FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Show the complete solution

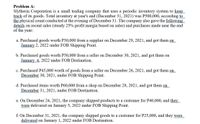

Transcribed Image Text:Problem A:

Slytherin Corporation is a small trading company that uses a periodic inventory system to keep

track of its goods. Total inventory at year's end (December 31, 2021) was P500,000, according to

the physical count conducted at the evening of December 31. The company also gave the following

details on recent sales (steady 25% profit margin based on sales) and purchases made near the end

of the year:

a. Purchased goods worth P30,000 from a supplier on December 29, 2021, and got them on

January 2, 2022 under FOB Shipping Point.

b. Purchased goods worth P50,000 from a seller on December 30, 2021, and got them on

January 4, 2022 under FOB Destination.

c. Purchased P45,000 worth of goods from a seller on December 26, 2021, and got them on

December 30, 2021, under FOB Shipping Point.

d. Purchased items worth P60,000 from a shop on December 28, 2021, and got them on

December 31, 2021, under FOB Destination.

e. On December 24, 2021, the company shipped products to a customer for P40,000, and they

were delivered on January 5, 2022 under FOB Shipping Point.

f. On December 31, 2021, the company shipped goods to a customer for P25,000, and they were

delivered on January 1, 2022 under FOB Destination.

Transcribed Image Text:g. On December 25, 2021, the company shipped products to a buyer for P20,000, and they were

delivered on December 29, 2022 under FOB Shipping Point.

h. On December 27, 2021, the company shipped items to a consumer for P25,000, and they

were delivered on December 28, 2022 under FOB Destination.

1. What is the correct inventory amount to include in the December 31, 2021 statement

of financial position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education