FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

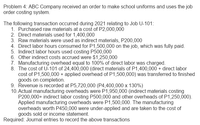

Transcribed Image Text:Problem 4: ABC Company received an order to make school uniforms and uses the job

order costing system.

The following transaction occurred during 2021 relating to Job U-101:

1. Purchased raw materials at a cost of P2,000,000

2. Direct materials used for 1,400,000

3. Raw materials were used as indirect materials, P200,000

4. Direct labor hours consumed for P1,500,000 on the job, which was fully paid.

5. Indirect labor hours used costing P500,000

6. Other indirect costs accrued were $1,250,000

7. Manufacturing overhead equal to 100% of direct labor was charged.

8. The cost of U-101 of 24,400,000 (direct materials of P1,400,000 + direct labor

cost of P1,500,000 + applied overhead of P1,500,000) was transferred to finished

goods on completion.

9. Řevenue is recorded at P5,720,000 (P4,400,000 x 130%)

10. Actual manufacturing overheads were P1,950,000 (indirect materials costing

P200,000+ indirect labor costing P500,000 and other overheads of P1,250,000).

Applied manufacturing overheads were P1,500,000. The manufacturing

overheads worth P450,000 were under-applied and are taken to the cost of

goods sold or income statement.

Required: Journal entries to record the above transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solt Corporation uses a job-order costing system and has provided the following partially completed T-account summary for the past year. Debit Balance 1/1 Debits Balance 12/31 Multiple Choice $453,000 $415,000 $403,000 Finished Goods The Cost of Goods Manufactured for the year was $415,000. The unadjusted Cost of Goods Sold for the year was: $503,000 38,000 Credits ? 50,000 Credit ?arrow_forwardProblem #1. ABC Corporation uses a job-order costing system with a plantwide overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine hours required to support estimated production 150,000 Manufacturing overhead costs ₱1,350,000 Required: 1.Compute the predetermined overhead rate. 2.During the year, Job 500 was started and completed. The following information was available with respect to this job: Direct materials requisitioned ₱350 Direct labor cost ₱230 Machine hours used 30 Compute the total manufacturing costs assigned to Job 500. 3.During the year the company worked a total of 147,000 machine-hours on all jobs and incurred actual manufacturing overhead costs of ₱1,325,000. What is the amount of underapplied or overapplied overhead for the year?arrow_forward1. What is the total cost of direct materials requistioned in June? 2. What is the total cost of direct labor used in June? ( please check plagiarism)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education