FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

11.

urgent need the answer of this question

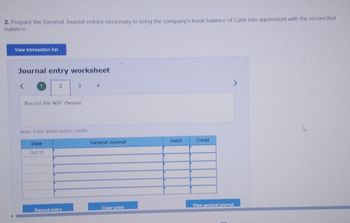

Transcribed Image Text:2. Prepare the General Journal entries necessary to bring the company's book balance of Cash into agreement with the reconciled

balance.

View transaction list

Journal entry worksheet

<

2

Record the NSF cheque.

Date

Oct 31

3

Note: Enter debits before credits.

Record entry

4

General Journal

Clear entry

Debit

Credit

View general journal

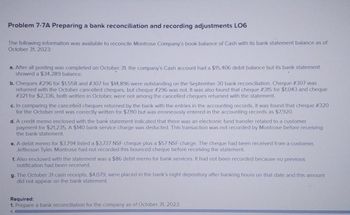

Transcribed Image Text:Problem 7-7A Preparing a bank reconciliation and recording adjustments LO6

The following information was available to reconcile Montrose Company's book balance of Cash with its bank statement balance as of

October 31, 2023:

a. After all posting was completed on October 31, the company's Cash account had a $15,406 debit balance but its bank statement

showed a $34,289 balance.

b. Cheques # 296 for $1,558 and # 307 for $14,896 were outstanding on the September 30 bank reconciliation. Cheque #307 was

returned with the October cancelled cheques, but cheque # 296 was not. It was also found that cheque # 315 for $1,043 and cheque

# 321 for $2,336, both written in October, were not among the cancelled cheques returned with the statement.

c. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320

for the October rent was correctly written for $7,110 but was erroneously entered in the accounting records as $7,920.

d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a customer

payment for $21,235. A $140 bank service charge was deducted. This transaction was not recorded by Montrose before receiving

the bank statement.

e. A debit memo for $3,794 listed a $3,737 NSF cheque plus a $57 NSF charge. The cheque had been received from a customer,

Jefferson Tyler. Montrose had not recorded this bounced cheque before receiving the statement.

f. Also enclosed with the statement was a $86 debit memo for bank services. It had not been recorded because no previous

notification had been received.

g. The October 31 cash receipts, $4,079, were placed in the bank's night depository after banking hours on that date and this amount

did not appear on the bank statement.

Required:

1. Prepare a bank reconciliation for the company as of October 31, 2023.

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education