Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

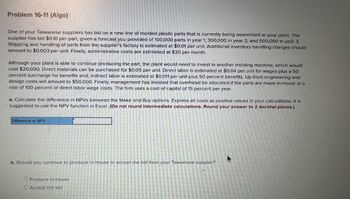

Transcribed Image Text:Problem 16-11 (Algo)

One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The

supplier has bid $0.10 per part, given a forecast you provided of 100,000 parts in year 1; 300,000 in year 2; and 500,000 in year 3.

Shipping and handling of parts from the supplier's factory is estimated at $0.01 per unit. Additional inventory handling charges should

amount to $0.003 per unit. Finally, administrative costs are estimated at $30 per month.

Although your plant is able to continue producing the part, the plant would need to invest in another molding machine, which would

cost $20,000. Direct materials can be purchased for $0.05 per unit. Direct labor is estimated at $0.04 per unit for wages plus a 50

percent surcharge for benefits and, indirect labor is estimated at $0.011 per unit plus 50 percent benefits. Up-front engineering and

design costs will amount to $50,000. Finally, management has insisted that overhead be allocated if the parts are made in-house at a

rate of 100 percent of direct labor wage costs. The firm uses a cost of capital of 15 percent per year.

a. Calculate the difference in NPVS between the Make and Buy options. Express all costs as positive values in your calculations. It is

suggested to use the NPV function in Excel. (Do not round Intermediate calculations. Round your answer to 2 decimal places.)

Difference in NPV

b. Should you continue to produce in-house or accept the bid from your Taiwanese supplier?

O Produce in-house

O Accept the bid

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- link of PDF : https://docdro.id/psUSO2n https://docdro.id/KV8USNQ question : 1/. According to Simpson and et.al, why should we measure the performance of our suppliers?arrow_forwardReactions and additional comments: Per the textbook definition, the term bullwhip effect “Describes the distortions in a supply chain caused by changes in customer demand, resulting in large swings in inventory levels as the orders ripple upstream from the retailer to the distributor and manufacturer” (Wallace, 2020, p. 137). The term is derived from physics. When cracking a whip, someone just has to snap their wrist and it causes a wave like effect that increases with a chain reaction. The bullwhip effect is a term that was first used in the 1990s. The makers of Pampers had many changes in order volumes, when usually diapers were bought at a constant rate (The Bullwhip effect : History and solutions, 2021). This caused the company to receive hard hits in demand with each new order from the retailers. For example, during the Covid-19 pandemic, everyone was told to stay home, go to school from home, and work from home. This caused the need for many more computers and electronic…arrow_forward1 - Which revenue model is based on a 130 year old practice that stemmed from door to door sales people and direct mailings? Fee for Transaction Advertising Fee-for-Content Web Catalogarrow_forward

- Chris Sandvig Irrigation, Inc., has summarized the price list from four potential suppliers of an underground control valve. See the table below. Annual usage is 1,100 valves; order cost is $10 per order; and annual inventory holding costs are $7.55 per unit. D D Vendor A Quantity 1-14 15-24 25-99 100-199 200-399 400+ Price $35.00 34.75 33.55 32.35 31.15 30.75 Vendor C Vendor D Vendor A D Vendor B Vendor B Which vendor should be selected and what order quantity is best if Sandvig Irrigation wants to minimize total cost? Chris Sandvig Irrigation should order units at a time from (enter your response as a whole number). Quantity 1-24 25-99 100-199 200-399 400+ Price $34.75 34.00 32.80 31.60 30.50 MacBook Air O Vendor C Quantity 1-49 50-149 150-299 300+ Price $34.50 33.75 32.50 31.10 Vendor D Quantity 1-149 150-299 300+ Price $34.25 33.00 31.00 Nextarrow_forward32.What is meant by deficient demand? Explain its causes and consequences?arrow_forwardHorizon Cellular manufactures cell phones for exclusive use in its communication network. Management must select a circuit board supplier for a new phone soon to be introduced to the market. The annual requirements (D) are 40,000 units and Horizon's plant operates 250 days per year. The data for three suppliers are in the attached table. Annual Freight Costs Shipping Quantity (Q) Supplier 10,000 20,000 Price/Unit (p) Annual Holding Cost/Unit (H) Lead Time (L) (days) Annual Administrative Cost Material Costs Abbott $11,000 $8,500 $29 $5.80 4 $11,000 $232,000.00 Baker $12,000 $9,500 $31 $6.20 3 $12,000 $1,240,000 Carpenter $9,000 $7,000 $28 $5.60 8 $9,000 $1,120,000 Which supplier and shipping quantity will provide the lowest total cost for Horizon Cellular? Using the supplier [X] and a shipping quantity of [X] units is the lowest cost alternative, with annual total costs to Horizon Cellular of [X]. (Quantity and Annual Total Costs are integer…arrow_forward

- DEFINE Expected value of demandarrow_forwardBradley Solutions and Alexander Limited are two well-established suppliers of inexpensive tools. Meanwhile, Weekend Projects is a national chain of retail outlets and wants to find a supplier for a particular tool set that promises to be a big seller. Expected annual sales are 100,000 units (D). Weekend's warehouses operate 50 weeks a year. Management collected data on the two suppliers, which are contained in the table below: Annual Freight Costs Shipping Quantity (Q) Annual Lead Annual Supplier 20,000 40,000 Price/unit(p) Administrative Holding Cost/Unit(H) (L)(wks) $1.5 $1.8 Time Cost Bradley $30,000 $20,000 Alexander $25,000 $22,000 $6 $5 $20,000 $30,000 4 What is the total annual cost for Weekend Projects if the company chooses Alexander as the supplier and determines the shipping quantity at 40,000 units per shipment? $608,600 O $609,600 $606,600 O $607,600arrow_forwardhow would you ensure quality of suppliers during a crisis?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.