FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

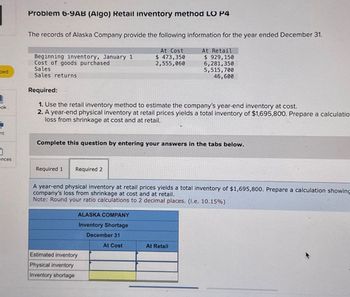

Transcribed Image Text:Problem 6-9AB (Algo) Retail inventory method LO P4

The records of Alaska Company provide the following information for the year ended December 31.

Beginning inventory, January 1

Cost of goods purchased

Sales

At Cost

$ 473,350

2,555,060

At Retail

$ 929,150

ped

Sales returns

6,281,350

5,515,700

46,600

ok

Required:

1. Use the retail inventory method to estimate the company's year-end inventory at cost.

2. A year-end physical inventory at retail prices yields a total inventory of $1,695,800. Prepare a calculatio

loss from shrinkage at cost and at retail.

nt

Complete this question by entering your answers in the tabs below.

ences

Required 1

Required 2

A year-end physical inventory at retail prices yields a total inventory of $1,695,800. Prepare a calculation showing

company's loss from shrinkage at cost and at retail.

Note: Round your ratio calculations to 2 decimal places. (i.e. 10.15%)

ALASKA COMPANY

Inventory Shortage

December 31

Estimated inventory

Physical inventory

Inventory shortage

At Cost

At Retail

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Module 3 Problem Set Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 15 units at $50 $750 Aug. 13 Purchase 7 units at $52 364 Nov. 30 Purchase 4 units at $53 212 Available for sale 26 units $1,326 There are 13 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the (a) first-in, first-out (FIFO) method; (b) last-in, first-out (LIFO) method; and (c) weighted average cost method (round per-unit cost to two decimal places and your final answer to the nearest whole dollar). a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) C. Weighted average costarrow_forwardA.4arrow_forwardNonearrow_forward

- 4arrow_forward6arrow_forwardces Date March 1 March 5 March 9 March 18 March 25 March 29 Problem 6-1A (Algo) Part 3 Perpetual FIFO Perpetual LIFO Date March 1 Complete this question by entering your answers in the tabs below. March 5 Weighted Average Compute the cost assigned to ending inventory using LIFO. Total March 5 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold include 60 units from beginning inventory, 190 units from the March 5 purchase, 40 units from the March 18 purchase, and 80 units from the March 25 purchase. March 9 Total March 9 March 18 Total March 18 Units Acquired at Cost 90 units @ $50.80 per unit 220 units @ $55.80 per unit Goods Purchased # of units 80 units @ $60.80 per unit 140 units @ $62.80 per unit Specific Id 530 units Cost per # of units unit sold Perpetual LIFO: Cost of Goods Sold Cost per…arrow_forward

- %24 Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as followS: Oct. 1 Inventory 72 units @ $20 7. Sale 58 units 15 Purchase 50 units @ $24 24 Sale 22 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forward6arrow_forward1arrow_forward

- Please do not give solution in image format thankuarrow_forwardQuestion Content Area Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 5 units at $35 $175 Aug. 7 Purchase 20 units at $36 720 Dec. 11 Purchase 11 units at $37 407 36 units $1,302 There are 18 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first-out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (round per unit cost to two decimal places and your final answer to the nearest whole dollar).arrow_forwardA1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education