Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Which of the following is a good constraint to model the fact that activity A is an immediate predecessor of activity B?

A B YB ≥ 5

-A+B+B ≤5

-A+B+B ≥ 5

A+B+B 5

None of the above.

Question 6

BONUS

Which of the following is a good constraint to model the fact that activity D is an immediate predecessor of activity F?

UP ≤1

-xD+F+YF ≥ 3

-D+p+UP > 4

None of the above.

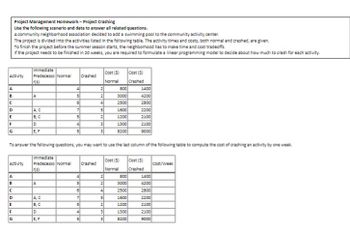

Transcribed Image Text:Project Management Homework-Project Crashing

Use the following scenario and data to answer all related questions.

A community neighborhood association decided to add a swimming pool to the community activity center.

The project is divided into the activities listed in the following table. The activity times and costs, both normal and crashed, are given.

To finish the project before the summer season starts, the neighborhood has to make time and cost tradeoffs.

If the project needs to be finished in 20 weeks, you are required to formulate a linear programming model to decide about how much to crash for each activity.

Activity

Immediate

Predecesso Normal

Gs)

Cost (5)

Cost (5)

Crashed

Normal

Crashed

A

4

2

800

1400

B

A

5

2

3000

4200

C

6

4

2500

2800

D

A, C

7

5

1600

2200

E

B, C

5

2

1200

2100

F

D

4

3

1300

2100

G

E, F

5

3

8200

9000

To answer the following questions, you may want to use the last column of the following table to compute the cost of crashing an activity by one week.

Immediate

Activity

Predecesso Normal

rs)

Crashed

Cost (5)

Cost (5)

Cost/Week

Normal Crashed

A

4

2

BOO

1400

B

A

5

2

3000

4200

CDEFG

6

4

2500

2800

A, C

7

5

1600

2200

B, C

5

2

1200

2100

D

4

3

1300

2100

E, F

5

3

8200

9000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- A still mill owner sells his steel for such low prices that many other steel mills cannot complete, and so go out of business, luckily this owner is able to buy their abandon factories and expand his business. Is this a vertical integration or a horizontal integration?arrow_forwardI need help finding the answer for this problemarrow_forwardThe table shows the hypothetical trade-off between different combinations of Stealth Bombers and B-1 Bombers that might be produced in a year with the limited U.S. capacity, ceteris paribus. Production Possibilities for Bombers Combination Number of B-1 Opportunity Cost (Foregone Stealth) S T 0 NA Number of Stealth 10 Opportunity Cost (Foregone B-1) 1 9 U V 2 3 In the production range of 7 to 9 Stealth bombers, the opportunity cost of producing 1 more Stealth Bomber in terms of B-1 Bombers is 7 4 NA Multiple Choice 0. 3. 0.5. 2.arrow_forward

- find the a. decision variables b. objective function c. constraintsarrow_forwardpls answer the 2nd question: The Montemar Company is considering contracting with a market research firm to do a survey to determine future market conditions. The results of the survey will indicate either positive or negative market conditions. There is a 0.60 probability of a positive report, given favorable conditions; a 0.30 probability of a positive report, given stable conditions; and 0.10 probability of a positive report; given unfavorable conditions. There is a 0.90 probability of negative report, given unfavorable conditions; a 0.70 probability given stable conditions; and a 0.40 probability, given favorable conditions. d & e, as per the guidelinesarrow_forwardVariable cells Cell Name Final Value Reduced Cost Objective Coefficient Allowable Increase Allowable Decrease $B$6 Activity 1 3 0 30 23 17 $C$6 Activity 2 6 0 40 50 10 $D$6 Activity 3 0 –7 20 7 1E+30 Constraints Cell Name Final Value Shadow Price Constraint R.H. Side Allowable Increase Allowable Decrease $E$2 Resource A 20 7.78 20 10 12.5 $E$3 Resource B 30 6 30 50 10 $E$4 Resource C 18 0 40 1E+30 22 What is the allowable range for the right-hand-side for Resource C? Multiple Choice 18 ≤ RHSc ≤ ∞ ∞ ≤ RHSc ≤ 62 −2 ≤RHSc ≤ ∞ − ∞ ≤ RHSc ≤ 40 0 ≤ RHSc ≤ 22arrow_forward

- L.P. Model: Minimize Subject to: Z = 15X+12Y 7X+11Y288 (C₂) (C₂) 16X+4Y280 X,Y 20 On the graph on right, constraints, C, and C₂ have been drawn. Using the point drawing tool, plot all the corner points for the feasible area. 24- 22- 20- 18- 16- 14- 12- 10 8- 64 4- 2- -N 10 12 14 16 18 20 22 24 X C Garrow_forwardPls solve this question correctly in 5 min i will give u like Question # 2 A company produces two products, A and B. The sales volume for product A is at least 40% of the total sales of the two products. Both products use the same raw material, of which the daily availability is limited to 200 kg. Products A and B use this raw material at the rates of 5 kg/unit and 2 kg/unit, respectively. The sales prices for the two products are $50 and $20 per unit. Determine the following: a)Optimum volume of each product to be produced? b)What impact does the production mix have, in case the sales price of Product B decreases by 50%?arrow_forward1arrow_forward

- Discuss in brief slack variables?arrow_forwardKathy receives her real estate license. Within a month of receiving her license, she gets a new job offer she can't refuse. She decides to continue to hold her license but not practice, do any real estate work, or collect any referrals at this time. She is willing to renew her license, do her continuing education, and pay the renewal fee for her license. What should Kathy do? ○ Opt not, renew her license or complete the educational requirements ○ Seek a voluntary inactive license. Seek an involuntary inactive license. Seek a broker who will not be upset if she does not work too hard.arrow_forwardQuorex is evaluating two mutually exclusive projects. Project A has a net investment of $50,000 and net cash flows over a six-year period of $13,000 per year (NOTE: that project requires a reinvestment with the same cost and cash flow for another six years). Project B has a net investment of $48,500, but its net cash flows of $8,740 per year will occur over a 12-year period. If Quorex has a cost of capital of 14% for these projects, which project, if either, should be chosen, and what is its NPV?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.