Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

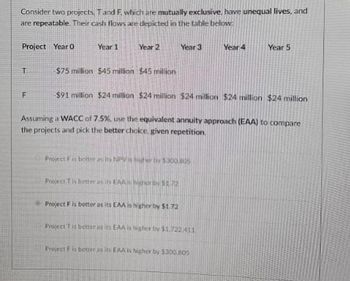

Transcribed Image Text:Consider two projects, T and F. which are mutually exclusive, have unequal lives, and

are repeatable. Their cash flows are depicted in the table below:

Project Year 0

T

Year 1

F

Year 2

$75 million $45 million $45 million

-$91 million $24 million $24 million $24 million $24 million $24 million

Assuming a WACC of 7.5%, use the equivalent annuity approach (EAA) to compare

the projects and pick the better choice, given repetition.

Year 3

Project F is better as its NPV 5300.805

Project Tis better as its EAA Nighort 55.72

Project F is better as its EAA is higher by $1.72

Project T is better as its EAA is higher by $1,722.411

Year 4

Project F is better as its EAA is higher by $300.805

Year 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please solve this practice problemarrow_forwardPlease do not give solution in image format thankuarrow_forward5. Compare the following 2 alternatives with a method of your choice. The market rate is 6% and inflation is expected to run at 2.5% per year. Alt A B Construction cost $ Benefits $/yr 450,000 380,000 2,000,000 1,500,000 Salvage 200,000 150,000 Life (yrs) 12 9arrow_forward

- 6) Year Project A Project B Difference 0 -75000 -75000 0 1 26300 24000 2300 2 29500 26900 2600 3 45300 51300 -6000 Crossover rate 14.60% Hi I need help with the following question! Thank you! Are you going to accept project A or project B? Why?arrow_forwardAttempts Attempt 1 score is6.7This attempt is in progress. Keep the Highest 6.7 out of 106.7 / 10 5. Present value of annuities and annuity payments The present value of an annuity is the sum of the discounted value of all future cash flows. You have the opportunity to invest in several annuities. Which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities earn the same positive interest rate. An annuity that pays $500 at the end of every six months An annuity that pays $1,000 at the beginning of each year An annuity that pays $1,000 at the end of each year An annuity that pays $500 at the beginning of every six months You bought an annuity selling at $17,390.08 today that promises to make equal payments at the beginning of each year for the next eight years (N). If the annuity’s appropriate interest rate (I) remains at 5.00% during this time, then the value of the annual annuity payment…arrow_forward2. Find All four present valuesarrow_forward

- Question No. r The following information is provided for five mutually exclusive alternatives that have 20-year useful lives. If the minimum attractive rate of return is 6%, which alternative should be selected using IROR Method? Alternatives B Cost 4,000 2,000 6,000 1,000 9,000 Uniform Annual Benefit 639 410 761 117 785 IROR 15% 20% 11% 10% 6% IROR (B-D) IROR (A-D) IROR (A-B) IROR (C-B) IROR (C-A) IROR (E-C) IROR (E-A) -5% 29% 18% 10% 9% 2% 14%arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease answer fast i give upvotearrow_forward

- 2arrow_forwardPlease help me with show all calculation thankuarrow_forwardConsider the following four alternatives. Three are do-something and one is Do -Nothing. Alternative A B D Cost $O $50 $30 $40 Net annual benefit Useful life (years) Which is the preferred alternative? If 10% interest rate is selected. Use PW analysis. $O $14 $5 $7 5 10 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education