College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Subject: accounting

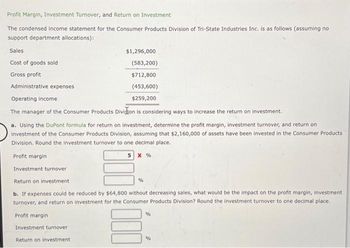

Transcribed Image Text:Profit Margin, Investment Turnover, and Return on Investment

The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no

support department allocations):

Sales

Cost of goods sold

Gross profit

Administrative expenses

Operating income

The manager of the Consumer Products Division is considering ways to increase the return on investment.

a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on

investment of the Consumer Products Division, assuming that $2,160,000 of assets have been invested in the Consumer Products

Division. Round the investment turnover to one decimal place.

Profit margin

5 X %

Investment turnover

Return on investment

b. If expenses could be reduced by $64,800 without decreasing sales, what would be the impact on the profit margin, investment

turnover, and return on investment for the Consumer Products Division? Round the investment turnover to one decimal place.

Profit margin

Investment turnover

$1,296,000

(583,200)

$712,800

(453,600)

$259,200

Return on investment

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- APPLY THE CONCEPTS: Target income (sales revenue) Another useful method for figuring out the type of performance your company will need to reach a target income is by using sales revenue. Rather than using the number of units, this method uses total sales revenue. In companies for which the total set of goods produced and sold is more varied, this would be the preferred method, as opposed to a business in which only one product is sold. Assume a company has pricing and cost information as follows: Price and Cost Information Amount Selling Price per Unit $30 Variable Cost per Unit $15 Total Fixed Cost $15,000 For the upcoming period, the company wishes to generate operating income of $40,000. Given the cost and pricing structure for the company’s product, how much sales revenue must it generate to attain its target income? Step 1: Calculate the contribution margin ratio: The contribution margin ratio is the contribution margin in proportion to the selling price on a…arrow_forwardProfit margin for an Investment center measures: Multiple Cholce Departmental contribution to overhead. How efficiently an investment center generates sales from its invested assets. Investment center income earned per dollar of sales. Investment center income compared to target investment center income. Investment center income generated from its invested assets.arrow_forwardRequired: 1. Prepare a contribution format income statement. 2. Prepare a traditional format income statement. 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit. 6. Which income statement format (traditional format or contribution format) would be more useful to managers in estimating how net operating income will change in responses to changes in unit sales?arrow_forward

- How to calculate profitability analysis?arrow_forwardCost-volume-profit (CVP) analysis for revenue planning determines: The desired profit level of a firm. Both revenue maximization and cost minimization. The costs associated with a certain level of revenue. The max amount of revenue a firm can receive. The revenue required to achieve a desired profit level.arrow_forwardWhat can the weighted average contribution margin ratio be used for? To solve for a measure, at any level of sales volume, of the sensitivity of operating profit to changes in volume. Breakeven and profit planning for sales volume expressed in dollars (Y) rather than units (Q). To calculate an average per-unit contribution margin based on an assumed sales mix. To figure out the relative proportion in which a company’s products (or services) are sold. To determine the extent of fixed costs in an organization’s cost structure.arrow_forward

- Below is a list of various metrics used to measure performance. For each metric, identify the correct balanced scorecard perspective with which the metric is associated. Metric Balanced Scorecard Perspective Average stock price Economic value added Employee turnover rates Manufacturing cycle time Market share Number of days from product launch to shelf Number of defects Number of new patent applications Percentage of repeat customers Percentage decrease in operating costs Percentage of sales generated by new products Research and development spending as a percentage of net revenues options: Customer Financial Internal Business Learning and Growtharrow_forwardTennair Corporation manufactures cooling system components. The company has gathered the following information about two of its customers: Evans Equipment and Rogers Refrigeration. Evans Equipment Sales revenue Rogers Refrigeration $ 160,000 61,000 Cost of goods sold General selling costs $ 229,000 102,000 37,000 23,800 28,500 General administrative costs 17,850 Cost-driver data used by the firm and traceable to Evans and Rogers are: Customer Activity Sales activity Order taking Special handling Special shipping Customer Activity Sales activity Order taking Special handling Special shipping Cost Driver Sales visits Sales orders Units handled Shipments Evans Equipment 12 visits 31 orders 460 units. 33 shipments Pool Rate $ 970 278 44 460 Rogers Refrigeration 9 visits 36 orders 410 units 44 shipments Required: A. Perform a customer profitability analysis for Tennair. Compute the gross margin and operating income on transactions related to Evans Equipment and Rogers Refrigeration.arrow_forwardFor CVP analysis calculations, which of the following statements is correct? A. In target profit calculations, sales revenue is less than total costs. B. CVP analysis relies on our knowledge of cost function to express relationships among costs, sales volume, and profit. OC. A company's sales mix is ultimately determined by the management of a company. D. The Break-even point is the point at which operating income is greater than $0. O E. If sales volume is expected to be higher than the indifference point, management should choose the cost structure with the higher fixed costs.arrow_forward

- Which of the following is not a revenue driver factor which affects sales volume for a manufacturing firm? Multiple Choice Price changes. Customer service. Delivery dates. Productivity. Discounts.arrow_forwardMatch each of the following descriptions with the appropriate term. Clear All Plots only the difference between total sales and total costs Indicates the possible decrease in sales that may occur before operating loss results Graphically shows costs, sales, and operating profit or loss at various levels of units sold The relative distribution of sales among products sold by a company Contribution margin divided by operating income Profit-volume chart Cost-volume-profit chart Operating leverage Margin of safety Sales mixarrow_forwardPlease help me with all answers thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning