FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

(Profitability Ratio)

What is the Price Earnings Ratio in 2019?

Transcribed Image Text:FRUITAS HOLDINGS, INC.

(A Subsidiary of LUSH PROPERTIES, INC.)

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Years Ended December 31

Number of Shares

Amount

Note

2020

2019

2018

2020

2019

2018

Capital Stock

Balance at beginning of year

17

1,600,000,000

533,680,000

P160,000,000

53,368,000

2,133,680,000

1,600,000,000

P213,368,000

P160,000,000

Issuances

Balance at end of year

2,133,680,000

2,133,680.000

1.600.000.000

213,368,000

213,368,000

160,000,000

Additional Paid-in Capital

Balance at beginning of year

17

7,044 83,ררר

Issuances

777,837,044

Balance at end of year

7,044ו,777

777,837,044

Retained Earnings

Balance at beginning of year

Net income (loss)

266,111,391

(48,068,054)

(21,336,800)

196,706,537

158,584,199

103,781,012

121,527,192

100,303,507

Cash dividends

17

(14,000,00

(45,500,320)

Balance at end of year

266,111,391

158,584,199

Years Ended December 31

Amount

Note

2020

2019

2018

Other Equity Reserves

Balance at beginning of year

Acquisition of a subsidiary

Balance at end of year

4.

55,192,582

(3,939,803)

55,192,582

55,192,582

51,252,779

55,192,582

55,192,582

Other Comprehensive Loss

Balance at beginning of year

16

(914,455)

(46,288)

(46,288)

Remeasurement loss on net retirement

benefits liability, net of deferred tax

Balance at end of year

(868,167)

(914,455)

(914,455)

(46,288)

P1,238,249,905

P1,311,594,562

P373,730,493

See accompanying Notes to Consolidated Financial Statements.

Capital Stock

This account consists of:

Number of Shares

Amount

2020

2019

2018

2020

2019

2018

Authorized Capital Stock

Common - P0.10 par value

Balance at beginning of year

5,000,000,000

(300,000,000)

4,700,000,000

4,700,000,000

4,700,000,000

P470,000,000

P470,000,000

P500,000,000

(30,000,000)

Reclassification to preferred stock

Balance at end of year

4,700,000,000

4,700,000,000

470,000,000

470,000,000

470,000,000

Preferred - PO.01 par value

Balance at beginning of year

3,000,000,000

3,000,000,000

30,000,000

30,000,000

3,000,000,000

3,000,000,000

7,700,000,000

Reclassification from common stock

30,000,000

3,000,000,000

7,700,000,000

30,000,000

P500,000,000

Balance at end of year

30,000,000

P500,000,000

3,000,000,000

30,000,000

7,700,000,000

P500,000,000

Issued and Outstanding- Common

Balance at beginning of year

P160,000,000

1,600,000,000

533,680,000

2,133,680,000

1,600,000,000

P213,368,000

P160,000,000

Issuances

53,368,000

160,000,000

P160,000,000

Balance at end of year

2,133,680,000

2,133,680,000

1,600,000,000

213,368,000

213,368,000

P213,368,000

P213,368,000

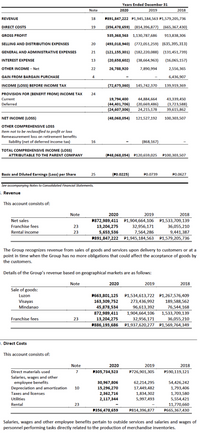

Transcribed Image Text:Years Ended December 31

Note

2020

2019

2018

REVENUE

18

P891,847,222 P1,945,184,563 P1,579,205,736

DIRECT COSTS

19

(356,478,659) (814,396,877) (665,367,430)

GROSS PROFIT

535,368,563 1,130,787,686

913,838,306

SELLING AND DISTRIBUTION EXPENSES

20

(493,018,940)

(772,051,259) (635,395,313)

GENERAL AND ADMINISTRATIVE EXPENSES

21

(121,155,301)

(182,220,088)

(131,451,739)

INTEREST EXPENSE

13

(20,658,602)

(38,664,963)

(16,065,157)

OTHER INCOME – Net

22

26,788,920

7,890,994

2,556,365

GAIN FROM BARGAIN PURCHASE

4

6,436,907

INCOME (LOSS) BEFORE INCOME TAX

(72,675,360)

145,742,370

139,919,369

PROVISION FOR (BENEFIT FROM) INCOME TAX

24

Current

19,794,400

(44,401,706)

44,884,664

43,339,450

(20,669,486)

24,215,178

Deferred

(3,723,588)

(24,607,306)

39,615,862

NET INCOME (LOSS)

(48,068,054)

121,527,192

100,303,507

OTHER COMPREHENSIVE LOSS

Item not to be reclassified to profit or loss

Remeasurement loss on retirement benefits

liability (net of deferred income tax)

16

(868,167)

TOTAL COMPREHENSIVE INCOME (LOSS)

ATTRIBUTABLE TO THE PARENT COMPANY

(248,068,054) P120,659,025

P100,303,507

Basic and Diluted Earnings (Loss) per Share

25

(P0.0225)

PO.0739

PO.0627

See accompanying Notes to Consolidated Financial Statements.

: Revenue

This account consists of:

Note

2020

2019

2018

Net sales

P872,989,411

13,204,275

5,653,536

P1,904,664,106

P1,533,709,139

Franchise fees

23

32,956,171

36,055,210

Rental income

23

7,564,286

9,441,387

P891,847,222 P1,945,184,563

P1,579,205,736

The Group recognizes revenue from sales of goods and services upon delivery to customers or at a

point in time when the Group has no more obligations that could affect the acceptance of goods by

the customers.

Details of the Group's revenue based on geographical markets are as follows:

Note

2020

2019

2018

Sale of goods:

Luzon

P663,801,125

163,309,752

45,878,534

P1,534,613,722 P1,267,576,409

273,436,992

96,613,392

Visayas

189,588,562

Mindanao

76,544,168

872,989,411

1,904,664,106

1,533,709,139

Franchise fees

23

32,956,171

P1,937,620,277 P1,569,764,349

13,204,275

36,055,210

P886,193,686

. Direct Costs

This account consists of:

Note

2020

2019

2018

Direct materials used

7

2305,734,523

P726,901,305

P590,119,121

Salaries, wages and other

employee benefits

Depreciation and amortization

30,967,806

62,214,295

54,426,242

1,793,406

1,703,580

10

15,296,270

17,449,482

2,362,716

2,117,344

Taxes and licenses

1,834,302

Utilities

5,997,493

5,554,421

Rental

23

11,770,660

2356,478,659

P814,396,877

P665,367,430

Salaries, wages and other employee benefits pertain to outside services and salaries and wages of

personnel performing tasks directly related to the production of merchandise inventories.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe how taxes and tax adjustment coefficients influence investment rankings?arrow_forwardWhat do the Profitability ratios show?arrow_forwardwhat do the final numbers for each of these ratios mean i.e solvency ratio 0.0322 - is this good? are they in profit, what can they do to improve,arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education