Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

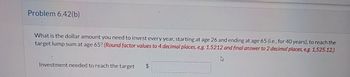

Transcribed Image Text:Problem 6.42(b)

What is the dollar amount you need to invest every year, starting at age 26 and ending at age 65 (i.e., for 40 years), to reach the

target lump sum at age 65? (Round factor values to 4 decimal places, e.g. 1.5212 and final answer to 2 decimal places, e.g. 1,525.12.)

Investment needed to reach the target

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- #28arrow_forward7arrow_forwardQuestion 4 of 9 lan purchased two trucks for his warehouse for a total of $58,000. This investment saved him $14,000 every year for 11 years. At the end of year 11, he sells both the trucks for a total of $10,500. a. What is the Net Present Value (NPV) of the investment if the required rate of return is 8%? Round to the nearest cent b. Does the investment meet the required rate of return? Yes Noarrow_forward

- Q34arrow_forwardQUESTION 6 Seaborn Co. has identified an investment project with the following cash flows. Year Cash Flow $950 1,050 1,320 1,200 1 2 3 4 If the discount rate is 10 percent, what is the present value of these cash flows? 3542.76 3578.84 3418.66 4470.00 3847.03 Click Save and Submit to save and submit. Click Save All Answers to save all answers. SEP 28 30 tv ♫ Aarrow_forwardQUESTION 109 If $200 is invested at the end of each year for 8 years at a rate of 12% what will the ending value of the investment be? TRUE OR FALSEarrow_forward

- Question content area top Part 1 (Present value of a growing perpetuity) Your firm has taken on cost saving measures that will provide a benefit of $10,000 in the first year. These cost savings will decrease each year at a rate of 4 percent forever. If the appropriate interest rate is 6 percent, what is the present value of these savings? Question content area bottom Part 1 The present value of these cost savings is $enter your response here. (Round to the nearest cent.)arrow_forwardTools Introductory ce An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $350 at the end of Year 5, and $500 at the end of Year 6. a. If other investments of equal risk earn 4% annually, what is its present value? Round your answer to the nearest cent. $ b. If other investments of equal risk earn 4% annually, what is its future value? Round your answer to the nearest dent. Darrow_forward11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education