FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Problem 16-21 (Algo) Incomplete Statements; Ratios Analysis [LO16-2, LO16-3, LO16-4, LO16-5, LO16-6]

Pepper Company provided the incomplete financial statements shown below as well as the following additional information:

a. All sales during the year were on account.

b. There was no change in the number of shares of common stock outstanding during the year.

c. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change

during the year.

d. Selected balances at the beginning of the current year were:

Accounts receivable

Inventory

Total assets

e. Selected financial ratios computed from the statements below for the current year are:

Earnings per share

Debt-to-equity ratio

Accounts receivable turnover

Current ratio

Return on total assets

Times interest earned ratio

$ 230,000

$ 340,000

$ 2,240,000

Acid-test ratio

Inventory turnover

$ 4.68

0.790

16.0

2.10

14%

7.75

1.20

9.0

Required:

Compute the missing amounts on the company's financial statements. (Hint: What's the difference between the acid-test ratio and the

current ratio?) (Do not round intermediate calculations.)](https://content.bartleby.com/qna-images/question/daa660fe-a48c-4432-ac78-63061d23db2c/334ffb41-a12d-4bba-95f5-75dad4ea7aec/2sjhd5b_thumbnail.png)

Transcribed Image Text:Problem 16-21 (Algo) Incomplete Statements; Ratios Analysis [LO16-2, LO16-3, LO16-4, LO16-5, LO16-6]

Pepper Company provided the incomplete financial statements shown below as well as the following additional information:

a. All sales during the year were on account.

b. There was no change in the number of shares of common stock outstanding during the year.

c. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change

during the year.

d. Selected balances at the beginning of the current year were:

Accounts receivable

Inventory

Total assets

e. Selected financial ratios computed from the statements below for the current year are:

Earnings per share

Debt-to-equity ratio

Accounts receivable turnover

Current ratio

Return on total assets

Times interest earned ratio

$ 230,000

$ 340,000

$ 2,240,000

Acid-test ratio

Inventory turnover

$ 4.68

0.790

16.0

2.10

14%

7.75

1.20

9.0

Required:

Compute the missing amounts on the company's financial statements. (Hint: What's the difference between the acid-test ratio and the

current ratio?) (Do not round intermediate calculations.)

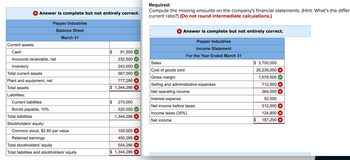

Transcribed Image Text:X Answer is complete but not entirely correct.

Pepper Industries

Balance Sheet

March 31

Current assets:

Cash

Accounts receivable, net

Inventory

Total current assets

Plant and equipment, net

Total assets

Liabilities:

Current liabilities

Bonds payable, 10%

Total liabilities

Stockholders' equity:

Common stock, $2.60

Retained earnings

par value

Total stockholders' equity

Total liabilities and stockholders' equity

$

91,500

232,500

243,000

567,000

777,286

$ 1,344,286

$ 270,000

520,000

1,344,286 X

104,000 X

450,286 X

554,286 X

$ 1,344,286

Required:

Compute the missing amounts on the company's financial statements. (Hint: What's the differ

current ratio?) (Do not round intermediate calculations.)

> Answer is complete but not entirely correct.

Pepper Industries

Income Statement

For the Year Ended March 31

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Interest expense

Net income before taxes

Income taxes (30%)

Net income

$ 3,700,000

26,235,000

1,076,500

$

712,500 ×

364,000

52,000

312,000 X

124,800 X

187,200 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $308,600 $240,000 Marketable securities 357,300 270,000 Accounts and notes receivable (net) 146,100 90,000 Inventories 689,000 427,000 Prepaid expenses 355,000 273,000 Total current assets $1,856,000 $1,300,000 Current liabilities: Accounts and notes payable (short-term) $336,400 $350,000 Accrued liabilities 243,600 150,000 Total current liabilities $580,000 $500,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forwardEX.17-179.ALGO The following information was from Slater Company's balance sheet: Fixed assets (net) Long-term liabilities Total liabilities Total stockholders' equity $2,049,082 504,700 686,080 2,144,000 Round your answers to two decimal places. a. Determine the company's ratio of fixed assets to long-term liabilities. b. Determine the company's ratio of liabilities to stockholders' equity.arrow_forwardsarrow_forward

