FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Problem 3-19 (Algo) (LO 3-3a)

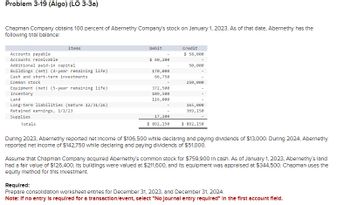

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2023. As of that date, Abernethy has the

following trial balance:

Items

Debit

Accounts receivable

Accounts payable

Additional paid-in capital

Credit

$ 58,000

$ 40,200

50,000

Buildings (net) (4-year remaining life)

Cash and short-term investments

170,000

66,750

Common stock

250,000

Equipment (net) (5-year remaining life)

Inventory

372,500

109,500

Land

116,000

Long-term liabilities (mature 12/31/26)

165,000

Retained earnings, 1/1/23

369,150

Supplies

Totals

17,200

$ 892,150

$ 892,150

During 2023, Abernethy reported net Income of $106,500 while declaring and paying dividends of $13,000. During 2024, Abernethy

reported net income of $142,750 while declaring and paying dividends of $51,000.

Assume that Chapman Company acquired Abernethy's common stock for $759,900 in cash. As of January 1, 2023, Abernethy's land

had a fair value of $126,400, its buildings were valued at $211,600, and its equipment was appraised at $344,500. Chapman uses the

equity method for this Investment.

Required:

Prepare consolidation worksheet entries for December 31, 2023, and December 31, 2024.

Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare consoldiation worksheet entries for December 31, 2020 and December 31, 2021.arrow_forwardhapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that date, Abernethy has the following trial balance: Debit Credit Accounts payable $ 56,700 Accounts receivable $ 43,800 Additional paid-in capital 50,000 Buildings (net) (4-year remaining life) 143,000 Cash and short-term investments 80,250 Common stock 250,000 Equipment (net) (5-year remaining life) 295,000 Inventory 110,500 Land 112,000 Long-term liabilities (mature 12/31/23) 171,000 Retained earnings, 1/1/20 268,750 Supplies 11,900 Totals $ 796,450 $ 796,450 During 2020, Abernethy reported net income of $122,500 while declaring and paying dividends of $15,000. During 2021, Abernethy reported net income of $159,250 while declaring and paying dividends of $49,000. Assume that Chapman Company acquired Abernethy’s common stock for $698,050 in cash. As of…arrow_forwardVinubhaiarrow_forward

- company's accounting year ends December 31. Date of Acquisition Cost 9/20/23 $38,000 10/2/23 14,000 Investment Colt Company stock Dana Company stock What amount is reported for gain or loss on these securities in 2023 income? Select one: O a. $800 loss O Fair Value 12/31/23 Date Sold Selling Price $37,000 2/10/24 $42,000 14,200 1/17/24 13,000 b. $1,000 loss c. No gain or loss d. $3,000 gain ہےarrow_forwardluxco acquires participation on Aprin 1, 2012 for 1000000. This investment is financed by (a) share premium for 100.000é (b) an interest-free shareholder loan for 250000€ and (c) bank loan bearing interest at 5% per annum for the balance. the interest on the bank mentioned above are payable on the last day of each civil quarter (March 31...). Any unpaid accrued interest bear also interest at 5% per annum starting from the day after their due date (from Aprin 1 for interest payable on March 31). Assuming that Luxco does not pay its interest on June 30, 2012, please detail the accounting entries in relation with the booking of interest as Jube 30, 0210 and September 30, 2012 Make the journal entries only for the interestarrow_forwardsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education