Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

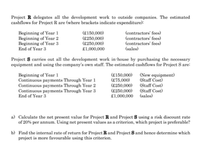

Transcribed Image Text:Project R delegates all the development work to outside companies. The estimated

cashflows for Project R are (where brackets indicate expenditure):

Beginning of Year 1

Beginning of Year 2

Beginning of Year 3

End of Year 3

(£150,000)

(£250,000)

(£250,000)

£1,000,000

(contractors' fees)

(contractors' fees)

(contractors' fees)

(sales)

Project S carries out all the development work in-house by purchasing the necessary

equipment and using the company's own staff. The estimated cashflows for Project S are:

Beginning of Year 1

Continuous payments Through Year 1

Continuous payments Through Year 2

Continuous payments Through Year 3

End of Year 3

(£150,000)

(£75,000)

(£250,000)

(£250,000)

£1,000,000

(New equipment)

(Staff Cost)

(Staff Cost)

(Staff Cost)

(sales)

a) Calculate the net present value for Project R and Project S using a risk discount rate

of 20% per annum. Using net present values as a criterion, which project is preferable?

b) Find the internal rate of return for Project R and Project S and hence determine which

project is more favourable using this criterion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Management of Ivanhoe Measures, Inc., is evaluating two independent projects. The company uses a 13 percent discount rate for such projects. The costs and cash flows for the projects are shown in the following table. Year Project 1 Project 2 0 $8,812,840 -$10,781,200 1 3,363,400 2,021,330 2 1,788,290 3,848,800 3 1,367,600 3,173,090 4 1,088,900 4,104,310 5 1,111,380 4,130,780 6 1,723,940 7 1,319,290 k A What are their NPVs? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to O decimal places, e.g. 1,525.) Q Ac The NPV of Project 1 is $ and the NPV of Project 2 is $ Qu Muarrow_forwardProvidence Health is evaluating two different linen supply vendors systems for handling facility linen replacement. There are no incremental revenues attached to the projects, so the decision will be made on the basis of the present value of costs. Providence's weighted average cost of capital is 6.25%. Here are the net cash flow estimates in thousands of dollars: Year 0 1 2 3 4 5 System X System Y S (1,800) $ (3,850) S (1,000) S (500) (1,000) S (500) S S (1,000) S S (1,000) S S (1,000) S (500) (500) (500) [a] Assume initially that the systems both have average risk. Which one should be chosen? [b] Assume that System Y is judged to have high risk. The organization accounts for differential risk by adjusting its corporate cost of capitalarrow_forwardConsider the following investment projects for SDL Engineering. All of the projects have a three-year investment life: Project’s Cash Flow ($) Time (n) Project A Project B Project C Project D 0 -$1,500 -$1,200 -$1,600 -$3,000 1 0 $600 -$1,800 $800 2 0 $800 $800 $1,900 3 $3,000 $1,500 $2,500 $2,300 Compute the Net Present worth of each project where interest rate is 9%. Which project do you recommend based on the NPW? Other than the NPW, why else would you recommend this project? (you will be using the same rate that was for part A for this part. Calculate the IRR for each project Show all workings in excelarrow_forward

- Hello, how can I solve the activity and what is the answer? Martian Corporation, a space vehicle development company, is starting a new division that will develop the next-generation launch missile engine configuration. Use a hand application of the MIRR method to determine the EROR for the estimated net cash flows (in $1000 units) of $-50,000 in year 0, $14,000 in years 1 through 8, and $-2,000 in year 9. Assume a borrowing rate of 14% and an investment rate of 21% per year. What is the external rate of return?arrow_forwardThe investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $1,104,000. The estimated net cash flows from each project are as follows: Net Cash Flow Year OfficeExpansion Server 1 $308,000 $407,000 2 308,000 407,000 3 308,000 407,000 4 308,000 407,000 5 308,000 6 308,000 The committee has selected a rate of 15% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $385,000. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5…arrow_forwardn Taraz Company has assembled the following dato with respect to eight projects. Project 1: Initial cost $100,000, NPV- $5.000 Project 2: intial cost $104000, NPv 55,150 Pject innal cost $tOR.000 NPV1530 Project 4: Initial cost $110,000; NPV = $5,450 Project 5: Initial cost $98,000, NPV $4950 Project 6 Ininial cost 596.000, NPV S4,900 Project 7. nitial coot S4000, NPVSAASO Paject ntia con po0 MPY $4,700 Taraz Company can only do one of the projects. Which ONE is the BEST? Note: Your calculator needs to display at least 4 digits after the decimal in order to anewer tha question comecty O Project 1 Project 2 Project 3 Project 4 O Project 5 Project 6 Project 7 Project 8 SUMIT ALL ANEWERSarrow_forward

- sarrow_forwardhe cash flows associated with a public works project in Buffalo, New York, are shown. Use the modified B/C ratio at a discount rate of 5% per year to determine the economic justification. First cost, $ 30,000,000 AW of benefits, $/year 7,700,000 AW of disbenefits, $/year 1,700,000 M&O costs, $/year 1,525,000 Life of project, years 30 The modified B/C ratio is . The project is economically (Click to select) justified not justified .arrow_forwardUsing the following information find the project's cash flow. Once you have that information find the NPV, PI and IRR. Cost of new equipt 7,800,000 Installation costs 200,000 Unit Sales Year Units sold 1 80,000 2 130,000 3 140,000 4 90,000 5 70,000 Sales price per unit $300 in years 1-4, $250 in year 5 Variable cost per unit $225/unit Annual fixed costs $225,000 in years 1-5 Working capital requirements: Initial working capital requirement $100,000 Each year net working capital equal to 10% of the year's sales All working capital terminated at the end of year 5 Depreciation Bonus depreciation method - all is taken in year 1 Income tax rate 21% Required rate of return 12%arrow_forward

- Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $229,500. Project 2 requires an initial investment of $156,000. Annual Amounts Project 1 Project 2 Sales of new product $ 148,000 $ 128,000 Expenses Materials, labor, and overhead (except depreciation) 77,000 44,000 Depreciation—Machinery 32,000 30,000 Selling, general, and administrative expenses 20,000 32,000 Income $ 19,000 $ 22,000 (a) Compute each project’s annual net cash flow.(b) Compute payback period for each investment.arrow_forwardShaylee Corp has $2.10 million to invest in new projects. The company’s managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Project A Project B Project C Project D Initial investment $ 720,000 $ 400,000 $ 960,000 $ 1,115,000 Present value of future cash flows 935,000 500,000 1,650,000 1,310,000 Required:1. Is Shaylee able to invest in all of these projects simultaneously?multiple choice No Yes 2-a. Calculate the profitability index for each project. (Round your answers to 4 decimal places.)arrow_forwardHow do you calculate net investment in working capital, net cash flows, present value of net cash flows, and NPV? WACC is 10.10%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education