FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

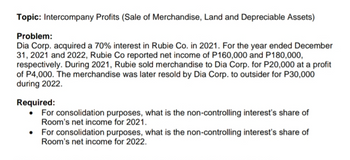

Transcribed Image Text:Topic: Intercompany Profits (Sale of Merchandise, Land and Depreciable Assets)

Problem:

Dia Corp. acquired a 70% interest in Rubie Co. in 2021. For the year ended December

31, 2021 and 2022, Rubie Co reported net income of P160,000 and P180,000,

respectively. During 2021, Rubie sold merchandise to Dia Corp. for P20,000 at a profit

of P4,000. The merchandise was later resold by Dia Corp. to outsider for P30,000

during 2022.

Required:

• For consolidation purposes, what is the non-controlling interest's share of

Room's net income for 2021.

•

For consolidation purposes, what is the non-controlling interest's share of

Room's net income for 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 15. Northridge, Inc., buys 40% of Matador Company on January 1, 2019. for $550,000. The equity method of accounting is to be used, Matador's net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Matador immediately begins supplying inventory to Northridge as follows: Amount Held by Northridge Year Cost to Matador Transfer Price At Year End (at transfer price)2019 $70,000 $100,000 $25,0002020 $96,000 $150,000 $45,000Inventory held at the end of one year by Northridge is sold at the beginning of the next. Matador reports net income of $100,000 in 2019 and $150.000 in 2020 and declares (and pays)…arrow_forwardCamille, Incorporated, sold $147,000 in inventory to Eckerle Company during 2023 for $245,000. Eckerle resold $109,000 of this merchandise in 2023 with the remainder to be disposed of during 2024. Required: Assuming that Camille owns 34 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2023 to defer the intra-entity gross profit? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. 1.Record the entry at the end of 2023 to defer unrealized gross profit.arrow_forwardWeisman Company, a 100% owned subsidiary of Martindale Corporation, sells inventory to Martindale at a 20% profit on selling price. The following data are available pertaining to inter-company purchases by Martindale: 4. 5. a. b. Weisman's profit numbers were $125,000, $142,000 and $265,000 for 2020, 2021, and 2022, respectively. Martindale received dividends from Weisman of $25,000 for 2020 and 2021, and $30,000 for 2022. C. d. 3. Assume Weisman uses the equity method to account for its investment in Martindale. What is the balance in the pre-consolidation Income (loss) from subsidiary account for 2021? $136,000 a. b. Inter-company sales $18,000 $19,400 $21,500 C. d. 2020: 2021: 2022: a. b. C. d. $140,800 $141,600 $142,800 Assume Weisman uses the equity method to account for its investment in Martindale. What is the balance in pre-consolidation Income (loss) from subsidiary for 2022? Unsold at year end (based on selling price) 2020: 2021: 2022: $235,000 $264,600 $265,400 $268,600…arrow_forward

- In 2024, Banchero Corp. changed from a FIFO cost flow assumption to average cost flow assumption for inventory valuation in financial reporting. Banchero's tax rate is 20%, and Banchero has used, and will continue to use FIFO for tax reporting purposes. Below is a summary of cost of goods sold, as calculated under both methods, for Banchero's first three years of operations. 2022 2023 2024 FIFO COGS $205,100 $228,700 $226,400 Average cost COGS $236,800 $223,100 $258,700 Implementing the accounting change in 2024 will require a debit (enter as a positive number) or a credit (enter as a negative number) to retained earnings for what amount?arrow_forwardRequired: a. Determine the maturity dates of the March 1 and November 1 notes. Date of Note Maturity Date March 1 November 1arrow_forwardplease dont provide answer in image format thak youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education