Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

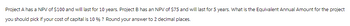

Transcribed Image Text:Project A has a NPV of $100 and will last for 10 years. Project B has an NPV of $75 and will last for 5 years. What is the Equivalent Annual Amount for the project

you should pick if your cost of capital is 10 % ? Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a project with an initial investment (today, t = 0) of $225,000. This project will generate cash flows of $68,750 per year for the next 6 years. The company will pay $50,000 to another for clean-up and disposal in Year 6. What is the Profitability Index (PI) of the project if shareholders demand 8.25% return? Answer in whole numbers, rounded to three decimal places.arrow_forwardAn investment costs $100 and it promises $50 in 3, 4, 5, 6 and 7 years. What is the return of this investment? Answer in decimal form using four decimal digitsarrow_forwardProject L requires an initial outlay at t = 0 of $52,799, its expected cash inflows are $9,000 per year for 10 years, and its WACC is 14%. What is the project's IRR? Round your answer to two decimal places. _____________ %arrow_forward

- You have been offered an investment opportunity that pays $600 every quarter for nine years and paying you $19,000. If you can invest in a similarly rsiy project that gives you a return of 8.4%, what is the current value of the project? A)Less tha $23,000. B)BEtween $23,000 and $23,500 C)Between $23,500 and $24,000 D)Between $24,000 and $24,500 D)Greater than $24,500arrow_forward2) see picturearrow_forwardYou can only take one of the following two projects. You have no capital constraints and the cost of capital is 10%. The information below for each project includes the IRR and NPV. Project A: Costs 500 dollars today, pays 200 at t = 1 years from now, pays 250 at t = 2 years from today, and pays 300 at t = 3 years from today. The IRR is 21.65 %. The NPV is $113.82. Project B: Costs 750 dollars today, pays 300 at t = 1 years from now, pays 350 at t = 2 years from today, and pays 400 at t = 3 years from today. The IRR is 17.93%. The NPV is $112.51. According to our class notes, which project should be the best choice? a. Flip a coin b. Choose A c. Choose Barrow_forward

- A project has an initial cost of $55,000, expected net cash inflows of $14,000 per year for 6 years, and a cost of capital of 11%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardYou have the choice to invest in a related project at time T+1. The required investment is $10 million, but will generate $1 million per year in the next ten years starting from time T+1. Using a rate of 8%, calculate the present value of the new project at time T.arrow_forwardWhat is the NPV of a project that COSTS $0.5M today and cash inflows $5,000 monthly, paid annually, for ten years from today if the opportunity cost of capital is 6% ?arrow_forward

- You are evaluating a project that will cost $502,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.7% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is will not willarrow_forwardProject L requires an initial outlay at t = 0 of $56,000, its expected cash inflows are $10,000 per year for 10 years, and its WACC is 14%. What is the project's payback? Round your answer to two decimal places.arrow_forwardA project has an initial cost of $ 55,000, expected net cash inflows of $10,000 per year for 10 years, and a cost of capital of 9%. What is the project's NPV ? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education