Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Subject: accounting

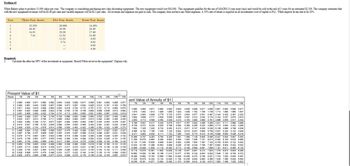

Transcribed Image Text:Problem #3

White Bakery plans to produce 15,000 cakes per year. The company is considering purchasing new cake decorating equipment. The new equipment would cost $30,000. This equipment qualifies for the use of MACRS (3-year asset class) and would be sold at the end of 3 years for an estimated $2,500. The company estimates that

with the new equipment revenues will be $2.60 per cake and variable expenses will be $2.1 per cake. All revenues and expenses are paid in cash. The company does not have any fixed expenses. A 10% rate of return is required on all investments (cost of capital is 8%). White expects its tax rate to be 30%.

Year

1

2

3

4

5

6

7

8

Three-Year Assets

33.33%

44.45

14.81

7.41

Present Value of $1

Period 1% 2%

3%

Five-Year Assets

4%

20.00%

32.00

19.20

5%

11.52

11.52

5.76

Required:

1.

Calculate the after-tax NPV of the investment in equipment. Should White invest in the equipment? Explain why.

6%

7%

Seven-Year Assets

8%

14.29%

24.49

17.49

12.49

8.93

8.92

8.93

4.46

KA

9% 10% 11% 12% 13% 14%

1 0.990 0.980 0.971 0.902

2 0.980 0.961 0.943 0.925

3

4

0.971 0.942 0.915 0.889

0.961 0.924 0.888 0.855

0.951 0.908 0.863 0.822

0.901 0.893 0.885 0.877

0.812 0.797 0.783 0.709

0.731 0.712 0.693 0.675

0.659 0.638 0.813 0.592

0.593 0.567 0.543 0.519

0.535 0.507 0.480 0.456

0.482 0.452 0.425 0.400

5

6

0.942 0.888 0.837 0.790

7

0.933 0.871

8

0.923 0.853

9

0.952 0.943 0.935 0.928 0.917 0.909

0.907 0.890 0.873 0.857 0.842 0.820

0.884 0.840 0.816 0.794 0.772 0.751

0.823 0.792 0.763 0.735 0.708 0.683

0.784 0.747 0.713 0.681 0.650 0.621

0.746 0.705 0.008 0.630 0.598 0.564

0.813 0.780 0.711 0.665 0.623 0.583 0.547 0.513

0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.487 0.434 0.404 0.376 0.351

0.914 0.837 0.768 0.703 0.645 0.592 0.544 0.500

0.460 0.424 0.391 0.361 0.333 0.308

10 0.905 0.820

0.820 0.744 0.878 0.614 0.558 0.508 0.463 0.422 0.388 0.352 0.322 0.295 0.270

11 0.898 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350

0.317 0.287 0.261 0.237

12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.288 0.257 0.231 0.208

13 0.879 0.773 0.681 0.001

0.530 0.469 0.415 0.368 0.328 0.290 0.258 0.229 0.204 0.182

14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.203 0.232 0.205 0.181 0.100

15 0.861 0.743

0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.200 0.183 0.160 0.140

16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123

17 0.844 0.714 0.605 0.513 0.438 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108

18 0.836 0.700 0.587 0.494 0.410 0.350 0.296 0.250 0.212 0.180

0.153 0.130 0.111 0.095

19 0.828 0.688 0.570 0.475 0.398 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083

0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073

20

sent Value of Annuity of $1

196

2%

3%

4%

5%

6%

7%

8%

9%

10% 11% 12% 13%

14%

0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877

1.970 1.942 1.913 1.888 1.850 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647

2.941 2.884 2.829 2.775 2.723 2.673 2.824 2.577 2.531 2.487 2.444 2.402

2.444 2.402 2.361 2.322

3.902 3.808 3.717 3.630 3.540 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914

4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433

5.795 5.601 5.417 5.242 5.078 4.917 4.787 4.823 4.486 4.355 4.231 4.111 3.998 3.889

6.728 8.472 6.230 6.002 5.788 5.582 5.389 5.200 5.033 4.868 4.712 4.564 4.423 4.288

7.652 7.325 7.020 8.733 6.483 6.210 5.971 5.747 5.535 5.335 5.146 4.988 4.799 4.639

8.588 8.162 7.788 7.435 7.108 6.802 8.515 8.247 5.995 5.759 5.537 5.328 5.132 4.946

9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216

10.388 9.787 9.253 8.760 8.308 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.887 5.453

11.255 10.575 9.954 9.385 8.883 8.384 7.943 7.538 7.161 8.814 8.492 6.194 5.918 5.000

12.134 11.348 10.635 9.988 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842

13.004 12.108 11.296 10.563 9.899 9.295

8.745 8.244 7.788 7.367 6.982 6.628 6.302 6.002

13.805 12.849 11.938 11.118 10.380 9.712 9.108 8.550 8.081 7.606 7.191 6.811 68.462 6.142

14.718 13.578 12.561 11.852 10.838 10.100 9.447 8.851 8.313

8.313 7.824 7.379 6.974 8.804 8.285

15.582 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 8.729 6.373

16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372

9.372 8.756 8.201

8.201 7.702 7.250 6.840 6.487

17.228 15.678 14.324 13.134 12.085 11.158 10.338 9.804 8.950 8.365 7.839 7.388 6.938 6.550

18.048 16.351

16.351 14.877 13.590 12.482 11.470 10.594 9.818 9.129 8.514 7.963 7.489 7.025 0.023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education