FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Manji

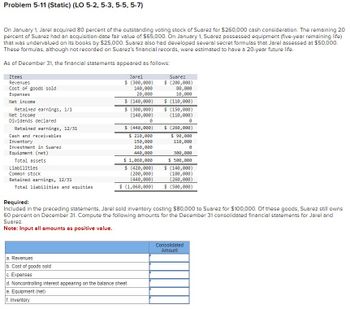

Transcribed Image Text:Problem 5-11 (Static) (LO 5-2, 5-3, 5-5, 5-7)

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20

percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remaining life)

that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000.

These formulas, although not recorded on Suarez's financial records, were estimated to have a 20-year future life.

As of December 31, the financial statements appeared as follows:

Items

Revenues

Cost of goods sold

Expenses

Net income

Retained earnings, 1/1

Net income

Dividends declared

Retained earnings, 12/31

Cash and receivables

Inventory

Investment in Suarez

Equipment (net)

Total assets

Liabilities

Common stock

Retained earnings, 12/31

Total liabilities and equities

Jarel

$ (300,000)

140,000

20,000

$ (140,000)

$ (300,000)

(140,000)

0

$ (440,000)

$ 210,000

150,000

260,000

440,000

$ 1,060,000

$ (420,000)

(200,000)

(440,000)

$ (1,060,000)

a. Revenues

b. Cost of goods sold

c. Expenses

d. Noncontrolling interest appearing on the balance sheet

e. Equipment (net)

f. Inventory

Suarez

$ (200,000)

80,000

10,000

$ (110,000)

$ (150,000)

(110,000)

0

$ (260,000)

$ 90,000

110,000

0

300,000

$ 500,000

$ (140,000)

(100,000)

(260,000)

$ (500,000)

Required:

Included in the preceding statements,Jarel sold inventory costing $80,000 to Suarez for $100,000. Of these goods, Suarez still owns

60 percent on December 31. Compute the following amounts for the December 31 consolidated financial statements for Jarel and

Suarez.

Note: Input all amounts as positive value.

Consolidated

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education