FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

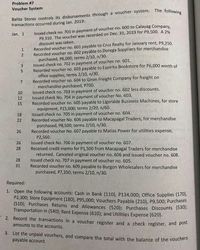

Transcribed Image Text:Problem #7

Voucher System

transactions occurred during Jan. 2019:

Issued check no. 701 in payment of voucher no. 600 to Calayag Company,

P9,310. The voucher was recorded on Dec. 31, 2019 for P9,500. A 2%

discount was taken.

Recorded voucher no. 601 payable to Cruz Realty for January rent, P9,250.

Recorded voucher no. 602 payable to Dorega Suppliers for merchandise

purchased, P8,000; terms 2/10, n/30.

Issued check no. 702 in payment of voucher no. 601.

Recorded voucher no. 603 payable to Espiritu Bookstore for P6,000 worth of

office supplies; terms 2/10, n/30.

Recorded voucher no. 604 to Giron Freight Company for freight on

merchandise purchased, P700.

Issued check no. 703 in payment of voucher no. 602 less discounts.

Issued check No. 704 in payment of voucher No. 603.

Recorded voucher no. 605 payable to Ligeralde Business Machines, for store

equipment, P15,000; terms 2/20, n/60.

Issued check no. 705 in payment of voucher no. 604.

Recorded voucher No. 606 payable to Macapagal Traders, for merchandise

purchased, P8,500; terms 2/10, n/30.

Recorded voucher No. 607 payable to Matias Power for utilities expense,

Jan. 1

3

10

12

15

18

22

26

P2,560.

Issued check No. 706 in payment of voucher no. 607.

Received credit memo for P1,500 from Macapagal Traders for merchandise

returned. Canceled original voucher no. 606 and issued voucher no. 608.

Issued check no. 707 in payment of voucher no. 605.

Recorded voucher no. 609 payable to Burgon Wholesalers for merchandise

purchased, P7,350; terms 2/10, n/30.

26

28

28

31

Required:

1. Open the following accounts: Cash in Bank (110), P134,000; Office Supplies (170),

P2,300; Store Equipment (180), P95,000; Vouchers Payable (210), P9,500; Purchases

(510); Purchases Returns and Allowances (520): Purchases Discounts (530);

Transportation In (540); Rent Expense (610); and Utilities Expense (620).

* 2. Record the transactions in a voucher register and a check register, and post

amounts to the accounts.

3. List the unpaid vouchers, and compare the total with the balance of the vouchers

payable account.

12

7,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple choicearrow_forwardab User Management,... H https://outlook.offi... FES Protection Plan System 7 - North C... Homework Exercises Saved Lewis Corporation engaged in the following transactions during June. DATE TRANSACTIONS 20X1 4 Purchased merchandise on account from Salinas Company; Invoice 100 for $1,005; terms n/30. 15 Recorded purchases for cash, $1,490. 30 Paid amount due to Salinas Company for the purchase on June 4. June Book Required: Record these transactions in a general journal. erences View transaction list Journal entry worksheet 1. 21 3 Paid amount due to Salinas Company for the purchase on June 4. Note: Enter cebits before credits.arrow_forwardThe trader of Children City purchased goods from the trader of Muscat City OMR 22500. Which of the following is the Credit term for the invoice 1/10, n/30? a. 1 day b. 30 days c. 20 days d. 10 daysarrow_forward

