FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

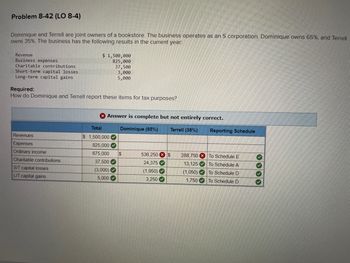

Transcribed Image Text:Problem 8-42 (LO 8-4)

Dominique and Terrell are joint owners of a bookstore. The business operates as an S corporation. Dominique owns 65%, and Terrell

owns 35%. The business has the following results in the current year:

Revenue

Business expenses

Charitable contributions

Short-term capital losses

Long-term capital gains

Required:

How do Dominique and Terrell report these items for tax purposes?

venues

Expenses

Ordinary income

Charitable contributions

$ 1,500,000

825,000

37,500

3,000

5,000

S/T capital losses

LIT capital gains

X Answer is complete but not entirely correct.

Dominique (65%) Terrell (35%)

Total

$1,500,000

825,000✔

675,000

37,500✔

(3,000)

5,000

$

536,250 $ 288,750

24,375

13,125

(1,950)✔

(1,050)

3,250

1,750

333*

Reporting Schedule

To Schedule E

To Schedule A

To Schedule D

To Schedule D

>>>>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jimmy Corporation had the following income and expenses during the current year: Gross receipts Selling and Administrative expenses $480,000 200,000 Other operating expenses Contributions to qualified charitable organizations Capital gains Capital loss carryback Depreciation expense Dividend income 40,000 32,000 4,000 3,000 40,000 30,000 Dividends-received deduction 21,000 What is Jimmy Corp's charitable contribution deduction for the current year? Be sure to explain your answer and show your work.arrow_forwardUrgent Need (Explanation Require) Multiple Choice Questions. 1. Similar to the example given in class, assume that a corporation has $500 of cash revenue and $300 of cash expenses. Therefore the corporation has $200 of taxable income. The corporation pays taxes at the 40% income tax rate (i.e., all of the $200 of taxable income will be taxed at 40%). The corporation plans to pay any cash left over after the payment of income taxes to the stockholders. If the stockholders pay taxes at the 20% tax rate (i.e., any dividends they receive will be taxed at 20%), how much income tax (both corporate and individual) will be paid? A. $82 B. $104 C. $112 D. $116 E. $120 F. $140 2. A project requires an initial investment of $10 million and produces a single positive cash flow in one year. The opportunity cost of capital for the project is 8%. The expected return for the project is X%. Which of the following statements is true? A. The project will create value for the owner only if the expected…arrow_forwardook Problem 6-37 (LO 6-1) Kelly is a self-employed tax attorney whose practice primarily involves tax planning. During the year, she attended a three-day seminar regarding new changes to the tax law. She incurred the following expenses: Lodging Meals Course registration Transportation $ 460 81 410 210 Required: a. How much can Kelly deduct? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. Kelly believes that obtaining a CPA license would improve her skills as a tax attorney. She enrolls as a part-time student at a local college to take CPA review courses. During the current year, she spends $1,800 for tuition and $360 for books. How much of these expenses can Kelly deduct? a. Total deduction: b. Deductible education expensesarrow_forward

- Nicole and Mohammad (married taxpayers filing jointly) are equal owners in an S corporation. The company reported sales revenue of $410,000 and expenses of $287,000. The corporation also earned $21,000 in taxable interest and dividend income and had $13,650 investment interest expense. Required: How are these amounts reported for tax purposes in the following schedules? > Answer is complete but not entirely correct. Schedule A Schedule B Schedule E $ $ $ Amount 0X 21,000✔ 13,650 xarrow_forwardSubject:Accountingarrow_forwardA-5arrow_forward

- Income Tax. Deferred Tax Liability and Deferred Tax Asset (PAS 12) Problem 11. The 2015 income statement of Rob Inc. reported a financial income of P3,000,000. The tax accountant and tax auditor have found the following items included in such amount: Capital gain from the sale of a land classified as capital asset Illegal contribution to political parties and candidates Interest income from a 6-year time deposit Representation expenses in excess of the amount allowed by NIRC 400,000 P300,000 200,000 500,000 Based on the analysis conducted by the accountant and tax auditor, they also found out the following differences in tax and accounting treatments: • Unearned revenue of P200,000 was recorded by Rob Inc. in its accounting books but was reported as income in the corporate income tax return. • Installment sales of P300,000 was recorded by Rob Inc. in its accounting books but was only collected on year 2016. • Provision for lawsuit for P400,000 was recognized by Rob Inc. in its…arrow_forwardDinesh bhaiarrow_forwardWhat are the tax consequences to Paul?arrow_forward

- In the current year, Phillip Hard earned the following income: • Employment income • Business Income $90,000 $15,000 • Property income 2,000 • Gains: • Shares of Corporation X $12,000 • Personal-use property 7,000 • Listed personal property 1,600 20,600 • Losses: • Shares of Corporation Y (15,000) • Shares of small business corporation (4,000) • Listed personal property (300) (19,300) $108,300 Determine net income in accordance with the aggregating formula in Section 3 of the ITA. Assume Other deductions total $2,000.arrow_forward18. Ron and Hermione formed Wizard Corporation on January 2. Ron contributed cash of $200,000 in return for 50 percent of the corporation’s stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation’s stock: (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) FMV Adjusted Tax Basis Building $ 75,000 $ 20,000 Land 175,000 80,000 Total $ 250,000 $ 100,000 To equalize the exchange, Wizard Corporation paid Hermione $50,000 in addition to her stock. What is Hermione’s tax basis in the stock she receives in return for her contribution of property to the corporation?arrow_forwardPlease do not give solution in image format ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education