FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ook

int

ences

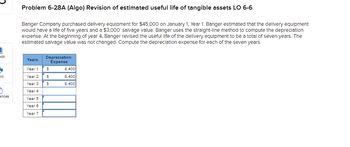

Problem 6-28A (Algo) Revision of estimated useful life of tangible assets LO 6-6

Banger Company purchased delivery equipment for $45,000 on January 1, Year 1. Banger estimated that the delivery equipment

would have a life of five years and a $3,000 salvage value. Banger uses the straight-line method to compute the depreciation

expense. At the beginning of year 4, Banger revised the useful life of the delivery equipment to be a total of seven years. The

estimated salvage value was not changed. Compute the depreciation expense for each of the seven years.

Years

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Depreciation

Expense

$

$

$

8,400

8,400

8,400

Expert Solution

arrow_forward

Step 1: Explanation of Straight line Depreciation method

Straight-line depreciation evenly spreads the cost of an asset over its useful life, resulting in a consistent annual expense.

It simplifies accounting by allocating a portion of the asset's value as an expense each year until its estimated value reaches zero.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Exercise 7-11A Determine depreciation under three methods (LO7-4) [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $42,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,400. During the four-year period, the company expects to drive the van 180,000 miles. Actual miles driven each year were 46,000 miles in year 1 and 50,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) Exercise 7-11A Part 3 3. Activity-based. Annual Year Depreciation 2. to search ASUSarrow_forwardRequired information Problem 7-5A (Algo) Determine depreciation under three methods (LO7-4) [The following information applies to the questions displayed below.] University Car Wash purchased new soap dispensing equipment that cost $231,000 including installation. The company estimates that the equipment will have a residual value of $25,500. University Car Wash also estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: Year 1 2 3 4 Year 1 2 3 4 5 5 6 Hours Used 2,900 1,800 1,900 2,100 Problem 7-5A (Algo) Part 1 1,900 1,900 Required: 1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) UNIVERSITY CAR WASH Depreciation Schedule-Straight-Line End of Year Amounts Depreciation Expense Accumulated Depreciation Book Value Sarrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $282,600. The equipment was expected to have a useful life of four years, or 4,800 operating hours, and a residual value of $23,400. The equipment was used for 1,680 hours during Year 1, 1,008 hours in Year 2, 1,344 hours in Year 3, and 768 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in the…arrow_forward

- ra1arrow_forwardDeprecation exercise instructions: Assumptions: Purchase at time 0 of a piece of widget processing equipment for an assumed cost of $18,300. The equipment is assumed to have a 7-year economic life. The assumed salvage value for the widget equipment at the end of its economic life is $800. The equipment is expected to produce 35,000 widgets over its economic life. Actual annual production of widgets is 3,450 in year 1, 5,200 in year 2, 5,400 in year 3, 5,350 each in years 4-6 and 4,900 in year 7. Assume for the declining balance method that you will apply a double declining balance approach. Use an Excel spreadsheet to create a table similar to the one shown below. On your Excel spreadsheet, using the assumptions listed above, calculate the annual depreciation expense for the widget processing equipment using each of the four methods and fill in the table in Excel. After you have completed the calculations, determine which method you would choose to use for tax purposes, if you were in…arrow_forwardProblem 6-25 (Algo) Identify depreciation methods used LO 3 Grove Co. acquired a production machine on January 1, 2019, at a cost of $495,000. The machine is expected to have a four-year useful life, with a salvage value of $86,000. The machine is capable of producing 56,000 units of product in its lifetime. Actual production was as follows: 12,320 units in 2019; 17,920 units in 2020; 15,680 units in 2021; 10,080 units in 2022. Following is the comparative balance sheet presentation of the net book value of the production machine at December 31 for each year of the asset’s life, using three alternative depreciation methods (items a–c): Required: Identify the depreciation method used for each of the following comparative balance sheet presentations (items a–c). If a declining-balance method is used, be sure to indicate the percentage (150% or 200%). (Hint: Read the balance sheet from right to left to determine how much has been depreciated each year. Remember that December 31, 2019, is…arrow_forward

- Required information Problem 7-5B (Algo) Determine depreciation under three methods (LO7-4) [The following information applies to the questions displayed below.] Quick Copy purchased a new copy machine. The new machine cost $128,000 including installation. The company estimates the equipment will have a residual value of $32,000. Quick Copy also estimates it will use the machine for four years or about 8,000 total hours. Actual use per year was as follows: Year 1234 Hours Used 2,100 1,900 1,900 3,300 Problem 7-5B (Algo) Part 1 Required: 1. Prepare a depreciation schedule for four years using the straight-line method. (Do not round your intermediate calculations.) QUICK COPY Depreciation Schedule-Straight-Line End of Year Amounts Year Depreciation Accumulated Book Value Expense Depreciation 1 2 3 4 Totalarrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $725,600. The equipment was expected to have a useful life of four years, or 10,400 operating hours, and a residual value of $60,000. The equipment was used for 3,640 hours during Year 1, 2,184 hours in Year 2, 2,912 hours in Year 3, and 1,664 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in…arrow_forwardDepreciation by different methods, and sale of a fixed asset New machines were purchased by Nunez Co. on January 1 for $300,000. The equipment was expected to have a useful life of four years and an estimated salvage value of $40,000. Required: 1. Determine the annual depreciation expense for each of the four years under A. The Straight-line method Year 1 $65,000 Year 2 $65,000 Year 3 $65,000 Year 4 $65,000 B. The double-declining balance method Beg. BV DDB% Dep. Exp. End. BV Year 1 300,000 50.0% 150,000 150,000 Year 2 150,000 50.0% 75,000 75,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education