FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

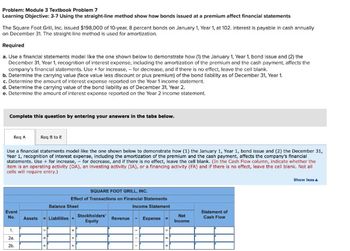

Transcribed Image Text:Problem: Module 3 Textbook Problem 7

Learning Objective: 3-7 Using the straight-line method show how bonds issued at a premium affect financial statements

The Square Foot Grill, Inc. Issued $198,000 of 10-year, 8 percent bonds on January 1, Year 1, at 102. Interest is payable in cash annually

on December 31. The straight-line method is used for amortization.

Required

a. Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the

December 31, Year 1, recognition of interest expense, including the amortization of the premium and the cash payment, affects the

company's financial statements. Use + for increase, - for decrease, and if there is no effect, leave the cell blank.

b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1.

c. Determine the amount of interest expense reported on the Year 1 income statement.

d. Determine the carrying value of the bond liability as of December 31, Year 2.

e. Determine the amount of interest expense reported on the Year 2 income statement.

Complete this question by entering your answers in the tabs below.

Req A

Req B to E

Use a financial statements model like the one shown below to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31,

Year 1, recognition of interest expense, including the amortization of the premium and the cash payment, affects the company's financial

statements. Use + for increase, for decrease, and if there is no effect, leave the cell blank. (In the Cash Flow column, indicate whether the

item is an operating activity (OA), an investing activity (IA), or a financing activity (FA) and if there is no effect, leave the cell blank. Not all

cells will require entry.)

Show less A

SQUARE FOOT GRILL, INC.

Effect of Transactions on Financial Statements

Balance Sheet

Income Statement

Event

No.

Statement of

Assets

=Liabilities

Stockholders'

Equity

Revenue

Expense

Net

Income

Cash Flow

1.

28.

2b.

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- did not fully awnser questionarrow_forwardWhat does the term "no mutual agency" meanarrow_forwardZina Manufacturing Company started and completed Job 501 in December with the following Job Cost Sheet and transferred it to the warehouse. Direct Materials Date Dec 17 Dec 30 Total Direct Labor Amount Date Amount $2,000 Dec 20 $4,000 8,000 Dec 30 3,800 Total Job Cost Sheet - Job No. 501 Total Cost The journal entry to record the transaction is A) WIP Inventory FG Inventory B) Cost of Goods Sold WIP Inventory C) FG Inventory WIP Inventory D) FG Inventory WIP Inventory Debit Credit 35,800 17,800 17,800 Manufacturing Overhead Date Amount Dec 24 $10,000 Dec 30 8,000 Total 35,800 35,800 17,800 17,800 35,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education