FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

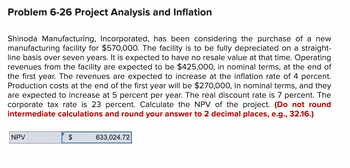

Transcribed Image Text:Problem 6-26 Project Analysis and Inflation

Shinoda Manufacturing, Incorporated, has been considering the purchase of a new

manufacturing facility for $570,000. The facility is to be fully depreciated on a straight-

line basis over seven years. It is expected to have no resale value at that time. Operating

revenues from the facility are expected to be $425,000, in nominal terms, at the end of

the first year. The revenues are expected to increase at the inflation rate of 4 percent.

Production costs at the end of the first year will be $270,000, in nominal terms, and they

are expected to increase at 5 percent per year. The real discount rate is 7 percent. The

corporate tax rate is 23 percent. Calculate the NPV of the project. (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

NPV

$

633,024.72

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- QUESTION 10 Georgia Mills Company (GMC) purchase a milling machine, which it intends to use for the next five years, for $180,000. This machine is expected to save GMC $35,000 during the first operating year. Then, the annual savings are expected to decrease by 3% each subsequent year over the previous year due to increased maintenance costs. Assuming that GMC would operate the machine for an average of 5,000 hours per year and that the machine would have no appreciable salvage value at the end of the five year period, determine the equivalent dollar savings per operating hour at 15% interest compounded annually. OA $3.24 lost per hour OB. $4.09 lost per hour OC $6.74 lost per hour D.$5.92 lost per hourarrow_forwardProblem 6-26 Project Analysis and Inflation Shinoda Manufacturing, Incorporated, has been considering the purchase of a new manufacturing facility for $540,000. The facility is to be fully depreciated on a straight- line basis over seven years. It is expected to have no resale value at that time. Operating revenues from the facility are expected to be $410,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 2 percent. Production costs at the end of the first year will be $255,000, in nominal terms, and they are expected to increase at 3 percent per year. The real discount rate is 5 percent. The corporate tax rate is 25 percent. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forward20- Project Beta is a 4-year project which requires an initial outlay of $6,000. This outlay will be depreciated using straight-line depreciation over the life of the project. It will generate incremental revenue of $6000 per year and incremental costs (excluding depreciation) of $1400. The tax rate is 35%. What is the project's annual incremental EBIT? a. $3100 b. $4600 c. $1600 d. $6100 Clear my choicearrow_forward

- Problem 6-4 Calculating Project Cash Flow from Assets Esfandairi Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life. The project is estimated to generate $1,790,000 in annual sales, with costs of $700,000. The project requires an initial investment in net working capital of $410,000, and the fixed asset will have a market value of $420,000 at the end of the project. a. If the tax rate is 21 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567. A negative answer should be indicated by a minus sign.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places,…arrow_forward13-11arrow_forwardQUESTION 10 A project will produce operating cash flows of $57,000 a year for 3 years. During the life of the project, inventory will be lowered by $10,000 and accounts receivable will increase by $20,000. Accounts payable will decrease by $5,000. The project requires the purchase of equipment at an initial cost of $90,000. The equipment will be salvaged at the end of the project creating a $17,000 after-tax cash inflow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 12%? $48,772.08 $54,681.35 $56,209.19 $42,908.17 $44,141.41arrow_forward

- Problem 6-6 NPV and Bonus Depreciation Esfandairi Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $2.29 million. The fixed asset qualifies for 100 percent bonus depreciation. The project is estimated to generate $1,790,000 in annual sales, with costs of $684,000. The project requires an initial investment in net working capital of $410,000, and the fixed asset will have a market value of $420,000 at the end of the project. a. If the tax rate is 21 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) a. Year 0 cash…arrow_forwardProblem 7-2 Scenario Analysis We are evaluating a project that costs $520,000, has a life of 6 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 73,000 units per year. Price per unit is $45, variable cost per unit is $30, and fixed costs are $840,000 per year. The tax rate is 21 percent, and we require a return of 15 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case NPV Worst-case NPVarrow_forwardBrief Exercise 12-9 Swift Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $123,465 and will increase annual expenses by $67,000 including depreciation. The oil well will cost $481,000 and will have a $10,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to 0 decimal places, e.g. 13%.) Annual rate of return % Click if you would like to Show Work for this question: Open Show Workarrow_forward

- Problem 7-2 Scenario Analysis We are evaluating a project that costs $1,080,000, has a life of 10 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 52,000 units per year. Price per unit is $50, variable cost per unit is $30, and fixed costs are $730,000 per year. The tax rate is 25 percent, and we require à return of 15 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case NPV Worst-case NPVarrow_forwardReclamation of a gravel pit is expected to begin 9 years from today with estimated end of year costs of 1.5 million dollars each year at the end of years 9, 10, 11 and 12. Part A What amount would the company need to invest or escrow today (time zero) to cover the future liabilities of 1.5 million in years 9, 10, 11, & 12? Other opportunities exist to invest available capital elsewhere and earn 10% per year compounded annually. Part B What amount would your company need to invest each year for the next 8 years (Years 1-8) to pay for the future liabilities of 1.5 million in years 9, 10, 11, & 12? Assume the same nominal 10% interest rate.arrow_forwardProblem 7-18 Abandonment We are examining a new project. We expect to sell 6,100 units per year at $75 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $75 x 6,100 $457,500. The relevant discount rate is 18 percent, and the initial investment required is $1,720,000. After the first year, the project can be dismantled and sold for $1,550,000. Suppose you think it is likely that expected sales will be revised upward to 9,100 units if the first year is a success and revised downward to 4,700 units if the first year is not a success. a. If success and failure are equally likely, what is the NPV of the project? Consider the possibility of abandonment in answering. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to abandon? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. NPV b. Option value S $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education