ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

Transcribed Image Text:Problem 17.047

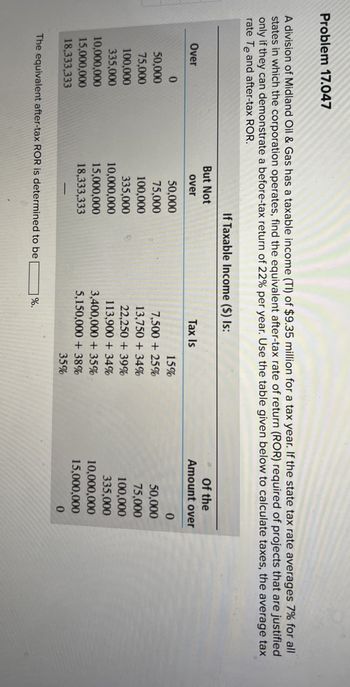

A division of Midland Oil & Gas has a taxable income (TI) of $9.35 million for a tax year. If the state tax rate averages 7% for all

states in which the corporation operates, find the equivalent after-tax rate of return (ROR) required of projects that are justified

only if they can demonstrate a before-tax return of 22% per year. Use the table given below to calculate taxes, the average tax

rate Te and after-tax ROR.

If Taxable Income ($) Is:

Over

But Not

over

Tax Is

Of the

Amount over

0

50,000

15%

0

50,000

75,000

7,500 + 25%

50,000

75,000

100,000

13,750 + 34%

75,000

100,000

335,000

22,250 + 39%

100,000

335,000

10,000,000

113,900+34%

335,000

10,000,000

15,000,000

3,400,000+ 35%

10,000,000

15,000,000

18,333,333

5,150,000+38%

15,000,000

18,333,333

35%

0

The equivalent after-tax ROR is determined to be

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the AVC and MC?arrow_forwardPrepare a flow chart for a typical family of 4 (3 drivers), taking a two-week (Monday is 1st-14th is a Sunday) vacation driving from New York to Orlando in August. Your return to workday is 15th of the month which is a Monday. Discuss areas of concerned revealed by the flow chart.arrow_forwardWhat is the unit contribution margin?arrow_forward

- What are the ethical issues that could be encountered when running an e-commerce platform?arrow_forwardPlease help Why is basic understanding of global geography important? Just q&a DO NOT COPY FROM OTHER WEBSITES Upvote guarenteed for a correct and detailed answer. Thank you!!!arrow_forwardcan you do part b, c, d and e i can hse 4 questions for itarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education