Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

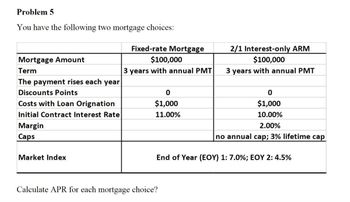

Transcribed Image Text:Problem 5

You have the following two mortgage choices:

Mortgage Amount

Term

The payment rises each year

Discounts Points

Costs with Loan Orignation

Fixed-rate Mortgage

$100,000

3 years with annual PMT

0

$1,000

2/1 Interest-only ARM

$100,000

3 years with annual PMT

0

$1,000

Initial Contract Interest Rate

11.00%

Margin

Caps

Market Index

Calculate APR for each mortgage choice?

10.00%

2.00%

no annual cap; 3% lifetime cap

End of Year (EOY) 1: 7.0%; EOY 2: 4.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use chartarrow_forwardLoan Amount Loan Term Fully Amortized Interest Rate Origination Fee Prepayment Penalty 7.5% 8.1% 9.6% Old Loan 4,000,000 30 years Yes 7% 3% 7% 10.1% New Loan What is the internal rate of return of refinancing the old loan at the end of Year 10? (choose the closest answer) 6.8% 20 years Yes 5.5% 4% 3%arrow_forwardDate Name Section 8.7 - Worksheet The Cost of Home Ownership Comparing Mortgage Interest for 30-year rate vs 15-year rate. In the lesson notes example, the $175,500 mortgage was financed with a 30-year fixed rate at 7.5%. The total interest paid over 30 years was approximately $266,220. a) Use the loan payment formula for installment loans to find the monthly payment if the time of the mortgage is reduced to 15 years. Round to the nearest dollar. b) Find the total interest paid over 15 years. c) How much interest is saved by reducing the mortgage from 30 to 15 years?arrow_forward

- Please help complete in same format.arrow_forwardWhat is the effective yield to the lender through the date of prepayment on a $540,000 fixed rate mortgage loan fully amortizing over 30 years but paid off after 10 years if the stated annual interest rate is 6.50%, the lender charges 2.0% as an origination fee, $720 for an appraisal and $36 for a credit report and there is no prepayment penalty? -6.81% -6.71% -6.30% -6.50%arrow_forwardPlease correct answer and don't use hand ratingarrow_forward

- Intro You take out a 360-month fixed-rate mortgage for $100,000 with a monthly interest rate of 0.4%. Part 1 What is the monthly payment? 0+ decimals Submitarrow_forward*13.4.7 Find the monthly payment needed to amortize principal and interest for the fixed-rate mortgage. Use either the regular monthly payment formula or the given table Loan Amount Interest Rate $85,000 Term Real Estate Amortization Table 6% 20 years E Click the icon to view the Real Estate Amortization Table. Monthly payments to Repay Principal and Interest on a ST000 mortgage The monthly payment is $ (Round to the nearest cent as needed.) Term of Mortgage (years) Annual rate 5. 10 15 20 25 30 40 3.0% 17.96869 9.65607 6.90582 5.54598 4.74211 4.21604 3.57984 3.5% 18.19174 9.88859 7.14883 5.79960 5.00624 4.49045 3.87391 4.0% 18.41652 10.12451 7.39688 6.05980 5.27837 4.77415 4.17938 4.5% 18.64302 10.36384 7.64993 6.32649 5.55832 5.06685 4.49563 5.0% 18.87123 10.60655 7.90794 6.59956 5.84590 5.36822 4.82197 5.5% 19.10116 10.85263 8.17083 6.87887 6.14087 5.67789 5.15770 6.0% 19.33280 11.10205 8.43857 7.16431 6.44301 5.99551 5.50214 6.5% 19.56615 11.35480 8.71107 7.45573 6.75207 6.32068…arrow_forwardNonearrow_forward

- Calculating the Total Interest Payment for a negative amortizing CPM: $100,000 Mortgage 7% Interest 30 Years Monthly Payments 110% unpaid loan balance at maturity Answer is 217,049.1 but need help with work!!!!arrow_forwardGiven the following Adjustable Rate Mortgage (ARM): Loan amount: Term: $100,000 20 years, monthly payment Discount point: 0 Origination fee: $8,000 Teaser rate: 7.25% Margin: 225 basis points Rate caps: 2.5% annually, 6% lifetime Market Index: 1 EOY Index 8.6% 9.5% 2 3 4 5 10.5% 11.5% 10.5% What are the proper interest rates for calculating the monthly payments from year 2 t lifetime cap) 10.85%, 11.75%, 12.75%; 13.75%; 12.75% 10%, 11.75%, 12.75%; 13.5%; 12.75% O None of the above is all correct O 9.75%, 11.75%, 12.75%, 13.25%, 12.75%arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education