ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Don't use ai to answer I will report you answer

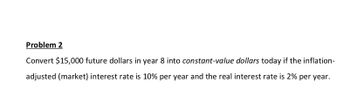

Transcribed Image Text:Problem 2

Convert $15,000 future dollars in year 8 into constant-value dollars today if the inflation-

adjusted (market) interest rate is 10% per year and the real interest rate is 2% per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- A man wishes to set aside money for his retirement at the age 65 in a fund which will have an amount equivalent to P60k with today’s purchasing power. The estimated inflation rate is 7.5%. If the fund will earn 8% compounded annually what amount should he invest now on his 40th birthday?arrow_forwardA man deposits P55, 000 in a bank account at 6% compounded monthly for 5 years. If the inflation rate of 6.5% per year continues for this period, will this effectively protect the purchasing power of the original principal?arrow_forwardYou just graduated from college and landed your first "real" job, which pays $42,000 a year. In 19 years how much will you need to earn per year to maintain the same purchasing power if inflation is 1.50% per year? Your Answer:arrow_forward

- A professional athlete signs a two-year contract in which the earnings c can be modeled by 2,400,000+ 500,000t, where t represents the year (a) Find the actual value of the athlete's contract in dollars. (b) Assuming an annual inflation rate of 3%, what is the present value of the contract in dollars? (Round your answer to the nearest cent.) $ Need Help?arrow_forwardFind the present worth of earthmoving equipment that has a first cost today of $147,000, an annual operating cost of $58,000, and a salvage value of 20% of the first cost after 5 years, these estimates being in future dollars. Assume that the real interest rate is 12.00% per year and that inflation has averaged 7.000% per year. Solve with inflation (a) not accounted for and (b) accounted for. a) The present worth with inflation not accounted for is $ b) The present worth with inflation accounted for is $arrow_forwardA bicycle tire company performed a web-based study of a popular tire retail price over time. The study indicated that price is set at $16.00 per tire, it was expected to increase to $19.00 over the next 5 years. a. Determine the annual rate of inflation over 5 years to increase the price from $16.00 to $19.00. b. Determine the market interest rate that must be used in economic equivalence computations if inflation is considered and real 8% per year interest rate is expected.arrow_forward

- A small scale mining investment is expected to generate $60,000 per year in profits over the next 15 years. If these profits are invested in a mutual fund account that earns a market interest rate of 18% per year, calculate how much the fund will be worth after the 15 years in actual dollars and in real dollars. Inflation is expected to average 6% per year over that period. Click the icon to view the interest and annuity table for discrete compounding when i = 6% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 18% per year. In actual dollars: OA. $2,118,010 B. $6,625,790 OC. $3,657,920 OD. $1,526,320 In real dollars: OA. $6,625,790 B. $2,118,010 OC. $1,526,320 OD. $3,657,920arrow_forwarda man deposit P50000 in a bank account at 6% compounded monthly for 5 years. If the inflation rate of 6.5% per year continues for this period , will this effectively protect the purchasing power of the original principal?arrow_forwardA renewable energy industry is one of the promising sectors in future and play a major role in the vision 2030. If a specialized company in energy planning to upgrade their equipment now to meet future demand at cost of $200.000 or they purchase the upgrade package three years from now at cost of $300,000. Assume that the minimum attractive rate of return is 12% per year and the inflation is 3% per year. If the company decided to purchase the upgrade 3 years from now without considering inflation what will be the cost?arrow_forward

- Your manager has decided to invest $4350 dollars at an annual interest rate of 8.0% to buy raw material that it is needed one of the main manufacturing processes of your company. The current price of the raw material is $4.0 per kilogram. If the annual inflation is 5.0%, how many kilograms of raw material will your manager be able to purchase in 8 years? $ What would be the actual dollars amount that will be paid in 8 years for that raw material? 2$arrow_forwardFor the next four years, a family anticipates buying $1.000 worth of groceries each year. If inflation is expected to be 3%/year, what are the constant-worth cash flow and the then- current cash flow required to purchase the groceries? Constant-worth (C.) $1,000 $1.000 $1,000 $1,000 Then-current (T.) $1.000 x 1.03= $1,030 $1.030 x 1.03 $1,060.90 $1,060.90 x 1.03 = $1,092.73 $1,092.73 x 1.03 = $1,125.51 Year (k) %3D %3D %3D The then-current equivalent cash flow will be T = T,(1+)* for k 1,..,n Since C = Ta. so T = C(1+)* for k = 1,.,n Using the cash flows of Example 1, determine the present worth of the grocery purchase using a. constant-worth analysis (in other words, using the constant-worth cash flow) b. then-current analysis (in other words, using the then-curent cash flow) The inflation rate is 3% per year and the real time value of money is 15%.arrow_forwardAn asset costs $10,000 today. If inflation is 4% per year and interest is 12% per year, what will be the appropriate future value of the machine adjusted for inflation in 8 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education