- Question.arrow_forwardNeed help with doing the statement entries on accounting paper.arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $655,500 $520,000 Marketable securities 759,000 585,000 Accounts and notes receivable (net) 310,500 195,000 Inventories 643,500 475,800 Prepaid expenses 331,500 304,200 Total current assets $2,700,000 $2,080,000 Current liabilities: Accounts and notes payable (short-term) $435,000 $455,000 Accrued liabilities 315,000 195,000 Total current liabilities $750,000 $650,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forward

- how to compute earnings per share please dont give image based thankuarrow_forwardProblem 16-17 (Static) Interpretation of Financial Ratios [LO16-2, LO16-3, LO16-6] Pecunious Products, Incorporated's financial results for the past three years are summarized below: Sales trend Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Dividend yield Dividend payout ratio Dividends paid per share* Year 3 128.0 2.5 9.4 6.5 7.1% 40% $1.50 Year 2 115.0 2.3 0.9 10.6 7.2 6.5% 50% $ 1.50 Year 1 100.0 2.2 1.1 12.5 8.0 5.8% 60% $ 1.50 *There have been no changes in common stock outstanding over the three-year period. Required: Review the results above and answer the following questions: 1. Is it becoming easier for the company to pay its bills as they come due? 2. Are customers paying their accounts at least as fast now as they were in Year 1? 3. Are the accounts receivable increasing, decreasing, or remaining constant? 4. Is inventory increasing, decreasing, or remaining constant? 5. Is the market price of the company's stock going up or down? 6. Is the…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $594,300 $495,600 Marketable securities 688,200 557,600 Accounts and notes receivable (net) 281,500 185,800 Inventories 852,700 575,800 Prepaid expenses 439,300 368,200 Total current assets $2,856,000 $2,183,000 Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $394,400 $413,000 285,600 177,000 $680,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio $ SAarrow_forwardCurrent position analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $368,200 $281,600 Marketable securities 126,400 316,000 Accounts and notes receivable (net) 174,400 105,600 Inventories 639,500 402,600 Prepaid expenses 129,500 257,400 Total current $1,930,000 $1,364,000 Current liabilities: Accounts and notes payable (short-term) $295,000 $300,000 Accrued labies Total current liabilities 214,200 $510,000 132,000 $640,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. 1. Working capital 2. Current ratio 3. Quick ratio b. The quidity of Nilo has result of an Current Year Previous Year from the preceding year to the current year. The working capital, current ratio, and quick ratio have all Most of these changes are the in current assets relative to current liabilities.arrow_forwardMarshall Inc. Measures of liquidity, Salvency, and Prafitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock wii $ 61 on December 31, 20Y2. Comparative Balance Sheet Marshall in. December 31, 20Y2 and 20Y1 Comparative Retained Earnings Statement 20Υ2 20Υ1 For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Assets outained arnings, Janry 1 $3,089,050 $2,603,550 Current assets Net income 729,600 533,200 Cash $912,500 $815,990 Total $3,818,650 $3,136,750 Marketable securities 1,381,080 1,352,220 Dividends: On preferred stock S11,200 $11,200 Accounts receivable (net) 781,100 737,300 On common stock 36,500 36,500 Inventories 584,000 452,600 Total dividends $47,700 $47,700 Prepaid expenses 172,627 163,200 Rutained earngs, Decembir 31 $3,770,950 $3,080,050 Total current assets $3,831,307 $3,521,310 Long-term investments 1,386,498 972,249 Marshall inc. Comparative Income Statement Property, plant, and equipment (net)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education