FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE PROVIDE THE NEEDED ANSWER AND SOLUTION OF THE PROBLEM IN THE PICTURE. THANK YOU SO MUCH

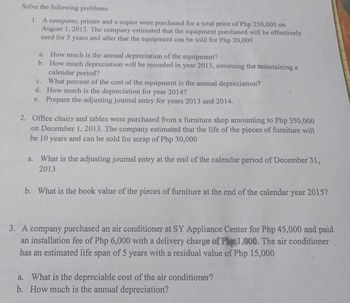

Transcribed Image Text:Solve the following problems

1. A computer, printer and a copier were purchased for a total price of Php 250,000 on

August 1, 2013. The company estimated that the equipment purchased will be effectively

used for 5 years and after that the equipment can be sold for Php 20,000

a. How much is the annual depreciation of the equipment?

b. How much depreciation will be recorded in year 2013, assuming the maintaining a

calendar period?

C.

What percent of the cost of the equipment is the annual depreciation?

d. How much is the depreciation for year 2014?

e. Prepare the adjusting journal entry for years 2013 and 2014.

2. Office chairs and tables were purchased from a furniture shop amounting to Php 350,000

on December 1, 2013. The company estimated that the life of the pieces of furniture will

be 10 years and can be sold for scrap of Php 30,000

a. What is the adjusting journal entry at the end of the calendar period of December 31,

2013

b. What is the book value of the pieces of furniture at the end of the calendar year 2015?

3. A company purchased an air conditioner at SY Appliance Center for Php 45,000 and paid

an installation fee of Php 6,000 with a delivery charge of Php 1,000. The air conditioner

has an estimated life span of 5 years with a residual value of Php 15,000

a. What is the depreciable cost of the air conditioner?

b. How much is the annual depreciation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi, my name is Jennifer. I am having trouble with this same problem. But the sub-parts I need help with are C, D, and E. But more specifically, really just sub-parts D and E. The only parts I see being answered are sub-parts A, B, and C only in the 8 solutions posted. May I please receive help for the top sub-parts of C, D, and E ONLY, please? It would be much appreciated. Thank you. :) -- Jennifer Suttonarrow_forwardwhat are the benefits of having items tracked via blockchain and the impact to rural areas and developing nations?arrow_forwardIm having an issue with this problem. Thank you!arrow_forward

- Title 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful Description 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful in your work with clients? Which ones might be helpful for your clients? 2. What do you think should be the minimum level of education, training, and experience for individuals who assist bereaved individuals?arrow_forwardI need help with B, C, D on the attached assignmentarrow_forwardGive me right solution urgent pleasearrow_forward

- Which of the following are part of Kwan's "Simple & Effective way to End a Presentation?" Thank you Are there any questions? And that is (Your Subject) What I talked about was (Summarize key points) The first thing I want you to do when you leave here today is (Call to action) In conclusion.....arrow_forwardexplain the benefits of having items tracked via blockchainand the impact to rural areas and developing nations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education