Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

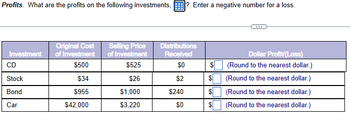

Transcribed Image Text:Profits. What are the profits on the following investments, ? Enter a negative number for a loss.

Investment

CD

Stock

Bond

Car

Original Cost

of Investment

$500

$34

$955

$42,000

Selling Price

of Investment

$525

$26

$1,000

$3,220

Distributions

Received

$0

$2

$240

$0

$

$

FA

$

69

$

Dollar Profit/(Loss)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ve What is the modified internal rate of return for the following cashflow? CFO ($8,250,000) 19.52% O 26.41% 32.11% O 14.03% CF₁ $4,950,000 i = 9% CF₂ H $4,950,000 CF 3 CF4 ($1,850,000) $4,550,000 CF5 H $2,850,000arrow_forwardtol Processing ng Help Save & Exit Submit Saved Practice Problems i Check my work Eaton Electronic Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). Assume: Rf = 7% Km 10% = 1.6 D1 = $ 0.70 $ 19 8% %3D PO = nt a. Compute Ki (required rate of return on common equity based on the capital asset pricing model). (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) ences Ki b. Compute Ke (required rate of return on common equity based on the dividend valuation model). (Do not round intermediate calculations, Input vour answer as a percent rounded to 2 decimal places.) < Prev 10 of 10 Next Mc Graw Hill 149 MacBook Airarrow_forwardstep by step instructions no excelarrow_forward

- Calculate the quick ratio and indicate wheather the ratio is favorable or unfavorable. Current Liabilities $28,000,000.00 Cash: $27,000,000 Investments $36,000,000 Accounts Receibable $12,000,000.00 Due from other funds: $2,500,000.00arrow_forwardPlease answer all 4 parts with explanations thxarrow_forwardShow manual calculationsarrow_forward

- Complete a and b thank youarrow_forwardFor the given cash flow, Which of the following statements is correct? Year 1 3 +2,000 -500 -8,100 +6,800 Select one: a. There are two interest rate b. The present worth converts in sign from positive to negative two times C. Non-conventional cash flow d. all the above %24arrow_forward► CRC Inc. is buying new equipment that has the following cash flows: Year Cash Flow O-$17.7 What is the NPV if the interest rate is $6%? O $482.24 D -$537.78 0 -$500 O $22.44 1 $100 2 $200 3 $250arrow_forward

- step by step instructions no excelarrow_forwardWhat is the modified internal rate of return for the following cashflow? CFO ($8,350,000) CF₁ 1 $4,200,000 i = 12% CF 2 $4,200,000 CF 3 ($2,850,000) CFA 4 $4,800,000 CF5 $3,400,000arrow_forwardP 9-1 Investment Scenarios (LO 9-3) Arkansas Best Freightways is considering a purchase of three different potential trucks. it is considering three different investment scenarios and their respective cash flows. Arkansas Best Freightways use a cost of capital of 9 percent to evaluate the investments. Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Buy new truck Increased profits Increased profits Increased profits Increased profits Net cash flows over life (not discounted) Investment 1 (85,000) 25,000 25,000 25,000 25,000 $ Investment 2 (105,000) 20,000 30,000 40,000 50,000 Required: 1. Calculate the net cash flows (not discounted) over the life of the three investments (years 0 to 4). (Negative amounts should be entered using a minus sign.) Answer is complete and correct. Investment 1 15,000 Investment 2 $ Investment 3 (125,000) 40,000 30,000 20,000 10,000 Investment 3 (25,000) 35,000 S Cost of Capital 9%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education