- ournalizing Cash Payments Transactions Enter the following cash payments transactions in a general journal: Sept. 5 Issued Check No. 318 to Georgetown Inc. for merchandise purchased August 28, $5,500, terms 2/10, n/30. Payment is made within the discount period. 12 Issued Check No. 319 to Martin Company for merchandise purchased September 2, $7,500, terms 1/10, n/30. A credit memo had been received on September 8 from Martin Company for merchandise returned, $500. Payment is made within the discount period after deduction for the return dated September 8. 19 Issued Check No. 320 to Professional Partners for merchandise purchased August 20, $3,900, terms n/30. 27 Issued Check No. 321 to Dynamic Data for merchandise purchased September 17, $9,000, terms 2/10, n/30. Payment is made within the discount period.arrow_forwardMatch the last day the discount may be taken to each letter Last Date Date Merchandise was Invoice Date Terms for Cash Received Discount a. September 28 October 4 8/10 EOM b. July 28 August 2 8/10 ROG C. January 22 January 27 2/10 EOM d. March 21 March 27 2/10 ROG е. May 30 June 6 1/15, n/30 f. September 14 September 17 3/10,n/30 [Choose] ( Choose ) I Choose) [ Choose] [Choose ) [ Choose]arrow_forwardSaenz Company uses a voucher system in which it records invoices at the gross amount. The following vouchers were issued during February and were unpaid on March 1: Voucher Number Company For Date of Voucher Amount 1729 Kipley Company Merchandise, FOB destination Feb. 26 $3,436 1732 J. R. Steven Merchandise, FOB destination Feb. 28 4,710 The following transactions were completed during March: Mar. 3 Issued voucher no. 1734 in favor of Larry Company for March rent, $1,220. 3 Issued Ck. No. 1829 in payment of voucher no. 1734, $1,220. 5 Bought merchandise on account from Lorenzo, Inc., $3,890; terms 2/10, n/30; FOB shipping point; freight prepaid and added to the invoice, $72 (total, $3,962). Issued voucher no. 1735. 5 Issued Ck. No. 1830 in payment of voucher no. 1729, $3,401.64 ($3,436 less 1 percent cash discount). 9 Issued voucher no. 1736 in favor of Mario Electric Company for electric bill, $216. 9 Issued Ck. No. 1831 in payment of…arrow_forward

- EB 14. LO 6.5 Review the following situations and record any necessary journal entries for Wall World. Dec. 6 Wall World purchases $5,510 worth of merchandise on credit from a manufacturer. Shipping charges are an extra $146 cash. Terms of the purchase are 2/15, n/40, FOB Shipping Point, invoice dated December 6. Dec. 10 Wall World sells $3,590 worth of merchandise to a customer, who pays on credit. The merchandise has a cost to Wall World of $1,400. Shipping charges are an extra $115 cash. Terms of the sale are 4/10, n/30, FOB Destination, invoice dated December 10.arrow_forwardProblem 7.6A (Algo) Recording sales made for cash, on open account, and with credit cards. LO 7-1, 7-2 The Aristocrat Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales tax. The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. The bank credit cards charge a 2 percent fee. American Express charges a 3 percent fee. The Aristocrat Gift Shop also grants trade discounts to certain wholesale customers who place large orders. These orders are not subject to sales tax. During February 20X1, The Aristocrat Gift Shop engaged in the following transactions: DATE TRANSACTIONS February 1, 20x1 Sold crystal goods to Beautiful kitchens, a wholesale customer. The list price is $4,200, with a 20 percent trade discount. This sale is not subject to sales tax. Issued Invoice 5950 with terms of "/15. February 15, 20x1 Recorded cash…arrow_forwardS Word Problem 7-35 (Algo) [LU 7-2 (2)] On March 16, Jangles Corporation received a $20,500 invoice dated March 13. Cash discount terms were 3/10, n/30. On March 20, Jangles sent an $8,200 partial payment. a. What credit should Jangles receive? (Round your answer to the nearest cent.) Credit b. What is Jangles' outstanding balance? (Round your answer to the nearest cent.) Outstanding balance Check my workarrow_forward

- October 14the Patrick Company sold merchandise with an invoice price of 2,600 2,350 cost with terms of 2/10, n/30, to the Baxter CompanyOn October 18400 of the (350 ) was returned because it was the wrong sizeOn October the Patrick Company received a check for the amount due from the Baxter Company. The options for the faint blue description boxes are: accounts receivable, cash, cost of goods sold, inventory, sales discounts, sales returns and allowances, sales revenue.arrow_forward53 a. Sent a check to XYZ company for the previous purchase of $3,500 of merchandise less a $70 discount Skipped View transaction list Journal entry worksheet < 1 Sent a check to XYZ company for the previous purchase of $3,500 of merchandise less a $70 discount. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardplease qucikly thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education