdge Company produces two models of its product with the same machine. The machine has a capacity of 154 hours per month. The following information is available. Selling price per unit Variable costs per unit Contribution margin per unit Machine hours per unit Maximum unit sales per month Required: Contribution margin per unit 노래 Contribution margin per machine hour Standard Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $ 140 55 1. Determine the contribution margin per machine hour for each model. Product Contribution Margin Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $85 1 hour 500 units Deluxe $ 170 102 $ 68 2 hours 200 units Standard 2. How many units of each model should the company produce? How much total contribution margin does this mix produce per month? Standard Deluxe…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education