FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please help me ?

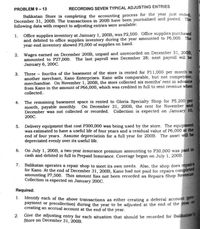

Transcribed Image Text:PROBLEM 9-13

RECORDING SEVEN TYPICAL ADJUSTING ENTRIES

Balikatan Store is completing the accounting process for the year just ended,

December 31, 200B. The transactions in 20OB have been journalized and posted. The

following data with respect to adjusting entries were available:

1. Office supplies inventory at January 1, 200B, was P2,500. Office supplies purchased

and debited to office supplies inventory during the year amounted to P6,000. The

year-end inventory showed P3,000 of supplies on hand.

2. Wages earned on December 200B, unpaid and unrecorded on December 31, 200B,

amounted to P27,000. The last payroll was December 28; next payroll will be

January 6, 200C.

3. Three fourths of the basement of the store is rented for P11,000 per month to

another merchant, Kano Enterprises. Kano sells comparable, but not competitive,

merchandise. On November 1, 200B, the store collected six months' rent in advance

from Kano in the amount of P66,000, which was credited in full to rent revenue when

collected.

4. The remaining basement space is rented to Gloria Specialty Shop for P5,200 per

month, payable monthly. On December 31, 200B, the rent for November and

December was not collected or recorded. Collection is expected on January 10,

200C.

5. Delivery equipment that cost P300,000 was being used by the store. The equipment

was estimated to have a useful life of four years and a residual value of P6,000 at the

end of four years. Assume depreciation for a full year for 200B. The asset will be

depreciated evenly over its useful life.

6. On July 1, 200B, a two-year insurance premium amounting to P30,000 was paid in

cash and debited in full to Prepaid Insurance. Coverage began on July 1, 200B.

7. Balikatan operates a repair shop to meet its own needs. Also, the shop does repair

for Kano. At the end of December 31, 200B, Kano had not paid for repairs completed

amounting P7,500. This amount has not been recorded as Repairs Shop Revenue.

Collection is expected on January 200C.

Required:

1. Identify each of the above transactions as either creating a deferral account (pre

payment or precollection) during the year to be adjusted at the end of the year o

creating an accrual account at the end of the year.

2.

Give the adjusting entry for each situation that should be recorded for Balikatan

Store on December 31, 200B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education